UNI took a dive following the reports that the US Securities and Exchange Commission (SEC) is investigating the developer of the major decentralized exchange Uniswap.

The SEC is looking into Uniswap Labs as part of their deeper examination of the digital asset market, and its decentralized side, according to the Wall Street Journal, citing “people familiar with the matter.”

Enforcement attorneys are searching for information on the ways in which investors use Uniswap, as well as how it is marketed.

A Uniswap Labs spokesperson told the WSJ that they are “committed to complying with the laws and regulations governing our industry and to providing information to regulators that will assist them with any inquiry.”

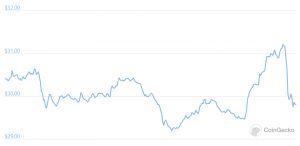

Uniswap’s own coin, UNI, dropped by 2% today, with the 24-hour chart showing a sudden dive in price. It is now (11:49 UTC) trading at USD 29.78.

Meanwhile, the coin appreciated 15% in a a week, as well as over 39% in a month.

This doesn’t come as a too big of a surprise, as the SEC chairman Gary Gensler did suggest last month that the watchdog could seek to regulate decentralized finance (DeFi) projects.

Furthermore, the Commission recently partnered with blockchain analytics firm AnChain.AI to help monitor and regulate the DeFi industry.

____

Reactions:

Shhh, some people still think decentralization doesn’t matter. https://t.co/iLSLQXzj4B

You should assume every company that’s issued a token in the US has gotten an sec subpoena at this point and it als… https://t.co/QP2QvmYt3s

___

Learn more:

– US Congress Now Aims At Decentralized Services Too

– DeFi Is Not a New Concept and Is Misnamed As Decentralized – SEC Chair

– Forked DEX On Binance Chain Tests Uniswap & Legal Limits

– UNI Outperformed By Competitors After Uniswap Launched Its Third Version

Credit: Source link