Ripple Price Prediction – June 28

The Ripple price has been trading in a downtrend while the bulls are making a serious effort to protect the support.

XRP/USD Market

Key Levels:

Resistance levels: $1.00, $1.10, $1.15

Support levels: $0.25, $0.20, $0.15

XRP/USD is now retreating to its lower limit. After falling from $0.66 today, the Ripple price is now closer to the $0.62 support, which could offer a rebound level for the next bullish rally. For the past few days, the bearish impulse movement has been suspended. Should the bears exhaust momentum around the $0.50 support level, a bullish continuation is expected to occur.

Ripple Price Prediction: Price May Heads Upward

The Ripple price may continue to hover at the downside but if the bears are out of breath below the 9-day and 21-day moving averages, a bullish pursuit is expected. However, traders should keep eye on the $0.85 before printing a new high at the resistance levels of $1.00, $1.10, and $1.15. Nevertheless, the Ripple bear dictates the pace for the moment in the long term but remains to range on the short-term outlook.

Moreover, traders should expect a quick buy once the trade reaches the support at $0.60. And if the price fails to rebound, then a bearish breakout is likely to trigger more selling opportunities for traders, which might cause the price to retest the low at $0.25 and could further drop to $0.20, and $0.15 support levels respectively. The Relative Strength Index (14) is about to cross above 40-level. Meanwhile, if the price oscillates downward, the Ripple price may fall.

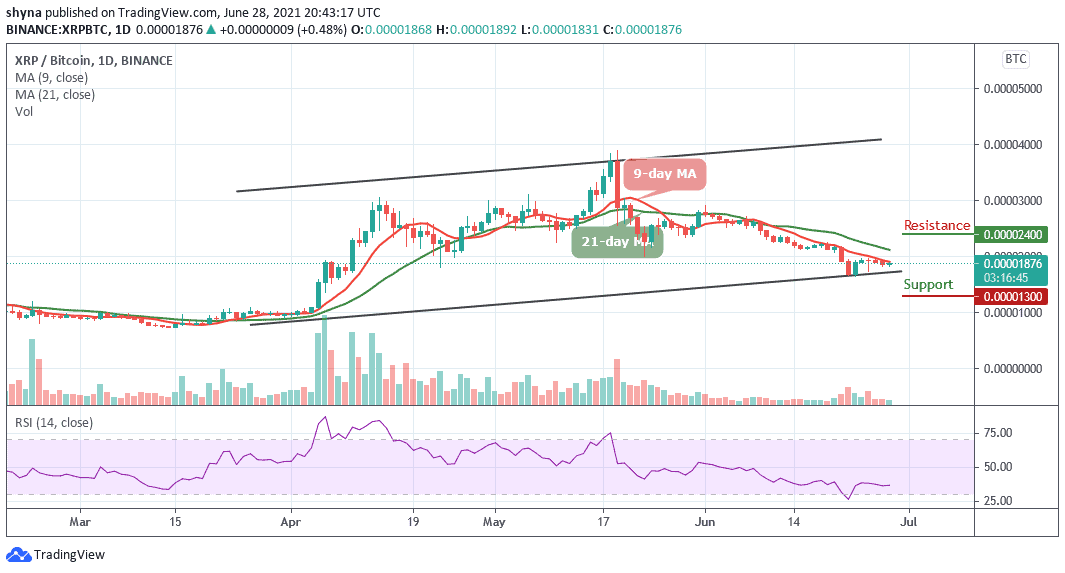

Against Bitcoin, for the past few days now, Ripple (XRP) has been falling drastically below the 9-day and 21-day moving averages but the bulls are trying to step back into the market. Moreover, if the bulls try to step back into the market, we can expect the price-rise to 2400 SAT and 2600 SAT resistance levels.

However, if the sellers continue to push the price down below the lower boundary of the channel within the channel, the next support level is located at 1600 SAT and further support could be found at 1300 SAT and 1100 SAT. The Relative Strength Index (14) is moving in the same direction around the 36-level, which may likely cause the market to move sideways.

Credit: Source link