In the financial system, a perpetual futures contract, also known as a perpetual swap, is a transaction representing an agreement to buy or sell an asset at an unspecified point in the future. It also allows users to trade using margin or leverage (using borrowed funds).

This means that rather than having the capital to trade a large notional value of the underlying asset (say, 500 ETH), users can just deposit a small part of it, leveraging their capital. Users can trade in both directions by buying (long) and selling (short) perpetuals. In short, users are using borrowed funds to bet on the future price of an asset.

Perpetual futures are a solution to enable derivatives markets for illiquid assets. They rose in popularity when introduced by BitMEX in 2016. Cryptocurrency perpetuals usually offer high leverage, sometimes over 100 times the margin. In 2022, these instruments on centralized exchanges like Binance, Kraken, and BitMEX will generate billions of trading volume daily, even beating spot crypto trading. However, there are now also decentralized platforms for perpetual markets.

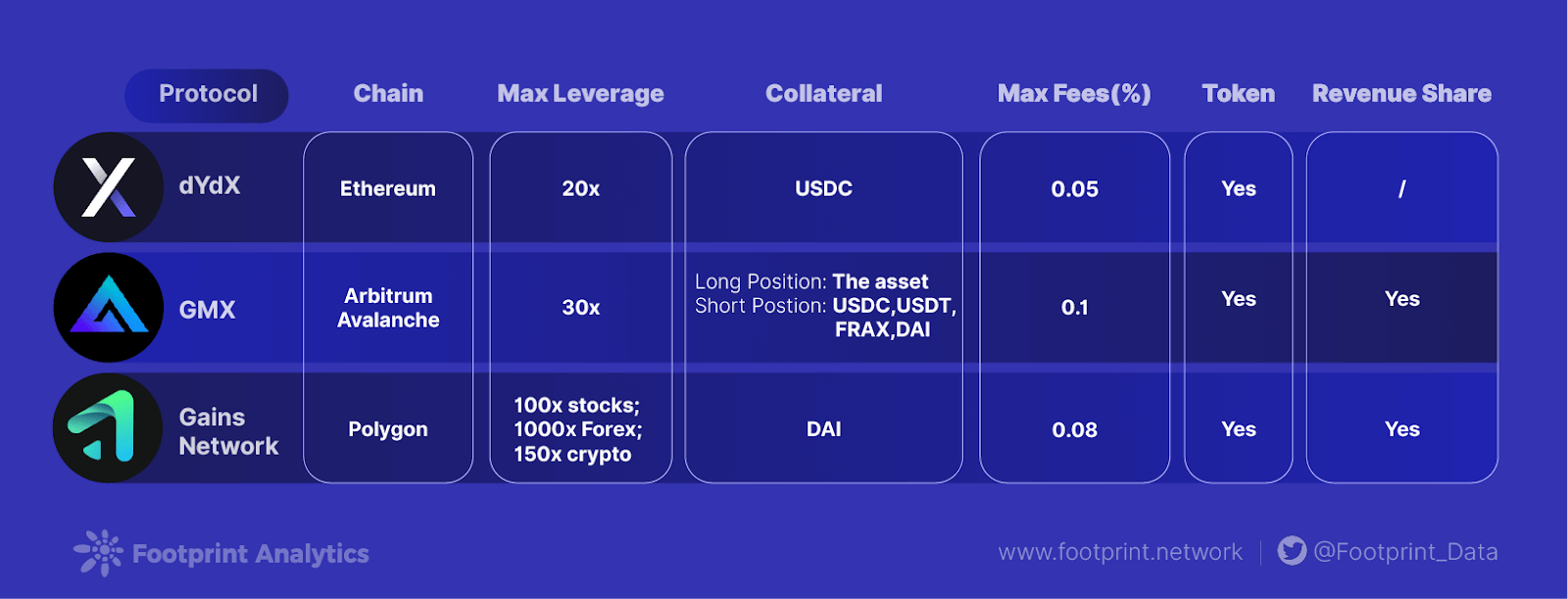

This article will cover relevant players in the Perpetual DEX sector, comparing their main features and key metrics:

