XRP Price Prediction – April 28

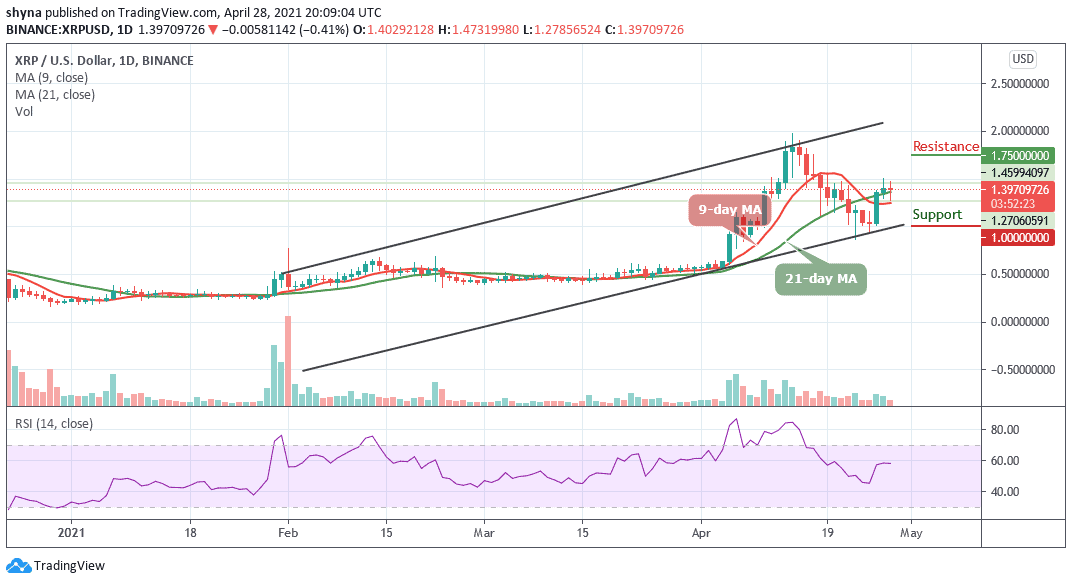

XRP/USD is targeting the $1.50 level but in case the bulls succeeded in breaking up this level then $1.70 may be the next target.

XRP/USD Market

Key Levels:

Resistance levels: $1.75, $1.85, $1.95

Support levels: $1.00, $0.90, $0.80

XRP/USD is currently at $1.397 right below a critical barrier at $1.40, which has been tested before. Meanwhile, a breakout above this point may drive the price of Ripple to move towards the higher level of $1.50. However, the market price is hovering above the 9-day and 21-day moving averages which confirms that the bulls may still be in charge of market control.

Would Ripple (XRP) Go Up or Down?

According to the daily chart, as the Ripple (XRP) keeps the upward movement, the coin needs to crack $1.50 for good. Meanwhile, XRP/USD has pierced through the critical resistance level at $1.39 several times in the past but never managed to close above it. However, a breakdown is expected below the moving averages to send the price lower to $1.20 and breaking the lower boundary of the channel couple drag the coin to the support level of $1.00, $0.90, and $0.80 respectively.

Meanwhile, for the upside, buyers need to make a sustainable move above the moving averages as soon as possible for the coin to resume back into the upward trend. However, for the upside to gain traction, the coin needs to regain ground above $1.75, while 1.85, and $1.95 resistance levels are the ultimate aims for the bulls.

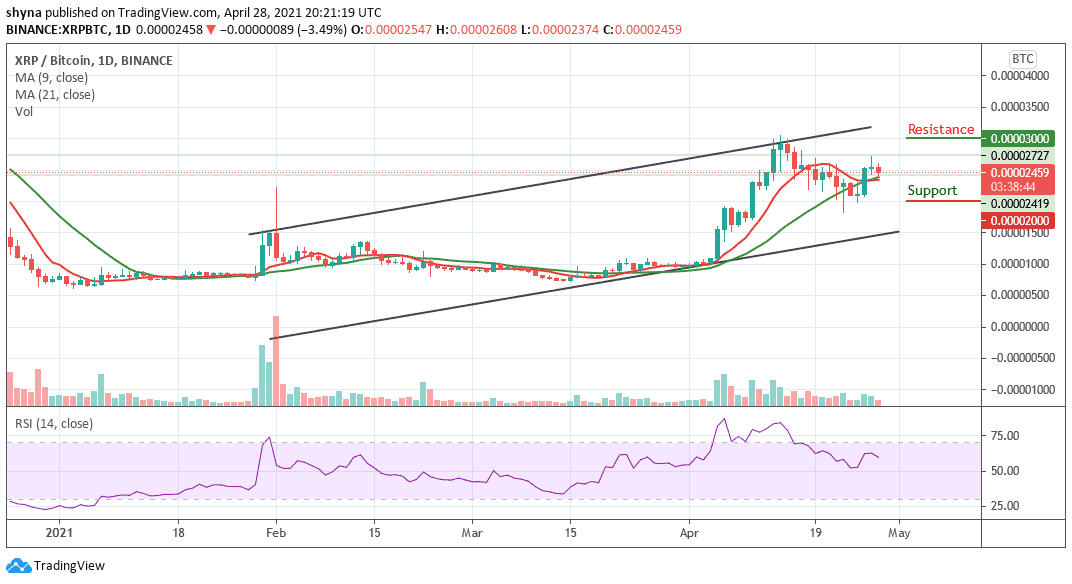

When compares with Bitcoin, XRP is trading at the negative side, although the price is maintaining the bullish movement above the 9-day and 21-day moving averages. However, if the selling pressure persists, the XRP price variation may likely create a new low in the next few days as the RSI (14) prepares to cross below 60-level Meanwhile, traders may see a negative move in the market soon.

In other words, XRP/BTC could decide to follow the upward movement within the ascending channel. More so, traders can therefore expect the nearest resistance at the 2800 SAT before breaking to 3000 SAT and above. However, if a bearish movement continues and breaks below the moving averages, traders can confirm a downtrend for the market, and the critical support level is located towards the south at 2000 SAT and below as the technical indicator, RSI (14) moves below 65-level.

Credit: Source link