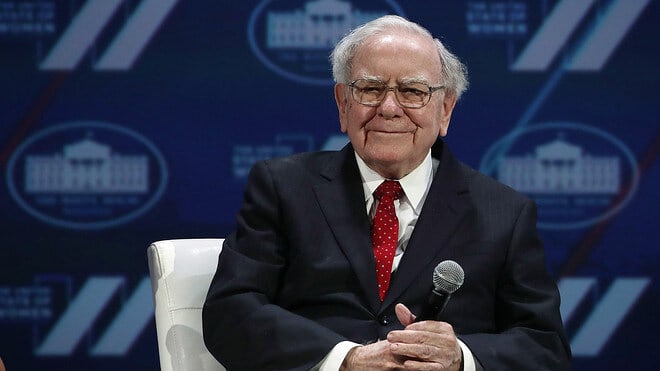

While some of the world’s top billionaire investors have announced expanding their investment portfolio with Bitcoin and other cryptocurrencies, Warren Buffet has remained undeterred. The legendary investor has dismissed Bitcoin as an unproductive asset that he would never invest in.

Warren Buffet dismisses Bitcoin

Warren Buffet was speaking at the Berkshire Hathaway Annual Shareholder meeting, saying that Bitcoin was not a productive asset and did not generate any tangible value. Buffet’s remarks come despite the rising global adoption of cryptocurrencies, including Bitcoin.

“Whether it goes up or down in the next year, or five or 10 years, I don’t know. But the one thing I’m pretty sure of is that it doesn’t produce anything. It’s got a magic to it, and people have attached magics to lots of things,” Buffet said.

Buffet has also dismissed any notion that he might invest in Bitcoin in the future. He said that he would not buy all of the Bitcoin globally even if it was sold to him for $25. Buffet said he was willing to invest $25 billion in US farmland and other $25 billion in apartments because they derived value.

“Now if you told me you own all of the Bitcoin in the world and you offered it to me for $25, I wouldn’t take it because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything. The apartments are going to produce rent, and the farms are going to produce food,” Buffet added.

Besides Buffet, Charlie Munger, another billionaire investor, has also dismissed Bitcoin, saying that the world’s largest currency lacked any value. Munger said that Bitcoin undermined the Federal Reserve currency, adding that China was smart to ban cryptocurrencies last year.

“In my life, I try and avoid things that are stupid and evil and make me look bad in comparison to somebody else – and Bitcoin does all three,” Munger said.

Crypto community reacts

Warren Buffet’s act of dismissing Bitcoin and the entire crypto sector caught the community’s attention. Ricardo Salinas Pliego, a Mexican billionaire entrepreneur, said it was saddening to see Buffet talk about something he did not understand.

The founder of Digital Assets Data, Mike Alfred, said that he had admired Warren Buffet’s work but said that the recent statements by the billionaire had prompted him to liquidate his holdings on Berkshire because Buffet lacked to change according to societal needs.

Your capital is at risk.

Read more:

Credit: Source link