dYdX

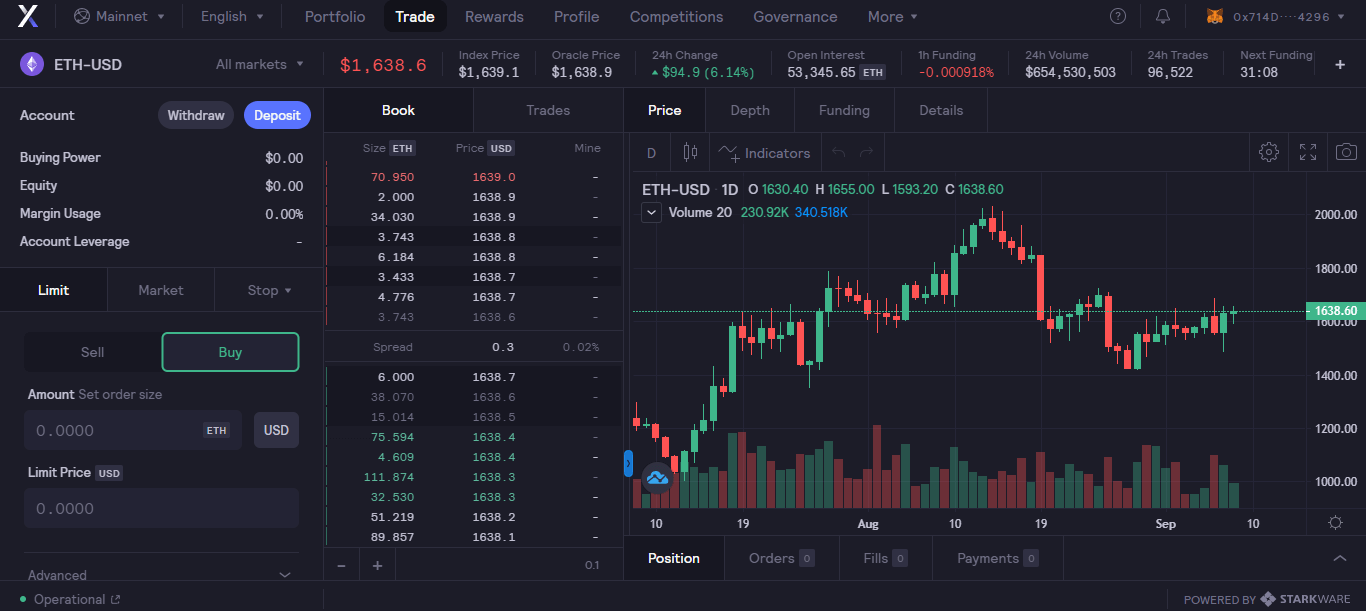

Launched in 2017, dYdX is a DEX that runs smart contracts on Ethereum to offer perpetual contract trading, margin trading, spot trading, lending, and borrowing services.

Users deposit their collateral at the dYdX exchange and start trading perpetual contracts.

But that is not the only way an investor can interact with the exchange. He can deposit USDC to the exchange trading pool (thus becoming a liquidity provider) and receive a yield on that capital.

