After Bitcoin reached a new yearly high at $31,413, the buy side has so far failed to initiate a trend-following move north. Although the bulls fended off a sell-off last Friday in the wake of the SEC’s perceived concerns over a Bitcoin spot ETF approval, the momentum seems to be increasingly flattening, or isn’t it?

What’s Next For The Bitcoin Price?

As the market awaits an approval from the Security and Exchange Commission (SEC) regarding a spot Bitcoin exchange-traded fund (ETF), investors are seemingly exercising caution. While open interest in the Bitcoin futures market continues to rise, activity in the spot market has recently declined.

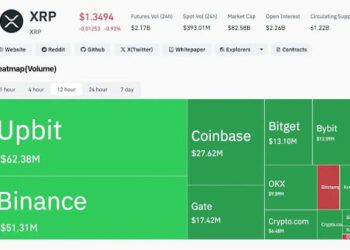

This shift indicates that price action in recent days has been primarily influenced by futures traders. Analyst @52Skew noted on Twitter, “$BTC Spot CVDs & Delta: Quite a bit of spot still being dumped on the market + no limit chasing today from coinbase buyers. Spot bid liquidity $30.5K.”

This observation underscores the reluctance of investors in the spot market who may be waiting for a decisive move by the SEC. However, it should be noted that US markets were closed yesterday for the 4th of July holiday. Most recently, huge spot buying volume came from Coinbase, pushing the market up. So today will be interesting to watch if yesterday’s retracement is bought today by US investors.

Bitcoin dominance, which had risen to resistance at 52.15%, has now consolidated somewhat, dropping to 51.25%. This consolidation, combined with the entry of investors into the altcoin sector, reinforces the prevailing wait-and-see attitude among investors.

Analyzing the Bitcoin price, it is clear that the market is currently facing strong resistance in the $31,300 to $31,416 range. The support area at $30,700 is currently proving to be a critical mark to watch. Holding above this support could give buyers the opportunity to launch a renewed offense.

If the Bitcoin price can break out dynamically above the year-to-date high, the next major chart hurdle awaits at $32,500. Yet, a temporary retracement to the support area at $29,800 could be acceptable to gain momentum for the next breakout attempt.

So far, the bears have lacked follow-through. The sell side also failed in its attempt to sell off the BTC price in the higher time frames back below the psychologically important $30,000 level in recent days. The goal of the bears must be to push Bitcoin permanently below $29,800.

Experts Remain Bullish For Now

Renowned analyst Josh Rager believes the pullbacks won’t be as deep as many experts expect, suggesting that ETF approval, particularly from BlackRock, is a real possibility. He says, “Only an ETF rejection can cause pain, but I think BlackRock will be approved this time,” adding:

The $24k, then up sentiment seems to be quite popular. I think people are overthinking it. Similar was said about Bitcoin needing to sweep $20k first. IMO, pullbacks won’t be this deep now and if we manage to see $25k again it won’t be until later on in the year after more upside before so.

Similarly, NewsBTC lead analyst Tony “The Bull” believes in the bullish case for BTC in the near term. However, he stresses the importance of Bitcoin’s Relative Strength Index (RSI) entering overbought territory, as a failure to do so could indicate a lack of strong upside momentum:

I want to see Bitcoin RSI push into overbought conditions by week end, or else I worry that this isn’t an impulse yet. We have a doji on the weekly, which signals indecision. We need to see follow through this week, or more correction becomes more probable w/ possible bear div.

Featured image from iStock, chart from TradingView.com

Credit: Source link