Ethereum has been moving higher after flatlining in the $1,150-1,250 range over the past week.

Despite a local drop, the cryptocurrency remains up by over 12 percent in the past day and 25 percent in the past seven days, per market data from CryptoSlate.

The cryptocurrency set an all-time high, well at least it did according to some investors, who say $1,420 is the all-time high price for ETH prior to today. Whatever the case, a venture investor still expects significant growth ahead due to positive on-chain trends.

On-chain trends signal potentially strong growth for Ethereum

Spencer Noon, an investor at crypto-focused venture firm Variant and an on-chain analyst, says that there are a number of on-chain trends indicating Ethereum will “blow past its all-time high.”

These on-chain trends include but are not limited to:

- Ethereum’s transaction fees are more than double of Bitcoin, indicating to some that it is one of the most useful, if not the most useful, crypto-asset and blockchain network.

- The amount of value transferred on Ethereum via stablecoins, ETH itself, and other tokens is surpassing Bitcoin and is far above that of other blockchains. This is largely attributed to the strength in the DeFi space and the rise of stablecoins, of which there is now over $20 billion worth on the Ethereum network, discounting algorithmic stablecoins.

- Ethereum has an all-time high of daily active addresses, at around 550,000 (90-day moving average).

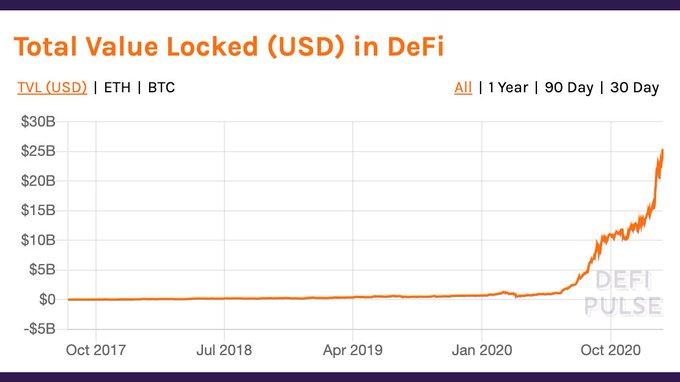

- There is now over $25 billion worth of capital locked in the DeFi space, which is far above the $100 million locked in the space at the start of 2018.

- Decentralized exchanges now process more than $30 billion worth of volume per month, which means they are starting to rival centralized platforms.

Noon thinks that these factors indicate Ethereum is primed to move past its previous all-time high.

This comes shortly after Raoul Pal, co-founder of Real Vision and a former Goldman Sachs head of hedge fund sales, said:

“By the way, ETH is up 60% in the first 14 days of the year. I think it outperforms all year but I still own much more BTC but have been adding to ETH. Next stop will be higher risk alts…. but much much smaller. More risk = smaller size.”

By the way, ETH is up 60% in the first 14 days of the year. I think it outperforms all year but I still own much more BTC but have been adding to ETH. Next stop will be higher risk alts…. but much much smaller. More risk = smaller size.

— Raoul Pal (@RaoulGMI) January 15, 2021

Disclaimer: This author is an analyst at ParaFi Capital. ParaFi Capital may hold positions in assets mentioned in this article. The views displayed in this article are opinions of the author—and the author only.

Ethereum, currently ranked #2 by market cap, is up 10.91% over the past 24 hours. ETH has a market cap of $157.45B with a 24 hour volume of $47.42B.

Ethereum Price Chart

ETHUSD Chart by TradingView

Like what you see? Subscribe for daily updates.

Credit: Source link