There are some things that grab the attention of the Cryptoverse for months on end, whether they deserve to or not. One thing that will bring an important change to Ethereum (ETH), and which has been a topic of discussion since last year, is the highly anticipated Ethereum Improvement Proposal, or EIP, 1559.

With EIP-1559 fast approaching, it’s a good time to remind ourselves what it is, what it will do – but also what it will not do, despite what some of the ETH fans are claiming.

What and when it is

First proposed in April 2019, EIP-1559 is a proposal set to significantly revamp Ethereum’s monetary system, primarily by bringing an automatic token burn mechanism for each transaction. It is also expected to help improve the fee market.

Anthony Sassano, Founder of the Ethereum-focused Daily Gwei newsletter, described it in August 2020 as “the largest and most complex change to Ethereum since it first went live.”

It will arrive as a part of the London upgrade on August 5, at block 12,965,000, along with four other EIPs: two of which are related to EIP-1559, one that will set the stage for broader Ethereum Virtual Machine (EVM) improvements, and one that delays the difficulty bomb, aka the ice age, that will make Ethereum impossible to mine, to December 1.

Developers started testing the London upgrade on the Ropsten testnet in late June. Ethereum advocate and former technology lead at DuckDuckGo, Adam Cochran, called this “huge news for Ethereum, one of the largest updates in years and critical for our future.”

As of the time of writing on Tuesday, 66% of clients are ready for the upgrade, per ethernodes.org data.

This particular EIP has been much-discussed within the ETH community and the Cryptoverse in general, and it seems that many are welcoming it. Not all, however, as a group of miners were arguing that a reduction in fees could potentially jeopardize the security of the Ethereum network. They attempted an “educational show of force” this past spring, by calling for 51% of Ethereum’s hashpower to be moved to the Ethermine pool for 51 hours. They failed.

No matter if the group were serious about moving the hashrate, or this was about attracting attention to start a discussion on the issue, Ethereum developers accelerated their plans to transition to the proof-of-stake-based Ethereum 2.0, which would do away with mining altogether.

What it will do

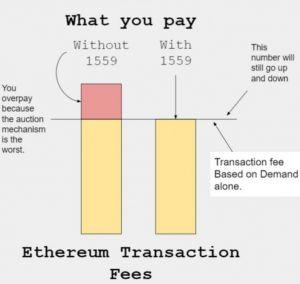

Currently, ETH sender must pay gas fee for each transaction, but that gas fee is unclear, unknown in advance, and there’s a risk of overpaying.

According to the Ethereum Foundation community manager Tim Beiko, what EIP-1559 will do is:

- burn a part of the transaction fees;

- bring a “base fee” in blocks on the network which will track the gas price the network accepts from transactions based on demand for blockspace, making it easier for wallets and users to estimate the right price for their transactions;

- add a new transaction type so users can specify the maximum fee they are willing to pay and the maximum miner tip, as well as get a refund for the difference between that maximum and the base fee and miner tip.

In other words, it’ll split the gas fees into a tip that can be set by a transaction’s sender, and a base fee that is burned. Basically, we’ll see most gas fees being destroyed.

Furthermore, per Tim Roughgarden, an American computer scientist and a Professor of Computer Science at Columbia University, what EIP-1559 should do is:

- decrease the variance in transaction fees and the delays that some users experience, through the flexibility of variable-size blocks;

- improve the user experience through easy fee estimation, in the form of an “obvious optimal bid,” outside of periods of rapidly increasing demand;

- at least modestly decrease the rate of ETH inflation through the burning of transaction fees.

Or as Sassano and Nader put it, the EIP will:

- enable better transaction fee estimation;

- create a symbiotic relationship between ETH, Ethereum network, and its users;

- allow for more reliable transaction inclusion.

“After EIP-1559 has been implemented, a transaction will only be valid if the Max Fee is greater than the Base Fee plus the Priority Fee. Any excess amount is refunded back to the user,” the authors said. “As a result, users will have much more certainty when submitting a transaction because they only need to make sure that they include enough to pay the Base Fee and a small Priority Fee to have their transaction included.”

Some also suggest that the EIP may have an impact on the price of ETH. Andrew Keys, managing partner at DARMA Capital, was quoted by Reuters as saying that ethereum’s current price has yet to factor in the looming software upgrade. The software adjustment this week, coupled with another upgrade in the first quarter of 2022, should “easily quintuple the price of ether” by next year, he said.

Matt Hougan, Chief Investment Officer at Bitwise Asset Management, said that EIP-1559 should increase transactions on Ethereum and raise the use of ETH, which “will likely help bring a wave of institutional investors into the market.”

