XRP Trade Converges at a Higher Zone – August 24

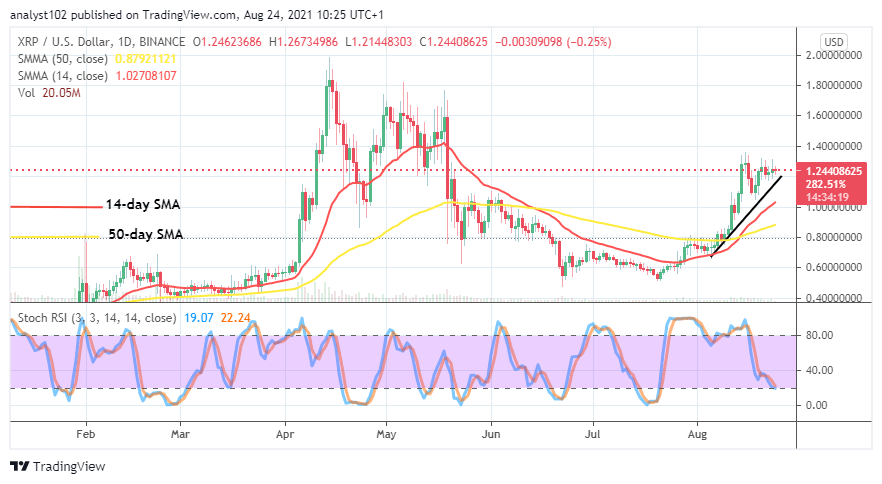

The Ripple XRP/USD trade converges at a higher trading zone as the crypto’s valuation trades around $1.24. A smaller negative percentage rate of 0.25 is on the record by the market as of writing.

Trade Converges at a Higher Zone: XRP Market

Key Levels:

Resistance levels: $1.40, $1.60, $1.80

Support levels: $1.10, $1.00, $0.90

Today’s daily chart shows that the XRP/USD trade converges at a higher trading zone. The line at 1.20 has been witnessing series of ups and downs over a couple of days’ sessions. The 14-day SMA trend-line is above the 50-day SMA trend-line as the bullish trend-line drew over them too closely, positioned at the level mentioned earlier. The Stochastic Oscillators have traveled southbound to touch the range-line of 20. That indicates some losses in the upside momentum of the crypto economy are featuring on a lighter note.

What could the subsequent price action as the Ripple XRP/USD trade converges at a higher trading zone?

It appears that the Ripple XRP/USD market may have to witness a chain of variant range trading situations primarily around $1.20 in the subsequent sessions. The present trading situation showcases that the crypto trade converges at a higher zone to set in new trading approach that traders needed to cautiously take note of. In addition to that, it would technically sound okay that a pull-down allows to feature in finding support so that bulls can rebuild their stance upon for reliable up-strides.

On the downside, it now seems that the Ripple XRP/USD bears cannot push the market southward strongly in the coming sessions. The positioning of the Stochastic Oscillators on the chart signifies a dicey chance that the trade may witness downs as against ups. As a result of that, traders are to put selling order execution on hold for some time while the sees a rejection at a higher trading line afterward.

XRP/BTC Price Analysis

The trending capacity outlook between Ripple XRP and Bitcoin on the daily price analysis chart shows that the duo-crypto trade converges at a higher trading zone. In other words, the base crypto appears to still have prevalence over the counter crypto to a reasonable extent. The 50-day SMA indicator remains intercepted by the 14-day SMA below the current zone that the current trading candlesticks appear. The Stochastic Oscillators have moved southbound close to the range 0f 20. And, yet, they briefly point to the southward. It means that price action is now running in less and slow motion. And that can as well cause an indecision trading moment in the two crypto market operations.

Looking to buy or trade XRP (XRP) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider.

Remember, all trading carries risk. Past performance is no guarantee of future results.

Credit: Source link