Block.One, the blockchain company behind EOS, wants to launch a decentralised exchange (DEX) platform named Bullish Global (BG.) The exchange is expected to be ready to go later this year.

Block.One Exchange Receives $10Billion Backing for Bullish Global

So far, the Block.One exchange has a war chest of $10 billion in cash and digital assets.

The venture has significant backing from prominent crypto luminaries, such as billionaires Peter Thiel, Louis Bacon, and Alan Howard. Other notable investors backing the upcoming DEX platform are crypto stalwarts Mike Novogratz, German financier Christian Nagermayer, Richard Li, and Japanese investment bank Nomura.

According to company statements, Bullish Global is focused on developing the decentralised finance (DeFi) far beyond its current position, which is already highly innovative.

BG will provide automated market making, lending, and portfolio management services, while allowing users to enjoy the full benefits of the DeFi market architecture.

The Cayman Islands-based firm also said that Bullish Global would be built on its EOS blockchain.

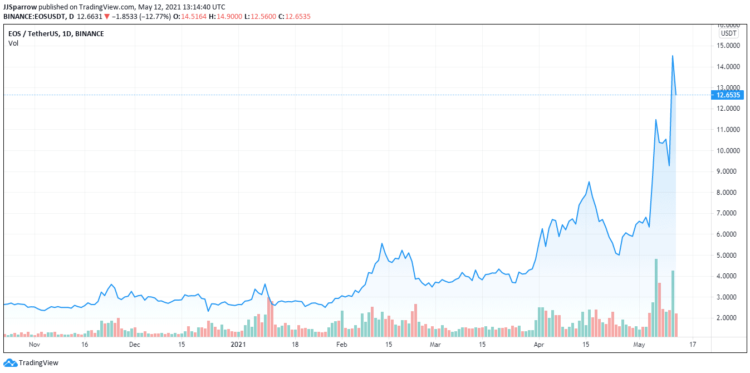

The EOS coin has jumped 14%, with a 24-hour trading volume of over $22 billion. EOS is the 19th-largest cryptocurrency by market cap, according to Coinmarketcap.

DEX Threatening CEX’s Continued Dominance

Cryptocurrencies have grown in the past year, with DeFi being one of the major facilitators of mainstream crypto adoption. The global pandemic’s impact has affected the markets, but the nascent crypto market has outperformed its rivals, posting massive returns for investments.

Against the background of the low returns traditional financial institutions and investment vehicles have paid out to investors, the DeFi space exploded, surging from just under a billion dollars in June 2020 to $87.34 billion in under a year, according to data aggregator DeFi Pulse.

As if this growth was not enough, industry experts postulate that DeFi could displace traditional finance. But, DEX platforms like the imminent Block.One exchange will not disrupt the traditional finance space alone, even crypto exchanges may soon be affected.

There are two types of cryptocurrency exchanges available to investors—centralised and decentralised exchanges. The popular ones are the centralised options. This includes the likes of Coinbase and Binance.

But things are starting to change rapidly. DEX platforms like UniSwap, Sushiswap and a growing number of DeFi projects have grown exponentially, with UniSwap posting trades over $1 billion as far back as September 2020.

Even though CEX platforms have begun offering several DeFi tokens on their platforms, more crypto investors favour these semi-automated trading platforms for numerous reasons.

These include security, more control over funds, financial inclusiveness, and privacy. With DEXs, crypto investors can trade their cryptocurrencies irrespective of their location.

Popular DEX Uniswap is the eighth-largest spot traders for cryptocurrencies. In the DEX space, it leads by a wide margin with thousands of unique active addresses. Just yesterday, it was revealed that liquidity provider (LP) fees for Uniswap surpassed Bitcoin network fees on a seven-day average. Uniswap Lps generated $7.1 million in fees as compared to Bitcoin’s $4.6 million.

Credit: Source link