Join Our Telegram channel to stay up to date on breaking news coverage

Trading forex vs trading cryptocurrencies has been a topic of discussion recently. The financial landscape around us is changing, and developers are introducing new methods of managing and investing money. Trading in cryptocurrency has become increasingly popular and has been one of the most significant changes in the last ten years. However, because of increased investment in digital currencies, the market value of all cryptocurrencies has increased by more than $3 trillion.

Despite the lack of centralized authority, cryptocurrency trading allows for frictionless transactions. However, it differs from the traditional fiat financial system, which relies on governments and central banks for various functions, including currency issuance and transaction facilitation via a smooth payment system.

Trading Forex vs Trading Crypto

In terms of investment, there are some similarities and many differences between forex trading and cryptocurrency trading. Several essential factors influence forex and cryptocurrency trading, including risk tolerance, willingness to speculate, and trading experience.

Considering the volatile nature of the cryptocurrency market, crypto traders have been interested in the speculative rise of blockchain technology and don’t want to miss out on big profits. In contrast, currency exchange prices in forex markets fluctuate very little.

Trading professionals can benefit from active participation in financial markets. As a result, understanding the trading strategies that work best for the assets will always increase the chances of making massive profits. However, keep in mind that you are the one who ultimately decides whether or not to trade. As a result, you must be aware of its benefits and drawbacks.

Cryptocurrencies have grown in popularity in recent years, and many traders are unsure whether they should rely on them instead of forex markets or if they should do both. If you want to trade, you should be familiar with both traditional forex and the cryptocurrency market.

This article will look at some of the similarities and differences between forex and cryptocurrency trading.

Similarities Between Trading Forex vs Trading Crypto

The similarities between forex and cryptocurrency trading are that both involve speculation on the value of a currency. Traders buy and sell currencies in the hopes of increasing their value. Forex traders can trade various currency pairs, whereas cryptocurrency traders can trade Bitcoin and other cryptocurrencies.

Let us now go over some of the similarities between forex and cryptocurrency trading in greater detail.

1. Forex and Crypto Trading Require Market Knowledge

Trading in forex and cryptocurrency both necessitate extensive market knowledge. Therefore, a trader must be familiar with a variety of terms in both markets. Furthermore, before entering any financial market, successful traders usually seek information.

It enables them to increase their profits while avoiding scams. On the other hand, those who are already familiar with the fundamentals of cryptocurrency trading will find it easy to understand forex trading, similar to forex traders who want to try their hand at cryptocurrency trading.

2. Accessibility of the Market

Traders can easily access both types of trading. All that is required to begin trading is a computer and an internet connection. Because the transactions in the two marketplaces are so simple, even inexperienced traders can use them.

Both forex and crypto traders can conduct transactions from anywhere in the world.

3. Supply and Demand Determine Price

Both trading markets operate on supply and demand economics. Supply and demand factors influence the price of any currency, whether in forex or cryptocurrency. It is a concept that explains the relationship between a product’s price and its availability.

Generally, limited supply and high demand raise the price, while abundant supply and low demand lower it.

4. Online Trading

Several digital trading platforms are used in cryptocurrency and foreign exchange trading. As a result, trading in cryptocurrencies and the Forex market is quick and easy because traders can trade from the comfort of their homes. Anyone can trade multiple currencies on various digital platforms.

5. Option of Going Long or Short

Trading cryptocurrencies and forex is based on speculation. A long or short position can be taken in either type of trading. In other words, if the forecast is correct, you will be profitable regardless of whether the asset’s price rises or falls. Furthermore, there are two ways to profit from trading: Long and short trades are possible.

For instance:

- A trader enters a long (buy) position because they believe the price will rise from that point forward.

- When traders anticipate a price decrease from a specific level, they exit the market by shorting (selling) the asset.

6. Psychological Risks

Both are susceptible to high unpredictability, resulting in significant price swings over short periods. As a result, you must be mentally prepared to deal with losing trades and avoid trading emotionally, as both types of trading involve psychological risks.

7. Trading Bots

Traders can use online auto bots (robots) to automate forex or cryptocurrency transactions. Bots have an advantage over traders in that they can react faster. A bot can always find the best deal, but most traders do not have the time to do so.

Trading bots can be profitable if they are properly managed. The best trading bots will undoubtedly make money. As a result, before acquiring trading bots, ensure you have a guarantee.

