Ripple Price Prediction – May 28

The Ripple price is hovering at $0.86 as it lacks imminent support and therefore, trades in the red with dense selling pressure.

XRP/USD Market

Key Levels:

Resistance levels: $1.32, $1.52, $1.62

Support levels: $0.50, $0.40, $0.30

XRP/USD has been facing a market-wide struggle and it is likely to stay here for some more days. The current movement at the lower side of 9-day and 21-day moving averages may hint towards Ripple’s upcoming surge. Following the path of all other coins, Ripple has also made a cut of 11.26% in the last 24 hours and the value touched $0.82 support.

Ripple Price Prediction: Ripple Price May see a further Downside

As the daily chart reveals, the Ripple price is changing hands at $0.865 and any attempt to make it cross below the lower boundary of the channel may open the doors for more downsides and the price could spike below the $0.70 support level. However, traders should keep eye on the $0.80 before creating a new bullish trend at the resistance levels of $1.32, $1.52, and $1.62.

Furthermore, we may experience a quick buy once the trade reaches the support at $0.75. Therefore, if the price fails to rebound, a bearish breakout is likely to trigger more selling opportunities within the market, which might cause the price to retest at $0.50 and could further drop to $0.40 and $0.30 support levels respectively. The Relative Strength Index (14) nosedives to 39-level suggesting that XRP/USD may fall more.

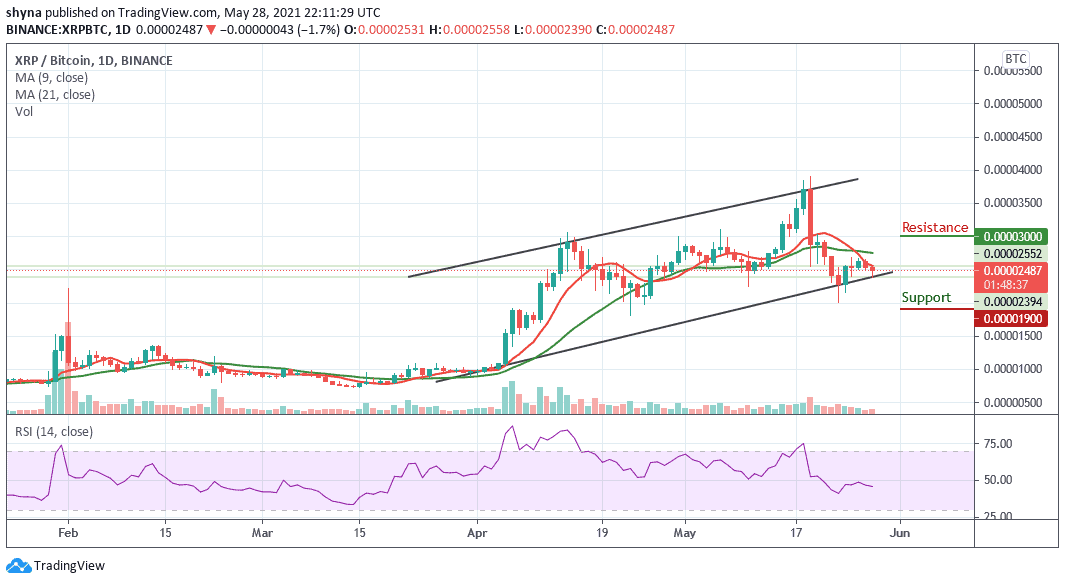

Comparing with Bitcoin, XRP moves at the downside, actually, the price action has remained intact within the channel. If the selling pressure continues, the Ripple price variation may close this month with a new low. At the moment, the Relative Strength Index (14) is moving below the 50-level; traders may continue to see a negative move in the market in as much as the 9-day (red-line) moving average stays below the 21-day (green-line) moving average.

However, the Ripple is currently hovering around the lower boundary of the channel at 2487 SAT. We may expect close support at the 2400 SAT before breaking to 2200 SAT and critically 1900 SAT levels. Should in case a bullish movement occurs and validates a break above the 9-day and 21-day moving averages; we can then confirm a bull-run for the market and the nearest resistance levels to reach lies at 3000 SAT and above.

Credit: Source link