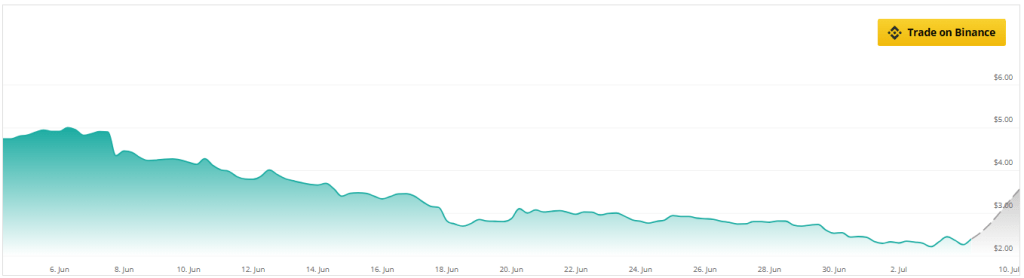

Worldcoin (WLD) has been on a rollercoaster ride the past few months. After hitting an all-time high of nearly $12 in March, the coin embarked on a downward spiral, plummeting over 60% in the last three months. This dramatic drop has made investors jittery, with whispers of regulatory woes and profit-taking swirling around the beleaguered token.

Related Reading

However, a recent surge in price suggests a potential comeback story in the making for the token powering the digital identity application. As of today, WLD sits at $2.27, a modest yet significant rise compared to its November 2023 lows. This upward trend has analysts cautiously optimistic, but several factors could determine whether WLD rebounds or retraces its steps.

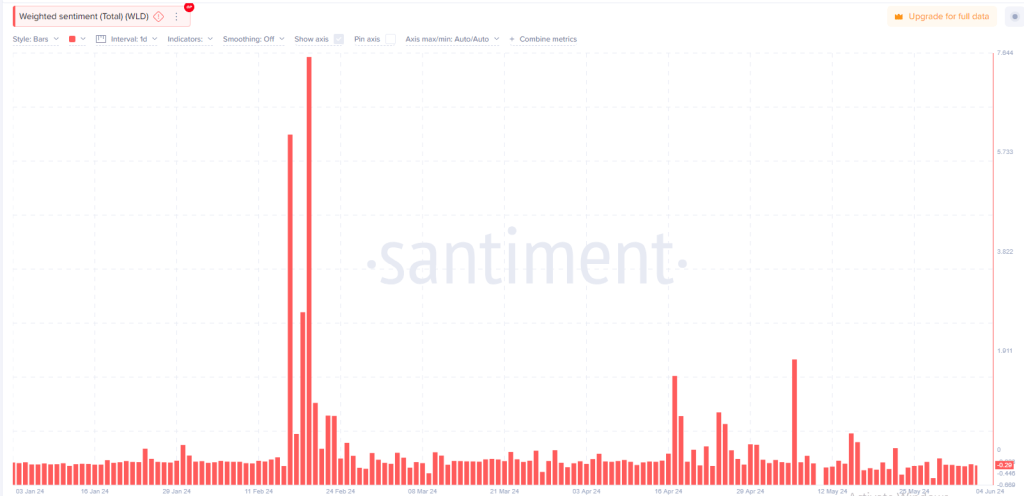

From Gloom To Hope: A Shift In Sentiment

Social media sentiment surrounding Worldcoin paints a fascinating picture. Just a month ago, the online conversation was dominated by negativity, with the “Weighted Sentiment” metric reflecting a decidedly gloomy outlook. This negativity likely stemmed from the sharp price decline, leading many to question the project’s future.

However, a recent shift in sentiment has emerged. The negativity has dissipated, replaced by a cautious optimism. Online chatter now reflects a “wait and see” approach, with some investors expressing renewed interest in the project. This positive sentiment could prove crucial in WLD’s potential recovery. A bullish online community can translate to increased demand for the token, propelling its price upwards.

This sentiment shift can be attributed to a few factors. Firstly, the recent price increase has undoubtedly boosted morale. When investors see a token clawing its way back from the abyss, it fosters a sense of hope and encourages them to hold onto their holdings.

Secondly, the oversold signal from the Relative Strength Index (RSI) might be interpreted as a buying opportunity by savvy investors, further contributing to the positive buzz.

Bulls Charge Ahead, But Can They Stay The Course?

Another interesting development is the activity of “whales,” large investors who can significantly impact a token’s price. According to the Bulls and Bears Indicator, there’s been a surge in buying activity from these whales. This suggests a renewed confidence in WLD’s potential, and if this buying pressure continues, it could propel the token towards the coveted $3 mark in the short term.

However, there are potential roadblocks ahead. The RSI, while currently indicating a healthy balance, could swing back towards overbought territory. This would signal a potential retracement, where investors who bought at lower prices might cash out, causing a temporary dip. Additionally, if the bulls lose steam and selling pressure mounts, the recent gains could be quickly eroded.

Related Reading

Worldcoin Price Forecast: A Bullish Long-Term View

Looking beyond the immediate future, several price prediction models offer a glimpse into WLD’s long-term prospects. One such model estimates a 48% increase in the next seven days, potentially pushing the price to $3.56. This short-term prediction hinges on sustained buying pressure and a healthy balance between bulls and bears.

The long-term outlook appears even more bullish. Some analysts predict a price of $6.41 in one year, representing a significant increase from current levels. This optimistic view is likely based on the continued development of the Worldcoin identity application and its potential for widespread adoption.

While the future remains uncertain, the recent developments surrounding WLD offer a glimmer of hope. A positive shift in sentiment, increased buying activity, and a potentially bullish long-term outlook paint a cautiously optimistic picture for the embattled token.

Featured image from X/@worldcoin, chart from TradingView

Credit: Source link