A mysterious investor spent over $3 billion to purchase nearly 133,000 Bitcoin on Aug. 10 and became one of the top three largest individual Bitcoin holders.

The unknown buyer purchased their Bitcoins for an average of $23,000 each.

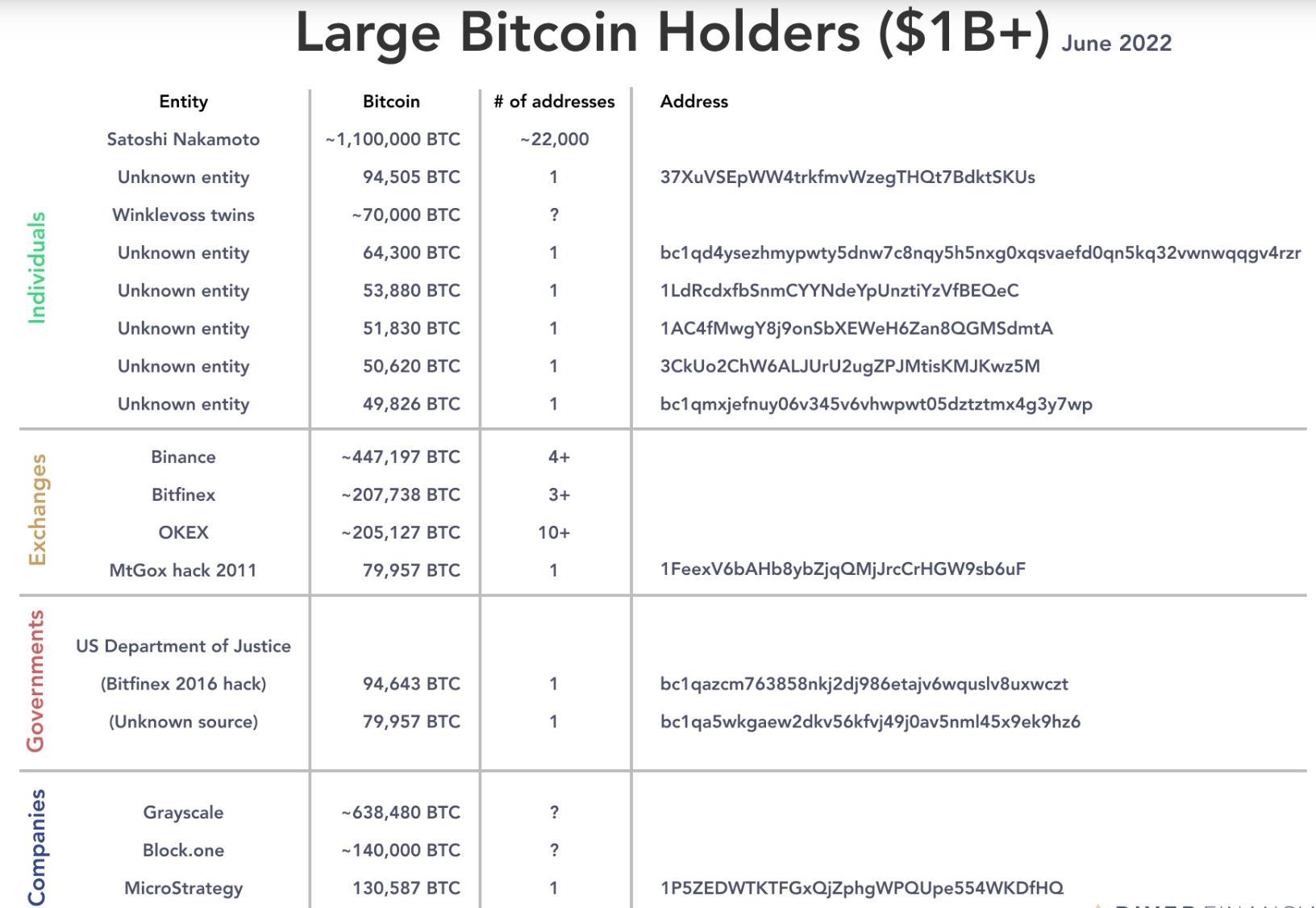

According to data from June 2022, Satoshi Nakamoto is the largest Bitcoin holder amongst all individuals, exchanges, governments, and companies. Nakamoto is estimated to have mined over 22,000 blocks, each with a 50 BTC reward, after launching Bitcoin in 2009. The estimations suggest that Nakamoto holds over 1.1 million Bitcoins in nearly 22,000 different wallets.

Largest Bitcoin Holders

Besides Nakamoto, the largest Bitcoin holder is the asset management firm Grayscale which holds nearly 683,480 Bitcoins. Crypto exchange giant Binance follows Grayscale as the second largest Bitcoin holder in all categories. With approximately 447,197 Bitcoins, Binance also ranks first among crypto exchanges that hold Bitcoin.

Almost all individual Bitcoin holders have unknown identities, except for Winklevoss Twins. Cameron and Tyler Winklevoss invested the millions they earned from a lawsuit against Facebook in Bitcoin and became the first Bitcoin billionaires. Reportedly, they own 1% of all Bitcoin in circulation. They rank third amongst the individuals with the largest Bitcoin holdings.

Binance’s CEO, Changpeng Zhao, is also estimated to be among the largest holders, as his net worth is $96 billion. He admitted that his crypto holdings make up most of his net worth and that he only holds Bitcoin as an investment.

Based on the chart above, the mysterious investor who purchased 113,000 Bitcoins has placed himself right behind Nakamoto as the second individual with the largest Bitcoin holdings.

Is the Bearish sentiment changing?

As soon as the winter market started, the largest Bitcoin holders started to sell off. The trend has been continuing since the beginning of May 2022. While the largest holders continued to quit the markets, crypto enthusiasts without a significant amount to spare to invest started to collect Bitcoin. Investors with less than 10 Bitcoin are called ‘Shrimps’ and have been buying while the prices are affordable.

According to Blockworks’ co-founder Jason Yanowitz, the shrimps may be on the right trajectory. He recently identified the stages of bear markets in crypto and said that the stagnant price stage would make investors want to leave the market. However, the ones who resist and stay in the market will be the real winners of crypto in the long term.

Bitcoin prices have been suffering during the coldest crypto winter in history. However, the Bitcoin price exceeded $24,000 on August 10, after a long time.

Credit: Source link