Differences Between Forex and Crypto Trading

Cryptocurrencies are a newcomer to the financial landscape. It has a much shorter time frame than forex, but this does not make it any less competitive in the trading sector. So let us now look at some of the differences between forex and cryptocurrency trading.

1. Variety of Trading Instruments Available

Unlike FX markets, cryptocurrency markets offer a diverse range of products. Because it is difficult to keep track of all cryptocurrencies, traders will have to limit the number of coins they follow. As a result, traders will continue to use predetermined wish lists.

Major currency pairings are frequently the focus of forex traders. Some traders prefer to trade unusual currency pairings that include a major currency and a currency from a developing country.

On the other hand, over 11,000 different cryptocurrencies are available, and the number is growing; many are only known to crypto enthusiasts.

2. Landscape

Cryptocurrency has been around since the launch of Bitcoin in 2009, with occasional price increases and decreases. Despite the emergence of competing currencies and several frauds, Bitcoin has remained a dominant force in cryptocurrency.

The Forex market, on the other hand, is the largest financial market in the world, involving the trading of fiat currencies. The market attracts traders because of its advantageous characteristics, such as the wide variety of products available for trading, low transaction fees, the market’s size, and volatility.

3. Market Size

In theory, traders could trade a wide range of assets on these exchanges. For example, a foreign exchange trader can deal in any currency pair that exists. A cryptocurrency investor, on the other hand, may own thousands of cryptocurrencies. In reality, only a small portion of each asset’s respective market defines them.

- Such as, most forex trading involves seven major currency pairs (EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, NZD/USD, and USD/CAD).

- On the other hand, nearly all of the value in the crypto market is concentrated in a few cryptocurrencies; for example, Bitcoin (BTC) accounts for more than 44% of the cryptocurrency market. However, this number was 70% in the past.

4. Liquidity

When it comes to converting your assets into cash, the forex market offers significant advantages. For example, currency trade reached $6.6 trillion in 2019. It demonstrates how easy it is for customers to exchange assets. Since the bid-ask spread is lower when there is more liquidity, it is easier for traders to exchange commodities at fair prices. Considering this, the liquidity of the FX market is 12 to 60 times that of the cryptocurrency market.

When it comes to cryptocurrency trading, things are a bit different. Some market assets have high liquidity, resulting in a small bid-ask spread and low coin trading costs. However, if you select coins with low trading activity, you may be unable to sell them at the desired price.

5. Operating Hours

The cryptocurrency market is open 24/7, whereas the foreign exchange market is open 24/5. On weekends, forex traders can switch off their computers and unwind. On the other hand, cryptocurrencies can experience significant fluctuations on weekends.

Trading in cryptocurrency necessitates constant market knowledge, even on weekends. This means that you can profit from cryptocurrencies even on the weekend.

6. Volatility

The cryptocurrency market is much more volatile than the Forex market. This aspect provides an opportunity for traders who want to make significant gains quickly. For example, the market capitalization of Bitcoin fluctuated as its value doubled and then fell by half. As a result, many of the market’s small-cap coins share the same characteristics.

Currencies with low trading volume, in particular, experience rapid fluctuations. On the other hand, cryptocurrencies with a higher market capitalization and trading volume maintain short-term stability. Such movements are uncommon in the forex market and usually involve exotic pairings.

The low volatility of the forex market has both advantages and disadvantages. It reduces the possibility of huge profits by controlling investment-related risks. Given this, trading forex is easier to manage risk, but cryptocurrency markets have a higher potential for reward.

7. Functionality

The supply and demand principles govern asset pricing in both types of trading. However, each has a distinct risk profile because of how they generate profits. Fiat currencies have a measurable value, but cryptocurrencies are speculative. A currency is widely used as a medium of exchange and is recognized as legal tender, and forex trading is supported by a strong government that can manage its supply.

Cryptocurrency, on the other hand, does not perform these functions. It is not recognized as a legal tender, has no government backing, and is not subject to central bank supply regulation, with very few exceptions. Cryptocurrencies only function when two people agree on their worth.

8. Digital Nature

Trading forex does not always require the internet, as it is not fully digital. The forex market was active well before the internet era. However, the technological component caused forex to grow, which is now the predominant mechanism for conducting these trades.

