Stephen Ehrlich, Co-Founder and CEO at Voyager Digital, a crypto-asset broker.

_____

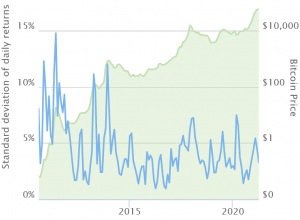

Volatility is good for crypto. It serves multiple purposes as the whole crypto ecosystem matures, which we have to remember is an industry and technology that is still only just over a decade old. New and emerging industries are by their nature volatile as they move towards mainstream adoption. But the volatility attracts people, investors, and technologists, who drive the pace of adoption forward and as it grows, volatility naturally decreases. In the case of bitcoin (BTC), its volatility has steadily been decreasing over time and even the recent sharp moves have not seen such a big rise in volatility compared to earlier swings.

Bitcoin price and volatility chart

Volatility continues to attract participants as it is unquestionably in our human nature to be drawn to assets that are subject to rapid price appreciation. Throughout history, there have been numerous asset bubbles that have burst, with Dutch tulips of the 1600s being the one that most referenced in relation to crypto-assets. But do tulips really provide any utility apart from looking and smelling good? Many crypto-assets actually provide a purpose, a utility, and serve as the backbone to new technology protocols upon which useful apps are being built. This is why we are seeing greater adoption and as the whole market continues to grow, we are now seeing institutions embrace Bitcoin by diversifying into it as an alternative store of value. This is why volatility is good for crypto. But another harsh reality is that it allows people to learn about the risks, as well as the rewards, of getting involved. Hopefully, this is done with the assistance of their chosen broker or through educational webinars, video, and other collateral.

Yes, there will be many that will get their fingers burnt, especially if they employ leverage into their trading without a disciplined approach to managing risk.

The same can be said of the internet boom and bust in the late 1990s and early 2000s that saw many a “dotcom” go bust. Leverage was around in those days too, so unfortunately many people learned the hard way, but it is a necessary evil for the industry to become even more established. For Bitcoin, we have seen multiple bubbles burst, with 2017/18 being the last cycle, and soon after the skeptics were suggesting the end for crypto-assets was nigh. But those who see the technology’s potential were keeping their heads down and building amazing platforms and applications. If we take a look at Bitcoin today, it’s clear that the end is nowhere near.

Volatility also attracts the attention of regulatory authorities, another natural evolution of nascent industries. On occasions though, there can be overregulation. Whilst the sentiment behind the UK’s Financial Conduct Authority ban on retail investors being able to trade crypto derivatives is right, in respect to trying to provide greater investor protection, it can limit choice and ultimately drive investors to offshore brokers that may afford much less regulatory protections. If an investor really wants to employ leverage in their trading then they’ll find a way to do it, so perhaps rather than an outright ban, perhaps limit the amount of leverage they can use instead.

Bans certainly don’t help liquidity and are actually counterproductive. We’ve seen multiple decisions to “ban” crypto reversed as authorities realize that people simply circumvented it by using a VPN or other means to buy BTC. India is now set to vote on a crypto ban, but at the same time, they are due to introduce their own central bank digital currency, which in itself sends out mixed messages. As governments become more knowledgeable on crypto-assets and understand how they are totally borderless, bans are likely to become less and liquidity will continue to improve further.

Coinbase’s prospectus filing and the fact that the US Securities and Exchange Commission (SEC) is allowing this anticipated USD 100bn direct listing to come public, with significant consumer involvement, is further acceptance of digital assets by the authorities. The continued evolution of the industry going mainstream and public companies vetted and allowed to move forward by the SEC, foreshadows the long-term outlook by the SEC that this industry is here to stay and regulation and acceptance of digital assets as an asset class is forthcoming. Regulation adds legitimacy to the industry and will attract a broader audience of investors and participants, as oversight gives comfort to a larger group of investors.

Regulation is very important, but it needs to find the balance that protects consumers, yet also fosters the adoption of what is a truly ground-breaking technology and asset class. So, for those people that complain about crypto markets being too volatile, we NEED volatility in order for the whole ecosystem to thrive.

____

Learn more:

– Bitcoin Market Changed ‘Radically’ & Volatility Decline Attracts Institutions

– CFOs and Financial Advisors Have Different Concerns About Bitcoin

– South Korean Traders Offered First Fear-Greed Crypto Volatility Tool

– Have Crypto Traders Learned? “Only” USD 600M Liquidated In One Hour

Credit: Source link