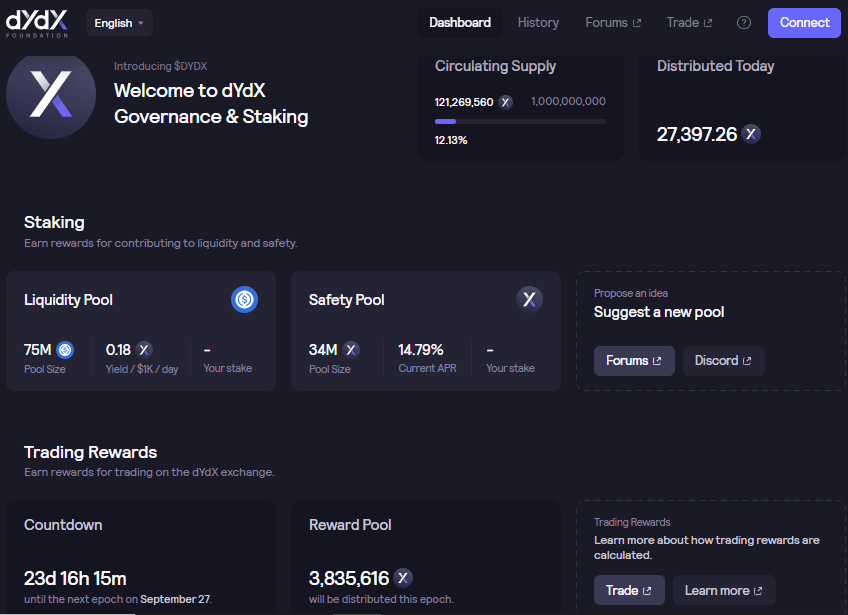

dYdX rewards

The exchange has a token (dYdX) that is received as a reward when you are a liquidity provider on their Liquidity Pool and can be staked to be part of the protocol’s safety pool. Currently, the latter has a yield of 14.79% APR.

GMX

GMX is a decentralized platform for spot and perpetual contract trading that supports users to leverage up to 30x on their trades. The protocol launched on Arbitrum in September 2021 and then went into Avalanche at the beginning of 2022.

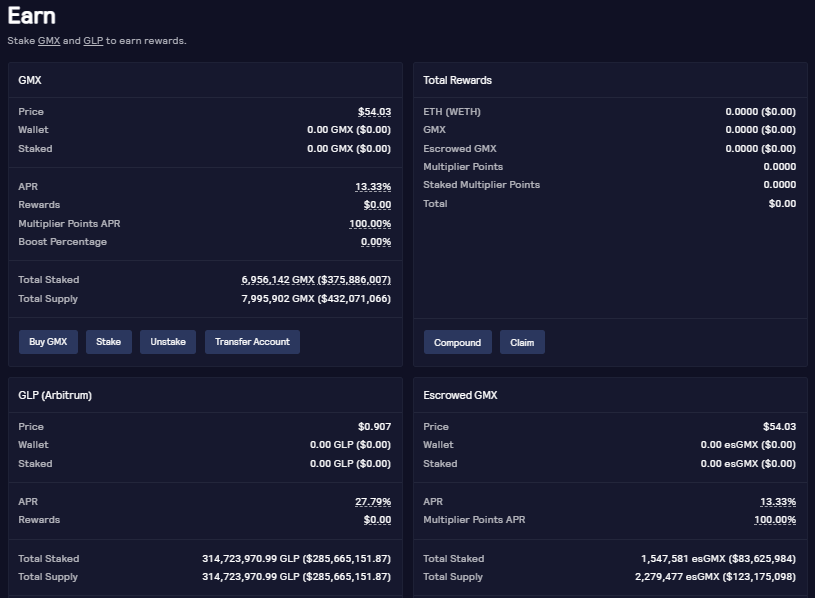

Similarly to dYdX, an investor can also provide liquidity to GMX’s trading pool to receive rewards. One difference is that he can send UDSC and other tokens (BTC, USDT, DAI, etc) to the pool; another difference is that the platform has two tokens: GMX and GLP.

GMX rewards

Investors can buy GMX and stake it to collect shared revenues from the protocol. GMX is the token used for Governance. GLP is given to investors that provide liquidity to the protocol and also can be staked. Fees are split between GMX (30%) and GLP (70%).

