Ripple Price Prediction – July 5

The Ripple price has failed to hold $0.65 as the coin now trades within the 9-day and 21-day moving averages.

XRP/USD Market

Key Levels:

Resistance levels: $0.95, $1.05, $1.15

Support levels: $0.40, $0.30, $0.20

As the daily chart reveals, XRP/USD is seen in a downtrend or at least extremely flat. However, the Ripple bulls might be losing both the 9-day MA and the 21-day MA as they have been rejected from crossing above the resistance level of $0.70 again. Traders are seeing a significant decrease in trading volume over the past few days due to the overall market weakness while the technical indicator Relative Strength Index remains on the negative side.

Ripple Price Prediction: What Could Be the Next Direction?

For now, the Ripple price is facing a reversal as selling activities mount, intensely pressing down on the resistance turned support at $0.65. The retracement level, marginally around $0.70 happened to be a resistance zone in the past few days. Meanwhile, if the Ripple price holds above this level, there is a chance that a bounce may occur, pulling the price above the $0.70 resistance level.

Presently, the technical picture is seen turning bearish as shown by the technical indicator RSI (14) as the extended losses below $0.65 could retest the support at $0.60. A formidable bounce is expected at the support level of $0.50, if not, the critical supports at $0.40, $0.30, and $0.20 may be visited. However, on the upside, gains above $0.70 must be followed by higher trading volume to sustain action towards $0.95, $1.05, and $1.15 resistance levels.

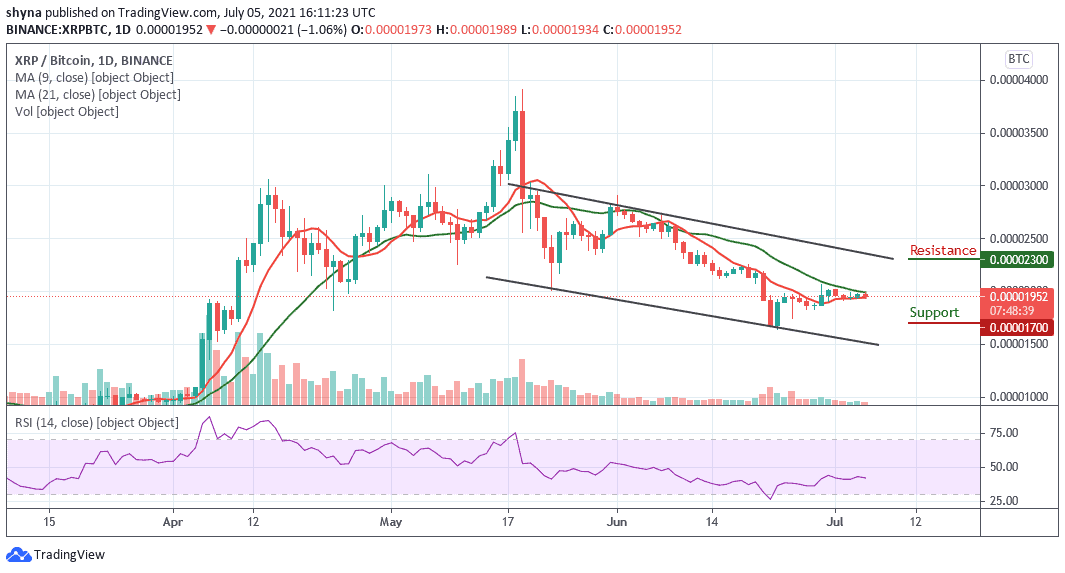

When compares with Bitcoin, the Ripple price continues to move sideways with the Relative Strength Index (14) moving in the same direction. However, the Ripple price is set to test 1930 SAT if Bitcoin’s gain continues to impact the Ripple price. With the look of things, the sellers remained dominant in the market as the bears continued to put pressure on the market.

Nevertheless, if the sellers occupy their positions, XRP/BTC may drop to the support level of 1700 SAT and below. At present, the market remains within the negative side of the channel, this could make the bulls push the coin above the channel. Any further bullish movement may likely hit the resistance levels at $2300 and above.

Credit: Source link