Bitcoin BTC Cryptocurrency Stock Market Concept. Financial Growth Chart. US Dollar BTC Cryptocurrency Bitcoin USD to BTC

- Macroeconomic elements, not the anticipation of a spot Bitcoin ETF, have been identified as the primary catalysts behind the recent surge in Bitcoin’s value.

- Future market movements may be influenced by upcoming financial reports and regulatory actions concerning cryptocurrency.

Keeping pace with CNF’s previous update on the potential impact of a Bitcoin ETF approval, alongside Bitcoin SV’s notable jump and InQubeta’s funding milestone surpassing $3.7 million, there is a broader narrative unfolding in the cryptocurrency realm.

Despite these developments, QCP Capital’s “Market Update – 3 Nov 23” indicates that it’s the macroeconomic factors steering Bitcoin’s climb to $35,000 last month, rather than the crypto-centric news of a possible spot Bitcoin ETF greenlight.

QCP Capital’s assessment indicates that Bitcoin’s recent price momentum has been largely influenced by global economic cues rather than the crypto-centric buzz of an ETF. A subdued Treasury supply estimate and a dovish posture from the Federal Reserve have led to a drop in bond yields, lifting Bitcoin along with other risk assets, signaling that investors may be increasingly looking beyond sector-specific news to broader economic trends.

Derivative Markets Gauge the Market’s Pulse

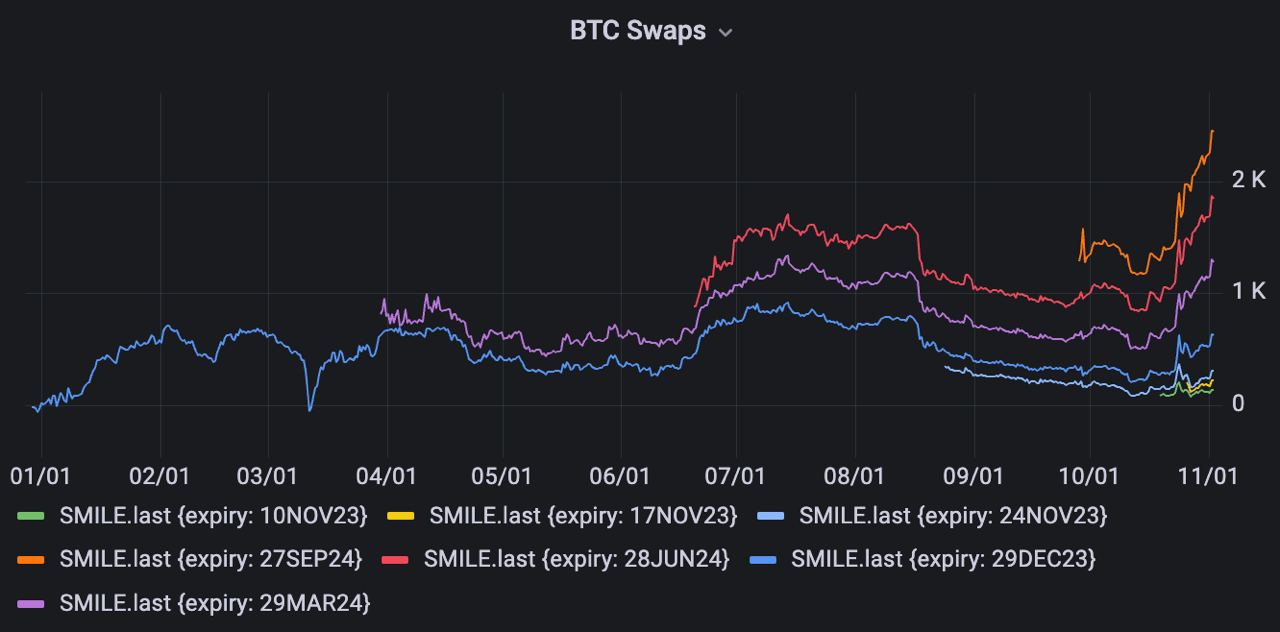

Amid these macroeconomic currents, Bitcoin’s derivatives market is signaling optimism. As BTC’s spot price ascends, perpetual funding and term forwards exhibit heightened activity, suggesting a market in eager anticipation of an upside breakout. These trends, encapsulated in Chart 2, showcase a critical aspect of the crypto trading sphere: the heightened state of anticipation and speculation over the effects of a spot Bitcoin ETF’s approval on the market.

Source: qcp.capital

Anticipated Reports Set to Shape Market Trends

The cryptocurrency market also braces for significant upcoming events, as highlighted by QCP Capital. Financial disclosures from Apple and Coinbase, along with imminent non-farm payroll data, stand poised to potentially catalyze or dampen the current market volatility and call option premiums.

The current situation in the Bitcoin market is a complex interplay of global economic indicators and the expectations surrounding the cryptocurrency industry. While the approval of a spot Bitcoin ETF would undoubtedly stir the market, the role of regulatory decisions remains crucial, exemplified by the potential for SEC Chair Gary Gensler’s actions to decisively impact market support levels. As such, the wider economic picture is proving to be an essential factor in understanding the forces behind Bitcoin’s price movements.

Related article: BlackRock CEO Larry Fink Says ‘Bitcoin’s Value Equals Human Freedom’ as Bitcoin ETF Approval Inches Closer

Best Crypto Exchange for Everyone

- Invest in Bitcoin (BTC) and 70+ cryptocurrencies and 3,000 other assets.

- 0% commission on stocks – buy in bulk or just a fraction from as little as $10.

- Copy top-performing traders in real time, automatically.

- Regulated by financial authorities including FAC and FINRA.

![]() 2.8 Million Users

2.8 Million Users

Crypto News Flash does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to cryptocurrencies. Crypto News Flash is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned.

Credit: Source link