Agata Soroko, PhD Candidate, Faculty of Education, L’Université d’Ottawa/University of Ottawa.

______

Shortly after the COVID-19 pandemic threw the global economy into a crisis in March 2020, I wrote an essay expressing my hope that the unfolding financial collapse wouldn’t be used to justify a push for more financial literacy education in schools. But this has since happened.

In May 2020, the Organization for Economic Co-operation and Development (OECD) announced its Program for International Student Assessment 2018 results with the following question: “With unemployment increasing and a global recession looming, it’s more important than ever to ask: are adolescents knowledgeable about money matters?”

Ontario recently added financial literacy to Grade 9 math curriculum. Some researchers have emphasized the relevance of financial literacy education amid the current COVID-19 economic crisis.

Financial literacy, as defined by the OECD, is “a combination of awareness, knowledge, skill, attitude and behavior necessary to make sound financial decisions and ultimately achieve individual financial well-being.”

My research on high school curriculum documents in Canada and the United States shows that financial literacy education frames financial outcomes in individualistic ways that are rooted in the ideology of merit. Mainstream financial literacy pays little attention to the broader economic and socio-political contexts in which taking control of finances is progressively more difficult for hard-pressed families as the gap between the rich and everyone else continues to widen.

Strong endorsement from the World Economic Forum @wef, recognizing Ontario as a global leader in financial literacy… https://t.co/MynILFjil6

Post-recession pushes

In the aftermath of the 2008 recession, financial literacy gained traction in both Canada and the US.

Education scholar Laura Pinto argues the negative economic effects of the 2008 financial crisis were less pronounced in Canada than in other OECD countries. Yet, the connections made by governments and the media between the state of the economy and the need for financial literacy among citizens led to the development of financial literacy education policy across the nation.

In 2010, a Toronto Star columnist summarized: “After the last stock market crash, the federal government realized that people needed help with spending, saving, investing and — of course — borrowing.”

In both industrialized and emerging economies, the OECD declared that a “lack of financial literacy was one of the factors contributing to ill-informed financial decisions …” It recommended that governments develop financial education programs and integrate financial literacy education into school curricula, and many followed suit.

Such recommendations and government efforts suggested that it was the spending habits of the general public at large that were to blame for the recession, despite the fact that both a lack of government regulation and reckless and illegal behavior in the financial sector were significant contributing factors.

Financial irresponsibility?

Today, some financial literacy proponents are focusing on how the COVID-19 recession has unmasked some people’s financial irresponsibility.

In the US, the Charles Schwab brokerage, whose CEO is a billionaire, is one of many financial services companies that produces financial literacy resources.

Results of the company’s online survey, conducted by the Harris Poll of more than 2,000 US adults in June 2020, are reported on the website Schwab Money Wise, which promotes school lesson plans. The survey found that 89% of people polled agree that lack of financial education contributes to poverty (58%), lack of job opportunities (53%), unemployment (53%) and wealth inequality (52%). According to the company, the findings expose the “grave impact” of the “lack of financial education during COVID-19.”

THE CANADIAN PRESS/Graham Hughes

Economic, racial injustices

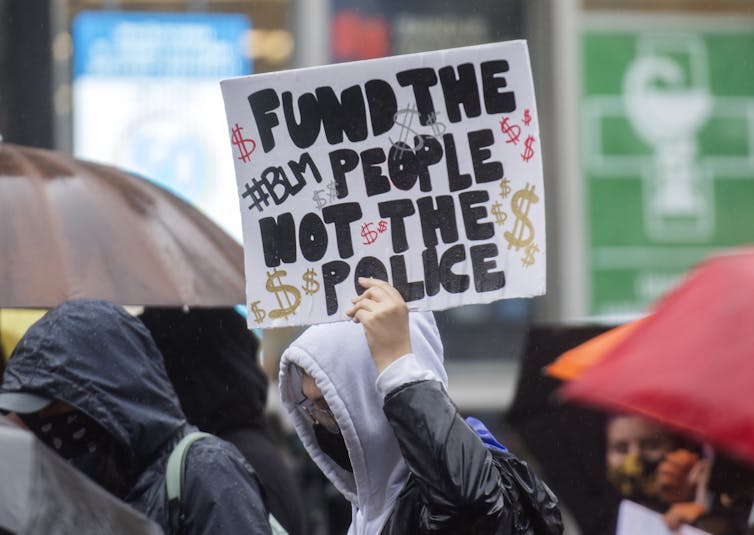

Advocates of financial literacy education continue to tie individual financial know-how and behavior to deep-seated social problems and economic woes even in the face of a financial crisis caused by a pandemic and a year of global civil rights protests following the murder of George Floyd in Minneapolis.

Both the pandemic and the protests have forced the public to reckon with the racial wealth gap in both the US and Canada, and economic racism in Canada’s pandemic response and recovery.

Economists like Darrick Hamilton and William A. Darity, Jr. have shown how deep-seated economic and social structures, such as inheritance and intergenerational wealth transfers benefiting whites, perpetuate wealth inequality and racism in the US. Yet, they write, financial literacy narratives imply that poor decision-making or deficient financial knowledge on the part of Black Americans is at the root of poverty.

Political economist Chris Clarke has noted how in response to economic crises, financial literacy education appears to serve as a coping strategy that makes people more resilient in the face of inevitable market failures.

But in positioning financial crashes as inevitable, the contradictory elements of this thinking become evident: Market-conforming behavior endorsed by financial literacy education cannot ultimately guarantee economic well-being for its subjects.

Recipients of financial literacy education are instructed, as Clarke writes, in “learning to fail.”

Key takeaways from COVID-19

Let’s challenge the idea that if we learn to better manage our money, we can prevent the next financial meltdown or thrive in it.

On the contrary, the pandemic has reminded us that we aren’t self-reliant but part of a collective. What we now see is a powerful case for a strong social safety net that includes paid sick leave, affordable housing, unemployment insurance and a strong health-care system.

Years of austerity policies and a disinvestment in the welfare state prior to the pandemic, however, have only exacerbated the effects of COVID-19 in Canada.

At the same time, the Canadian Emergency Response Benefit (CERB) showed economic restructuring and wealth redistribution are possible once a problem is deemed a crisis.

Poor decisions by those in power

Instead of focusing on financial literacy education for students, let’s reframe the discussion around the profound illiteracy of those in power.

Poor policy-making allowed Canadian billionaires to increase their wealth by $78bn during the pandemic while nearly three million Canadians lost their jobs in March and April 2020 alone.

Those working in poorly paid essential industries who could not afford time off bore the burden of COVID-19 infections and deaths.

Today, as the planet continues to burn and many people globally await vaccines, we see the hoarding and squandering of resources. Amazon founder Jeff Bezos, who’s amassed almost $70bn since the pandemic began, recently made headlines when he celebrated a private space race.

Teaching kids better budgeting won’t fix inequality. Addressing the financial literacy of politicians and key decision-makers who make policies that leave CEOs like Bezos avoiding federal income taxes or allow wealthy Canadians to squirrel funds away in offshore tax havens just might.![]()

This article is republished from The Conversation under a Creative Commons license. Read the original article.

____

Learn more:

– Solving These 7 Challenges Would Accelerate Bitcoin Adoption

– Knowledge of Crypto on the Rise, Encouraging Investment – Survey

– Mexico’s Biggest University Adds Course That Features Crypto Learning

– Honesty and Education Will Help Bitcoin Build Trust – Survey

– Academic: All Undergrads Should Learn About Bitcoin & Blockchain

– COVID-19 Further Exposes Inequalities in the Global Financial System

Credit: Source link