XRP price has met with selling pressure each time the bulls tried to move past the $0.48 price level. XRP declined by almost 1% over the last 24 hours. Over the past week, the altcoin depreciated more than 6%. The bulls could be back on the chart if the coin breaks past its immediate resistance level.

The technical outlook for XRP signalled that the bears are in control as demand for XRP had fallen. For the bulls to power through, it is important that demand for the altcoin returns to the market. At the moment, all technical indicators have painted a bearish image for the altcoin.

If buyers continue to remain low, a fall to $0.40 is just a matter of the next trading sessions. Once the coin pierces below the $0.40 mark, it could also trade at $0.38. XRP has made a significant recovery since last month, but buying strength has remained inconsistent, causing the coin to falter. XRP price is trading almost 87% lower than its all-time high of 2018.

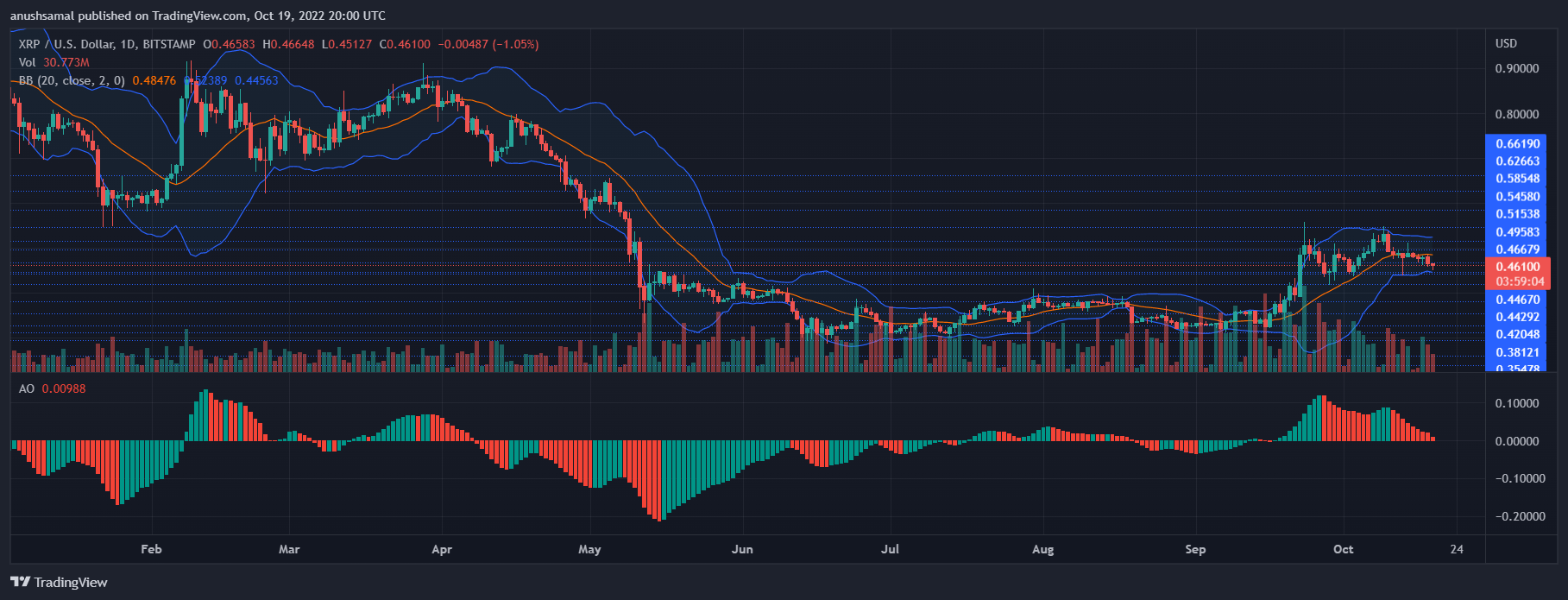

XRP Price Analysis: One-Day Chart

The altcoin was trading at $0.46 at the time of writing. It tried to topple over the $0.48 price mark, but the bears took over.

The coin has not been able to hold its recovery as demand for XRP continued to decline this month. Overhead resistance was at $0.48.

However, the bulls would only take charge if XRP traded above the $0.48 price mark.

Once the altcoin breaks above the $0.51 level, the bearish pressure will fade out.

On the other hand, less demand will let the XRP price slip further to its closest support line of $0.44.

Falling from the $0.44 mark will bring XRP down to $0.40 and then to $0.38. The amount of XRP that was traded in the last session experienced a fall, indicating low buying strength.

Technical Analysis

The recent rejection from the $0.48 level has caused the altcoin to witness low buying strength. The technical indicators point towards the same.

The altcoin even formed a death cross where the 200-SMA (green) line is above the 20-SMA (red) line.

This is considered quite bearish for the coin, and it means XRP might experience a further fall in price. The Relative Strength Index was below the half-line as sellers took over buyers.

XRP price was below the 20-SMA line, which corresponded to fading demand and sellers driving the price momentum in the market.

The altcoin registered sell signal in accordance with the other indicators on its chart.

The Awesome Oscillator reads the price direction and momentum. AO still displayed red histograms above the half-line, which was sell signal for XRP price.

Bollinger Bands measure the price volatility and chances of fluctuation. The bands were parallel and that meant less chance of upcoming volatility.

However, it also meant that XRP could move sideways in the next couple of sessions before it finally goes north or south.

Credit: Source link