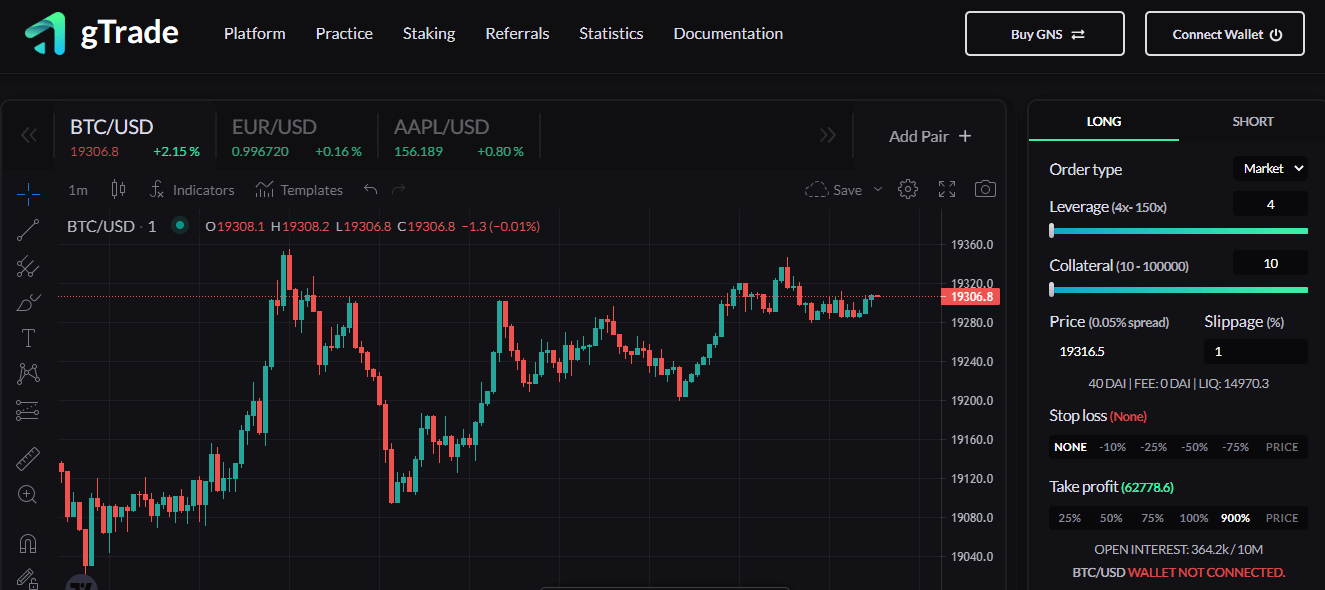

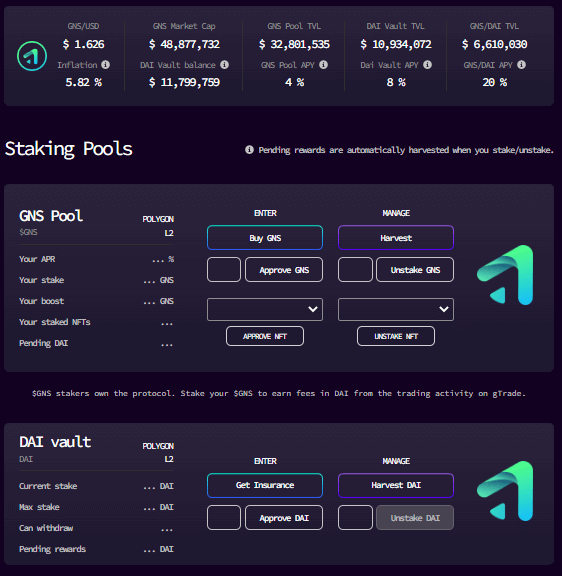

Gains Network

Gains Network is a decentralized perpetual exchange on Polygon. It launched gTrade, a decentralized leveraged trading platform with synthetic assets. Unlike the dYdX and GMX, these synthetic assets enable it to offer a wide range of leverages and pairs (up to 150x on cryptos, 1000x on forex, and 100x on stocks).

On Gains Network the investor also can provide liquidity to the vault (DAI in this case) used as counterpart to the trading activity, and receive rewards/revenue from the platform.

Gains Network rewards

The protocol has two tokens: an ERC-20 token (GNS) and ERC721 utility token (NFTs). GNS and the NFTs were created to be actively used within the platform. GNS holders receive platform fees when staking through Single Sided Staking, paid in DAI. NFT holders get reduced spread and boosted rewards, on top of the regular ones.