Cryptocurrency is digital or virtual money and uses cryptography to protect transactions. Instead of a central body issuing or regulating cryptocurrencies, they use a decentralized mechanism to track transactions and create new units. Because cryptocurrencies are entirely digital, trading them necessitates a functional internet connection.

9. Regulation

The foreign exchange market is highly regulated, and the asset class has thrived because there have always been markets to trade in. However, because of the volatility, governments maintain a strict stance on currency traders.

On the other hand, cryptocurrency is still in its infancy. The cryptocurrency markets claim that the technology products they are developing are no more vulnerable to SEC scrutiny than a word document. As a result, the government has not decided how to regulate cryptocurrencies. Furthermore, as the industry has grown in size, activity has slowed.

10. Security

Forex traders have fewer risks since the forex market is well-regulated. Forex traders must still conduct background checks on their brokers and research the relevant laws in the country where the broker is registered. Scams have mostly vanished as a result of the growth of the forex trading market. However, cryptocurrency exchanges are still in their infancy, and several countries are still developing relevant crypto trading laws. As a result, crypto traders must deal with counterparty risks and hacker concerns.

Furthermore, entering the forex market is more complicated than entering the cryptocurrency market. Because of the strict regulations, new participants must complete a lengthy list of requirements before trading on the Forex market. On the other hand, customers may spend less time on the customer activation procedure because cryptocurrencies are decentralized.

11. OTC and Exchange Trading

The majority of forex traders uses over-the-counter (OTC) trading. Despite providing global liquidity, OTC trading is executed through a broker. Even though traders had direct access to the market, it was heavily regulated, making it easier for buyers and sellers to use brokers. The disadvantage is that the broker will keep a portion of the profits. Furthermore, the amount will vary depending on the organizations involved, the market state, and the trading combination.

On the other hand, exchange trading is the more popular method of purchasing in the cryptocurrency market. Most digital currencies frequently act as middlemen and thus charge a commission. These costs, however, are lower because they are fixed. Moreover, it simplifies trade but requires users to accept the deal terms as there’s no room for negotiation.

12. Fundamentals Factors Impacting Asset Prices

A wide range of factors influences the foreign currency market. These could include a country’s GDP, unemployment rate, inflation, the election of a new administration, and other factors. As a result, traders use the economic calendar to stay updated on such information and other significant economic events that may affect the market.

On the other hand, three major factors influence the price of cryptocurrencies.

- Cyber-attacks on cryptocurrency exchanges due to security flaws.

- Countries declare cryptocurrency prohibitions.

- Disagreement over updates. For example, a cryptocurrency hard fork occurs when the blockchain splits in two.

What Are Regulators’ Thoughts on Trading Forex vs Trading Crypto?

How regulators view crypto vs. forex trading is determined by how an asset is classified; it may be subject to the laws and regulations of specific regulatory authorities in the United States and other countries.

Cryptocurrency Trading Regulation

The United States now relies on a mix of regulatory oversight rather than providing comprehensive cryptocurrency oversight. Previously, regulators and investors viewed cryptocurrencies as if they were watching Superman and wondering if it was a plane or a bird.

The rules governing cryptocurrencies have not kept pace with their rapid growth. However, here are some important cryptocurrency regulation facts:

- In 2014, the US Commodity Futures Trading Commission (CFTC) classified cryptocurrency as a commodity. As a result of this decision, cryptocurrencies are now subject to CFTC regulation, regardless of whether they are used in the context of futures contracts or if there is evidence of wrongdoing or fraud in international trade.

- The Internal Revenue Service (IRS) taxes cryptocurrency capital gains and losses like it taxes other capital assets.

- Every forex broker in the United States must be regulated by the National Futures Association (NFA). Most brokers in other countries must be regulated by top regulatory bodies such as the FCA, ASIC, CFTC, or MAS.

- The Federal Deposit Insurance Corporation (FDIC) does not currently insure cryptocurrency deposits held by member banks.

Forex Trading Regulations

Forex trading is subject to a stricter regulatory definition because regulators classify such transactions as commodities and securities. Fiat currencies may behave similarly to commodities in that traders can buy and sell them to profit from fluctuations in exchange rates. They are, however, safe because a centralized authority has authorized their release. As a result, currencies are subject to stricter regulatory oversight and provide investor protections such as FDIC and SIPC insurance.

Each country has a unique approach to regulating forex trading. National authorities govern each country’s financial services industry; no global institution is in charge of monitoring the global foreign exchange market.

