Ripple Price Prediction – June 7

The Ripple price is slightly bullish as the market continues to respect the $0.90 support and likely builds momentum to push to the $1.20 mark next term.

XRP/USD Market

Key Levels:

Resistance levels: $1.20, $1.30, $1.40

Support levels: $0.65, $0.55, $0.45

XRP/USD has been trading sideways since a few days ago, losing around 0.59% during the negotiation today. Looking at the daily chart, our Ripple price prediction proved XRP/USD has been dropping after a bullish rally that occurred yesterday. At the moment, the bulls are making an attempt to come back into the market with a cross above the 9-day and 21-day moving averages, which may head towards the resistance level of $1.00. Meanwhile, the Ripple price prediction shows that the coin hovers below the moving averages.

Ripple Price Prediction: Can Ripple Move Above $1?

The Ripple (XRP) remains the seventh-largest cryptocurrency with a market cap of $43.4 million. The Ripple price has seen a slight increase in the market yesterday and it is currently trading around $0.94. In the meantime, XRP/USD may continue to a sideways movement before any breakout or breakdown of the channel.

Moreover, should in case the Ripple price breaks above the 9-day and 21-day moving averages, the resistance levels of $1.20, $1.30, and $1.40 could be visited. Meanwhile, for a backward movement, the market can be supported at $0.65 and $0.55 and if the price falls below the previous levels, another support is around $0.45 while the Relative Strength Index (14) is moving in the same direction below the 45-level.

Looking to buy or trade Ripple (XRP) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

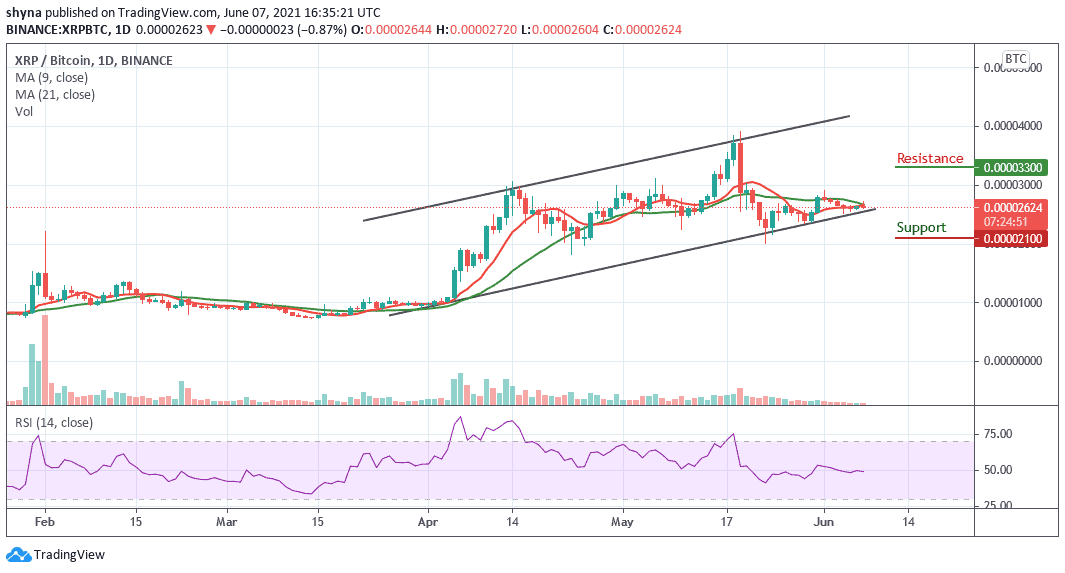

When compares with Bitcoin, the Ripple price is currently changing hands at 2624 SAT and it’s trading around the 9-day and 21-day moving averages. Therefore, if the above-mentioned level can serve as the market support, the Ripple price may likely face the key resistance at 3000 SAT. By reaching this level, XRP/BTC could hit the resistance level of 3300 SAT and above.

However, if the bulls fail to push the price above the 9-day and 21-day MAs, the market may continue its downtrend and the pair could probably record further declines below the lower boundary of the channel. Breaking this barrier could further push the market to the nearest support level of 2100 SAT and below while the signal line of the Relative Strength Index (14) moves in the same direction within the 50-level.

Credit: Source link