Ethereum (ETH) transactions can be tricky when it comes to fees, and this is far from the first time somebody paid massive amounts for a transaction, and a failed one at that – this time USD 533,901 in total.

What it seems had happened is that this user wanted to partake in the token sale by derivatives decentralized exchange (DEX) Strips Finance. Announced five days ago, Initial Dex Offering (IDO) – aka the STRP token sale – was conducted on Sushiswap’s MISO platform on October 13, lasting for 24 hours.

STRP 750,000 were available for auction – and were sold out in seconds. This suggests that the competitiveness likely led to the user being less careful with his attempted purchase.

Furthermore, in such a competing atmosphere, users may decide to use a communications protocol known as Flashbots. These allow Ethereum users to communicate with miners, and pay for their transaction to have priority. Therefore, it’s in their interest to keep it private until the miner includes it in the block.

For some reason, it seems this didn’t happen as planned, the transaction was public, included in a block, but the sale ended in second, the transaction failed “with error ‘DutchAuction: outside auction hours’” – and the user had to pay ETH 123.23 (USD 423,961 at the time).

Per Etherscan, an error occurred during contract execution.

“Something wrong with flashbots. It seems one relayer of flashbots doing kinds of evil,” commented one Twitter user. Usually, a transaction wouldn’t be completed if there are no tokens available for purchase.

However, Product Manager at Flashbots, Robert Miller, replied that the transaction was sent to the mempool, where Etherscan saw it. “Also, we never saw it in the Flashbots relay,” he said.

A person claiming to be the sender of the transaction said that they sent it to the flashbots, but it was “showing in mempool after my broadcasting, and has been mined occasionally by f2pool.”

The sender also paid another ETH 30 (109,940) following the failed transaction, and it seems that this payment may have been sent for the network to cancel a second transaction made during the STRP auction sent via Flashbots.

“This seems like a huge problem with the platform, it should be able to handle multiple addresses trying to buy tokens and not even try to charge a fee in the first place,” commented one Redditor.

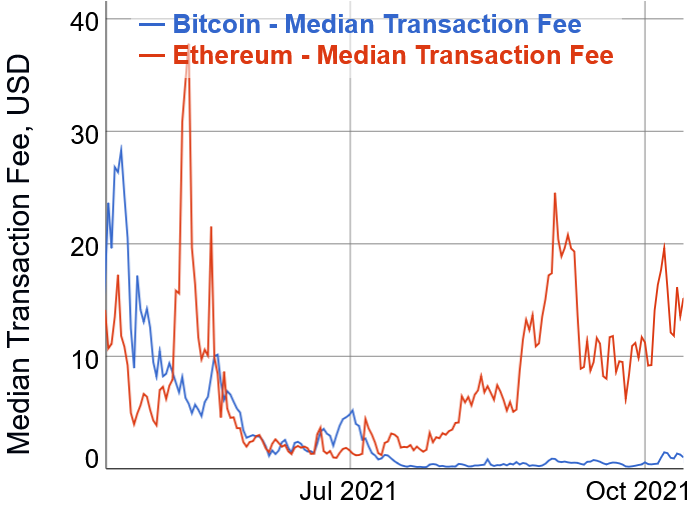

And others went even further, claiming that high fees on the network drove them away from Ethereum and ETH.

But there are those who argue that this wasn’t Ethereum’s fault, with some saying that it’s a mistake made by the person who programmed the bot in a bot trade. “This has nothing to do with ETH and everything to do with a very poor launch method,” said a user, with another stating that “Ethereum worked as intended.”

These commenters blame the teams behind the launch. It “seems like 0 thought went into how tokens should launch on there. At least have a max limit per address, whitelist addresses prior to launch, and release tokens slowly,” argued a Redditor.

While some wonder why the user didn’t send ETH 0 to himself to cancel the previous transaction instead of ETH 30, others listed the things that could’ve been paid for with more than half a million dollars given for fees in failed/canceled transactions – including a Lambo, a lavish property in the country the commenter lives in, and college debts.

Regardless of where the fault lies, “I tell you what. This happens to me you’ll see a grown ass man break down and cry enough to fill a bathtub,” concluded Redditor ‘Jasquirtin’.

____

Learn more:

– Ethereum’s EIP-1559 Helped Coinbase Save ETH 27 on Daily Fees

– DeversiFi Explains What Caused the USD 23M Transaction Fee on Ethereum

– Blockchain Game Axie Infinity Updates Fees as Token Hits All-Time Low

– Bitcoin’s Hashpower Estimate Up, Transaction Fee Revenue Estimate Down

Credit: Source link