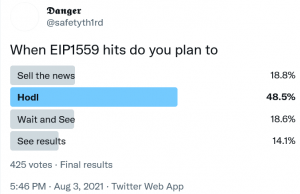

However, it’s not going to be a straight line up.

I’m a fan of EIP1559 technologically but this seems like an obvious sell-the-news event. Dip in the short-term upon… https://t.co/3xFMECH32X

At 15:58 UTC, ETH trades at USD 2,502 and is down by 5% in a day, trimming its weekly and monthly gains to 12%. The price is up by 575% in a year.

What it will not do

It is because of the base-fee burn element that some have claimed will transform ETH into a deflationary cryptoasset, and make it a store-of-value rival to bitcoin (BTC).

However, it is important to note that there’s no clear answer as to when this might happen exactly. Some things many expect to happen aren’t on the table at all. Per Sassano and Nader, the EIP itself:

- doesn’t lower the gas prices in the long run;

- doesn’t make ETH deflationary by default.

Whatever changes do happen on this front, they will likely have to wait a while.

According to industry players speaking with Cryptonews.com, Ethereum may need to move fully to a proof-of-stake consensus mechanism (PoS) before the deflationary aspect of EIP-1559 really kicks in.

“ETH won’t immediately become deflationary because the proof of work mining will continue producing net inflation until Ethereum switches to proof-of-stake this year,” developer Ryan Berckmans told Cryptonews.com. He added that inflation will likely turn negative when Ethereum 2.0 is finally rolled out.

Not everyone agrees with this prediction, with some arguing that Ethereum could become deflationary even before PoS. And some analysts also suspect that Ethereum might not reach the level of traffic whereby token burns outpace inflation.

Bitwise’s Hougan estimates that the EIP will reduce ETH’s overall inflation rate from c. 4% a year to 3% – about half as large a reduction proportionately seen in Bitcoin halving events, he said.

Another major point being discussed is EIP-1559 reducing the high transaction fees on the network. This is not what this EIP is meant to do.

Per developer James Hancock, EIP-1559 reduces overpaying transaction fees, not reducing fees.

Furthermore, MyCrypto founder Taylor Monahan argued that “when [ETH] price goes up your [transaction fees] are [gonna] be go waaaay up.”

As a matter of fact, several people have written about EIP-1559 not lowering the fees – at least not on its own – for months now. In December 2020, the above-mentioned professor Tim Roughgarden claimed that “no transaction fee mechanism, EIP-1559 or otherwise, is likely to substantially decrease average transaction fees,” adding that “persistently high transaction fees is a scalability problem, not a mechanism design problem.”

Then in March this year, Nate Maddrey, a Research Analyst at crypto intelligence firm Coin Metrics, said that EIP-1559 is not a solution for the high gas fee issue. He too notes that fees are fundamentally a scalability problem, arguing that they will stay high as long as there’s high competition for block space. “If Ethereum can only process a few hundred transactions (on average) per block, there’s going to continue to be high fees as long as [decentralized app] usage keeps increasing.”

Research scientist at the Ethereum Foundation Barnabé Monnot argued that the main point here is to not conflate the dynamics of the gas price seen before the EIP with the dynamics of the priority fee under this EIP, as these are structurally different.

Earlier this summer, with the London upgrade getting ready to go live on the testnet, Taylor Monahan urged the community to lower their expectations.

“While EIP-1559 is an “elegant solution to a lot of hard problems,” she said, it comes with drawbacks too – for example, a number of user experience issues. She also argued that users will not know “with sufficient certainty” the final cost of their transaction or when it will be delivered.

“The gas fee and gas limit are too complicated for new users. No one knows what gas to use-set,” she concluded, suggesting that issues such as these were “not necessarily addressed by EIP-1559.”

Also, in July, Monahan revisited the subject, suggesting that users do not have enough information to make necessary decisions when making a transaction and that there is not a one-size-fits-all solution, but that each user will have to figure out what works for them.

___

___

Learn more:

– Pantera CEO Trims Bitcoin Price Forecast For 2021, Sees ETH Outperforming

– ETH ‘Unlikely’ To Become ‘Popular Currency’ But It Still Can Compete With BTC

– ‘Fiat-Like’ Proof-of-Stake Chains Favor Centralization & Rich Players

– The Ethereum Economy is a House of Cards

– Why Ethereum is Far From ‘Ultrasound Money’

– Ethereum Needs to Try Harder To Keep Its Dominance in a Multichain Future

– MEV Harms Ethereum Users And it May Be Here For Some Time

– Ethereum Miners Can Transition to These Coins and Boost Their Values

Credit: Source link