The Foreign Exchange Working Group (FXWG) was established in 2015 to develop global best practices for the FX markets. In May 2017, it resulted in a global code of conduct for wholesale foreign exchange markets. Furthermore, the Bank of England is one of 16 organizations that have signed on to the Forex Global Code, helping to further regulate the forex market and offering international protection to retail customers who trade in the currency market.

Reasons for Preferring Forex Trading

Higher Liquidity

A market’s liquidity refers to how active it is. For instance, a currency pair has a high level of liquidity when it can be bought or sold quickly, and there is a significant exchange volume for that pair. Liquidity is essential in forex trading because it is required for a successful trade.

More Stability, Less Volatility

When a trading instrument is more liquid, its volatility is lower. That is why it costs so much more to move it in a specific direction. For instance, a large transaction would be required to significantly impact the US bond market or the EUR/USD currency pair. Because the forex market is stable, traders benefit because their assets are safe while they trade. Furthermore, there are very few chances that any currency will lose value overnight.

Extensive Leverage

Leverage is the process of using borrowed money to increase one’s trading position beyond what is possible with just cash. Trading forex often provides much higher leverage than other financial products. It is one of the reasons why so many people are drawn to it. Leverage in the foreign exchange markets is frequently as high as 100:1. For every $1,000 in your account, you can trade up to $100,000 in value.

Arguments in Favor of Cryptocurrency Trading

Increasing Asset Class

In the previous ten years, traders have been much more interested in the cryptocurrency market than in the Forex market. That is because cryptocurrencies are an expanding asset class. Thanks to the development of DeFi, NFTs, and meme coins, cryptocurrency traders now have access to many asset classes.

Easy Entry Into the Market

Foreign exchange trading is more difficult to enter than cryptocurrency trading. The Forex markets are extremely well-regulated. As a result, before beginning forex trading, newcomers must fulfill a number of requirements. On the other hand, customers may spend less time on the customer activation procedure because cryptocurrencies are decentralized, allowing them to enter the market more smoothly.

High Potential Return

The cryptocurrency market is volatile in comparison to other markets. On the other hand, the benefits and returns from volatility risk can be enormous. In cryptocurrency trading, there is a good chance that a coin’s value will rise over time. It can help investors and traders. Investors seek compensation for taking on risk in the form of higher returns. In the short run, volatility may also benefit day traders.

The Most Common Mistakes Made by New Traders

Learning from past mistakes is a great but costly technique for success. As a result, all traders, particularly newcomers, must adhere to clear strategies and guidelines for cryptocurrency and forex trading, just as they would for any other type of trading.

If you are new to investing in or trading cryptocurrencies or forex, you should avoid the following common trading mistakes:

Trading Without a Goal or Purpose

If you trade in the cryptocurrency or forex markets without a strategy and simply because everyone else is, you risk losing your investment. A successful transaction necessitates meticulous planning. When developing your plan and deciding on your goal, consider the following questions:

- What are your financial objectives, and how much risk are you willing to take?

- When do you expect to break even or make a profit on your investment?

- Do you want to invest for the short or long term?

Because all of the above factors are important, your answers must be related to your investing strategy.

Insufficient Market Analysis Knowledge

New traders begin trading without conducting adequate research. Many people began trading solely on the recommendation of a coworker. However, if you begin trading before studying market fundamentals, you will almost certainly lose money.

Before trading with forex or cryptocurrency, it is, therefore, advisable to complete your education and become acquainted with the fundamentals of market analysis.

Using an Untrustworthy Exchange or Broker:

As the forex and cryptocurrency industries grew, so did the number of apps and platforms. Some of these platforms, however, frequently overlook the trust and security components. New traders must ensure that they trade with a reputable, safe, and trustworthy exchange or broker.

Using a Short-term Strategy

The forex and cryptocurrency markets are volatile, and developers are still testing several features. Cryptocurrency prices can sometimes skyrocket for hours before plummeting dramatically within minutes. As a result, it is preferable to consider long-term investments when making currency investments.

Failure to Diversify

It is never a good idea to put all of your money into just three or four assets. Diversification is one of the most important components of long-term, profitable investment strategies. You must also keep a portion of your funds aside from crypto or forex trading.

As a result, if the market falls, you will lose less money and access more resources.