Key Metrics and Features

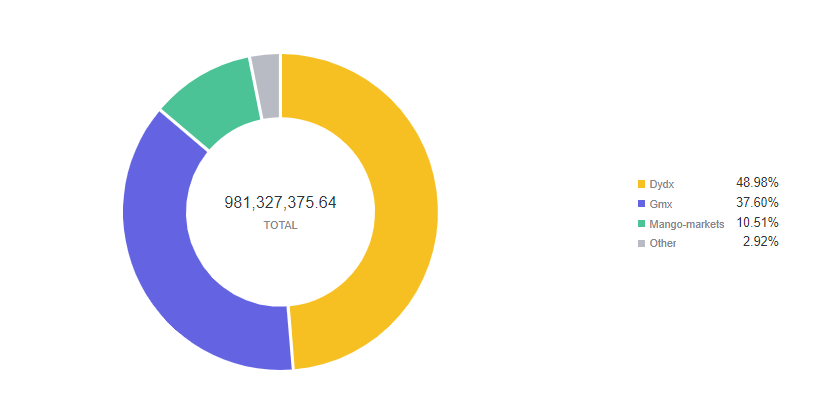

TVL

dYdX (USD 468 million) and GMX (USD 360 million) dominate the DEX Perpetual landscape in TVL, accounting for almost 87% of the market. One consolidated its position by being the first mover (dYdX), and the other is the new entrant that was able to better capture new users by using the “sharing the revenue” strategy, laso implemented by other exchanges like Gains Network.

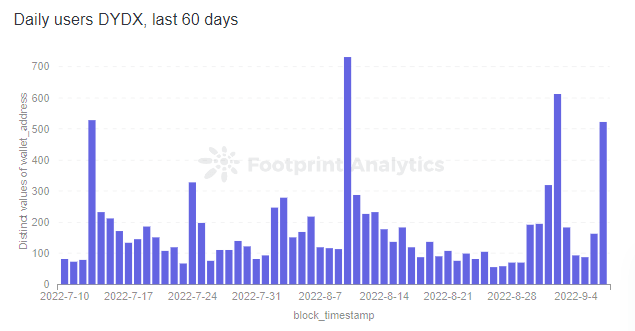

Daily Users

dYdX

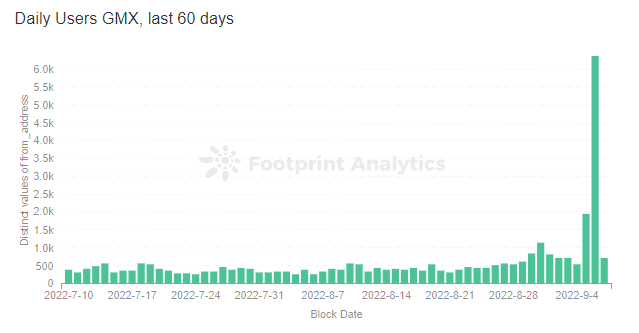

GMX

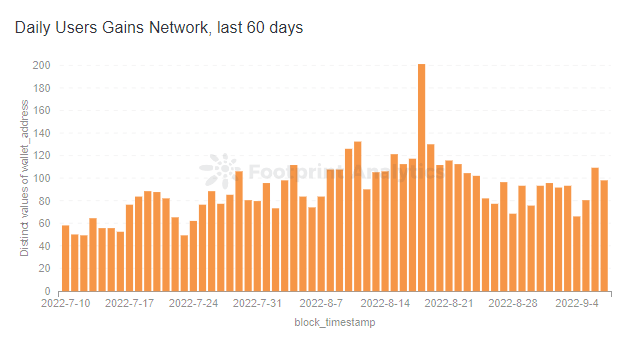

Gains Network

GMX had more daily users (average of 500) than dYdX (average of 200) over the last 60 days, and Gains Network (average of 80) is getting close to dYdX numbers. All platforms incentivize trading. DYdX does that through a trading rewards program, where the users receive dYdX tokens based on their trading activity. GMX uses a referral program to incentivize the new users’ onboarding, generating discounts for the new users and rebates for the referral code owner. Gains Network also uses a referral program to boost its daily average number of users.

Key Takeaways

dYdX and GMX are the most prominent players in the DEX perpetual markets vertical, as seen in the charts above. However, new entrants like Gains Network have new features (more leverage, more trading pairs) and are trying to increase their TVL. The ability to use more leverage, and the support of more collateral types, are good steps toward major adoption, when combined with the revenue sharing to the token holders, something dYdX does not do.

This piece is contributed by Footprint Analytics community.

Sept. 2022, Thiago Freitas

Data Source: dYdX & GMX $ Gains Network Comparison

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

Credit: Source link