“Hashrate” refers to the total combined computational power that is being used to mine and process transactions on a Proof-of-Work blockchain, such as Bitcoin and Ethereum (prior to the 2.0 upgrade).

A “hash” is a fixed-length alphanumeric code that is used to represent words, messages and data of any length. Crypto projects use a variety of different hashing algorithms to create different types of hash code – think of them like random word generators where each algorithm is a different system for generating random words.

For instance, the hash for “coindesk” using the hashing algorithm that Bitcoin uses, SHA256, = f2429204b339475a3d94dd5450f5ebb3c80130a85fbb91d62768741a3b34a6b6

Before new transactional data can be added to the next block in the chain, miners must compete using their machines to solve a difficult mathematical problem. More specifically, miners are trying to produce a hash that is lower than or equal to the numeric value of the ‘target’ hash by changing a single value called a ‘nonce’. Each time the nonce is changed, an entirely new hash is created. This is effectively like a lottery ticket system, where each new hash is a unique ticket with its own set of numbers.

For example, if we take “coindesk” and change the first letter to make “foindesk,” we get this hash = 5a12a9af1b5794bf6855c15944339d41ff713665e415b5434b8c9f081c61b66a

Since each hash created is completely random, it can take millions of guesses – or hashes – before the target is met and a miner wins the right to fill the next block. Each time that happens, a block reward of newly minted coins is given to the successful miner along with any fee payments attached to the transactions they store in the new block.

The block reward, which is a predetermined amount of free coins given to a miner each time a new block is mined, undergoes a programmed halving in order to incrementally reduce the total supply over the course of a coin’s mining lifespan. For Bitcoin, block rewards are cut in half every 210,000 blocks, or approximately 4 years. As of 2021, miners receive 6.25 bitcoins each time they mine a new block. The next halving is expected to occur in 2024 and will see bitcoin block rewards drop to 3.125 bitcoins per block. Dash is another mineable cryptocurrency that reduces its block rewards by 7.14% every 210,240 blocks, while Litecoin halves its rewards every 840,000 blocks.

Application-specific integrated circuit (ASIC) mining hardware now dominates the crypto mining space and is solely designed to perform hashing functions. Some modern-day ASIC rigs are capable of achieving 110 tera hashes per second (TH/S), which equates to 110 trillion attempts at solving the hashing problem per second.

Miners are motivated to do all this in search of monetary rewards. In the process, though, they play a key role in securing cryptocurrencies, most famously Bitcoin, by making it more difficult (namely very expensive) for attackers to gain a 51% majority control over the blockchain network.

Hashrate FAQs

What is Bitcoin’s current hash rate?

171 million EH/s, which stands for exa hashes per second, at the time this article was published. 1 exa hash = 1 quintillion hashes.

That means that miners are computing 171 quintillion hashes every second. Find the most current estimate at Blockchain.com.

Why is hashrate important?

Higher hashrate means more resources are being devoted to process transactions on the blockchain. This makes a network more resilient to attacks because a malicious agent would need to spend vast sums of money to outcompete other mining facilities in order to gain a 51% majority control and stop other people’s transactions, or double-spend their own coins.

It follows, then, that the higher the hashrate, the harder it is for a bad actor to source the necessary hashing power and, as such, the harder the network is to attack.

What is mining difficulty?

Mining “difficulty” is how difficult it is for miners to produce a hash that’s below the target hash.

In Bitcoin, the difficulty automatically adjusts every 2,016 blocks. Blocks are targeted to be found by miners every 10 minutes. So if miners are finding bitcoins more often than every 10 minutes on average, the difficulty moves upward. If miners are finding bitcoins less often than every 10 minutes on average, the difficulty moves down.

With Ethereum, mining complexity uses a similar system to Bitcoin with the added addition of a “difficulty bomb” that was introduced back in 2015 and went live during the Homestead update in early 2016. This increases the time it takes to mine each new block with the aim of phasing out ether mining to make way for the new Proof-of-Stake (POS) mechanism in the 2.0 upgrade.

Difficulty is a key piece of calculating a hashrate. The more difficult it is to mine, the more hashes will need to be generated to find the block rewards, pushing the total hashrate higher.

How is hashrate calculated?

There’s no way to know for sure the exact hashrate of a mineable cryptocurrency, though it can be estimated. Hashrate is traditionally estimated based on public data about the underlying cryptocurrency, including the difficulty metric described above.

Though this traditional estimation method is in the right ballpark, this methodology has long been criticized as not precisely accurate. The Kraken crypto exchange proposed another way of estimating the hash rate, using statistics to show with 95% confidence that the hashrate lies in some range.

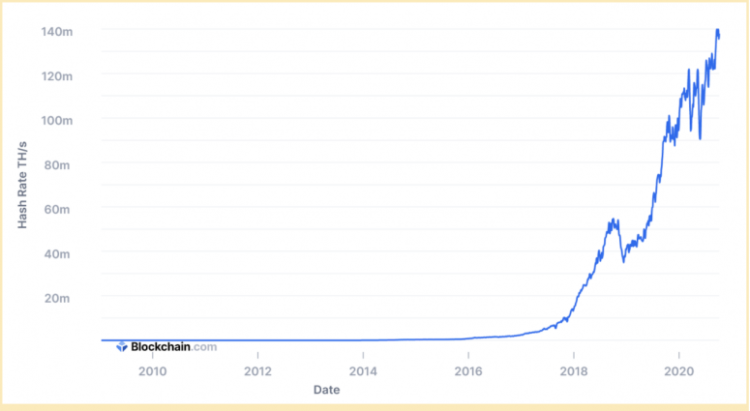

Why has Bitcoin’s hashrate gone up?

More and more miners have entered the fray in Bitcoin’s short history, pushing the hashrate up.

The most likely reason for new miners joining the highly competitive space is because of bitcoin’s high price potential. An increase in demand for bitcoin (which is a scarce asset) recently pushed the price above $40,000 per coin (it is lower now, at press time), which in turn has attracted more operators who are seeking to get in on these significant returns.

Any rise in miners pushes Bitcoin’s difficulty up, which then drives the hashrate up.

Credit: Source link