Excessive Leverage

The availability of leverage is one of the primary draws of markets such as foreign exchange trading and cryptocurrency CFDs. Leverage allows you to trade much larger positions with less trading capital. Leverage, on the other hand, can be a double-edged sword. It has the potential to increase both profitable and unsuccessful transactions.

Using excessive leverage is one of the traders’ most common mistakes, especially those unfamiliar with how it works. Some traders consider potential outcomes but disregard potential failures. If you use a lot of leverage and the transaction goes against you, you may lose your trading money.

Best Forex and Crypto Trading Strategies

Forex and cryptocurrency trading are similar in some ways. Both markets are highly technical and operate continuously. Cryptocurrency, like forex, will experience hot and cold trends. It enables the application of forex trading methods to cryptocurrency. When trading cryptocurrencies or forex, you cannot rely on luck. To open positions and make money in the future, you must have a clear strategy.

Invest in The Current Trend

Trend trading is a popular long-term forex and cryptocurrency trading strategy. It includes a currency pair’s dominant trend or directional movement. Asset prices usually follow the trend, whether it is upward or downward.

A trader can begin positions in the direction of the trend, for example, buying when the trend is up and selling when the trend is down.

Trend Shift

This method is more difficult and requires a solid understanding of technical analysis. A trend reversal is one way to start new trades. However, this method has the disadvantage of misclassifying a potential reversal.

Day Trading

It refers to a beginner’s forex approach. Traders must fulfill all roles before the end of the day. Usually, trades take between five and fifteen minutes, although they may linger for up to an hour. Most day traders employ trading strategies based on technical analysis of short-term charts that display intraday price activity. There are several day trading approaches, but traders mostly use breakout trading. Traders initiate deals when the exchange rate for a currency pair crosses a specified level on the chart.

Swing Trader

Using this method, a trader in the foreign currency market keeps positions for several days while making money off of short-term price trends. During trading, the bars must be checked every 30 to 60 minutes.

Buy in Equal Quantities

The most basic way to begin cryptocurrency trading is accumulating digital currency through regular purchases of equal amounts. This method allows you to purchase an asset regardless of the state of the market, which is advantageous. This method is appropriate for investors with a long-term view of asset growth and anticipates significant upside in the future. Averaging the entrance point by consecutive purchases at lower prices is possible if the value of the coin decline. Many people have noticed this trend with Bitcoin.

On the other hand, because each scenario is unique, it is difficult to precisely answer a new trader’s question about the most beneficial Forex strategies. However, a trader can use several tried and true Forex trading strategies.

Scalping

Scalping is a strategy for making quick money. Traders use this method to close transactions quickly and earn a small profit. Scalping provides the most trading opportunities, but it also necessitates technical analysis. Scalpers also monitor price charts for trends that can help them forecast future changes in exchange rates.

For currency pair analysis in forex and cryptocurrency, they frequently use extremely short-term tick charts. The best broker for scalpers has little or no order slippage, quick and accurate order executions, and tight spreads.

Positional trading:

Traders use this method to follow a long-term trend, and earnings rise due to price fluctuations. Positional trading can generate massive profits because it takes advantage of significant changes in the forex and cryptocurrency markets that last for weeks or months. Positions do not need to be reviewed daily. As a result, they are less concerned with the trader than short-term strategies. This strategy, however, requires self-control and patience.

Top Trading Platforms

It is often possible to trade forex and crypto using the same platform. Many top trading platforms offer both regular and cryptocurrency trading. However, it is usually best to use one broker for forex trading and another for crypto trading. Crypto trading platforms offer superior services when trading crypto, and forex trading platforms offer the best services when you want to trade forex. The primary way to trade forex is through brokers, providing very simple-to-open online accounts. Several forex trading platforms are available, each with a particular set of fees and requirements.

On the other hand, decentralized and centralized exchanges are available for trading cryptocurrencies. For privacy and dealing without an intermediary, some traders use decentralized marketplaces. Others, for a more secure environment, employ centralized exchanges.

Most forex brokers use the MT4 and MT5 platforms to allow investors to trade forex currency pairs. However, most exchanges use Tradingview charts. Let’s have a look at the best platforms:

MetaTrader 4

MetaTrader 4 is a Forex trading platform that allows you to analyze financial markets and use Expert Advisors. MT4 features that enhance your Forex trading experience include mobile trading, trade signals, and the market. Millions of traders with diverse requirements use MetaTrader 4 to trade on the market.

The platform provides extensive technical analysis, a flexible trading system, algorithmic trading, Expert Advisors, and mobile trading tools to traders of all skill levels.

MetaTrader 5

MetaTrader 5 (MT5) is a MetaQuotes multi-asset trading platform that allows you to trade currency, stocks, and futures. MT5 allows traders to browse charts, broadcast live prices, and place orders with their broker, as do most online trading platforms.

MT5 trading allows traders to access financial markets such as foreign currency, commodities, CFDs, stocks, futures, and indices. Technical and fundamental analysis techniques, copy trading, and automated trading is among its many features.

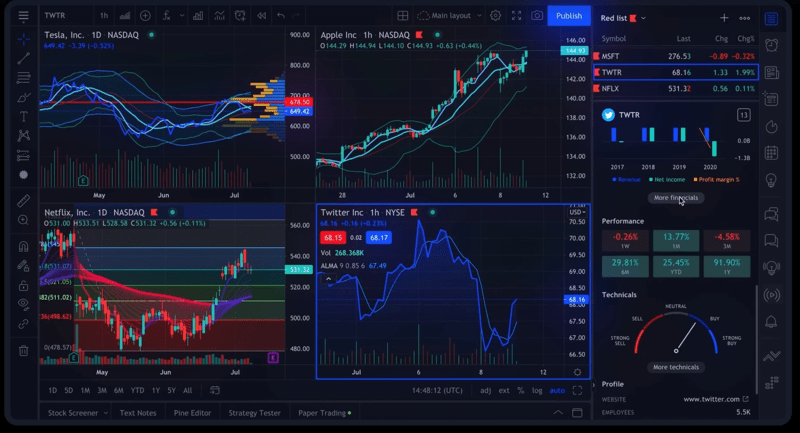

TradingView

TradingView, founded in 2011 in Westerville, Ohio, has a significant user base, with eight million accounts generated in 2020 alone. It’s an online platform and mobile app that provides a suite of charting tools to help traders share their insights with the world. TradingView also enables them to trade on any market in real-time, whether stocks, forex, or cryptocurrency, from anywhere in the world.

Customizable: TradingView charts are interactive and highly customizable. Users can display multiple indicators on each chart, add drawing tools, change the time frame or even use TradingView’s AI-powered sentiment analysis tool to find out how other traders feel about any given market or asset.

TradingView bills itself as a one-stop platform, offering technical indicators, real-time price charts, social networking, and cross-platform notifications, all of which are accessible via its online web interface, mobile apps, and dedicated desktop client. It aims to assist users in making well-informed investment and trading decisions.

Social Dimension: The social dimension is incorporated into the TradingView charts. For instance, when you open a TradingView chart for a certain cryptocurrency, forex currency pair, or stock, TradingView displays a feed showing news related to that security and chat rooms tailored to that asset’s community.

Bottom Line: Which is a Better Option, Forex or Crypto Trading?

Forex and cryptocurrencies both have similarities and differences. Trading cryptocurrencies involves purchasing and selling digital assets, including tokens, digital coins, and NFTs. Trading in forex is exchanging one fiat currency for another with the expectation that it would appreciate. Both markets have grown to be highly well-liked and potentially profitable investment options for traders. Traders now have access to the crypto and forex market thanks to high-speed internet and cutting-edge computer technologies.

We have reviewed and discussed the possible similarities and differences between crypto and Forex trading. After reading this article, you will have a fundamental and in-depth understanding of how various trading methods work and help you generate profits.

Remember that trading forex or cryptocurrencies depend primarily on a few crucial factors as neither is simple for novices. Due to the lack of a central regulating agency and the significantly lower liquidity, cryptocurrency trading is riskier than forex trading. However, trading cryptocurrencies have a far higher chance of being profitable, and several investors have gained billions of dollars. A trader can benefit and gain funds using this difference.

When deciding between the crypto and forex markets, you must consider your financial objectives, allocated funds, trading style, and personal requirements. Additionally, the best approach is to test with small accounts in both forex and cryptocurrency trading. The market that best meets your demands will become evident after a few months. Remember that you don’t always have to decide between trading in cryptocurrencies and forex. Therefore, you may reap the benefits of the opportunities offered by both markets.

Related

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link