It’s already October, and the world has now left both the month of September and the third quarter of the year behind. And as expected, lots of things have happened in the crypto space over the past quarter.

July ended up as a green month overall for the crypto market, despite drops and sideways trading in the first half of the month. Looking at the number one cryptocurrency, bitcoin (BTC), the month started at around USD 35,600 and ended the month at almost USD 42,000.

In terms of major developments in the space, July saw testing being commenced both for the Bitcoin network’s Taproot upgrade, as well as for the Ethereum (ETH) blockchain’s London upgrade, bringing with it the much-discussed EIP-1559.

August also ended as a good month for the crypto market, with nearly all of the top 100 coins by market capitalization in the green over the course of the month. Interestingly, the month was also marked by investors shifting their focus away from bitcoin and over to the world of decentralized finance (DeFi) and non-fungible tokens (NFTs).

September, meanwhile, was marked by the news of El Salvador implementing bitcoin as legal tender, and China banning crypto again.

And as far as prices go, the month of September was the only month this quarter that saw the bitcoin price move markedly lower, falling from just over USD 47,000 at the beginning of the month, to USD 43,489 as of this writing. However, today BTC and the rest of the market rallied sharply.

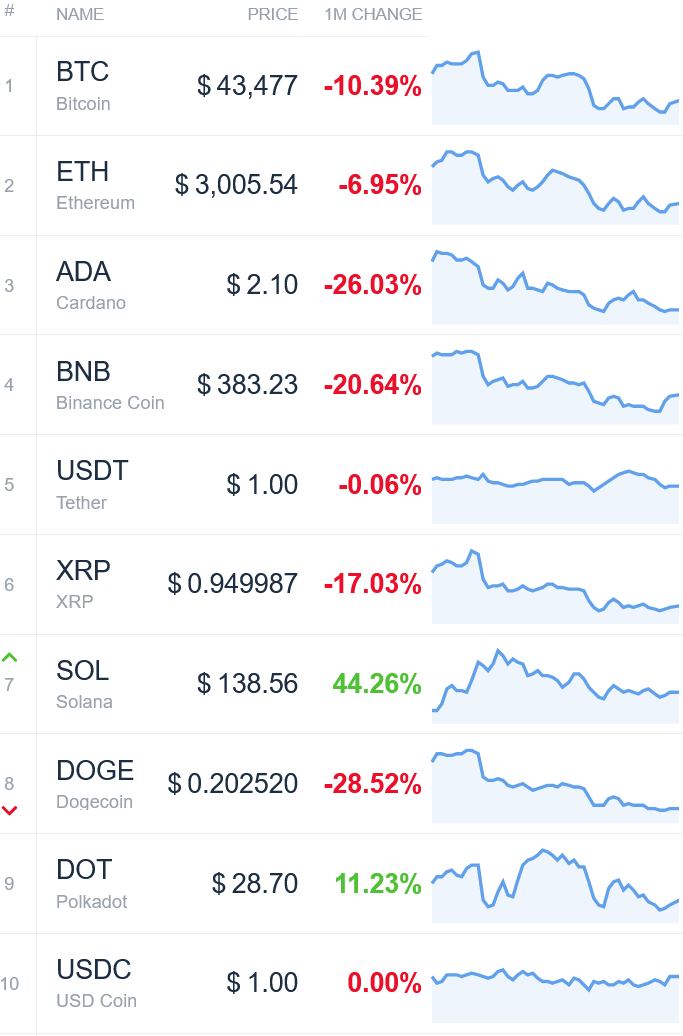

Top 10 coins in September and Q3

In September, the 10 coins by market capitalization generally ended the month lower, with the notable exception of solana (SOL) and polkadot (DOT), which were up by more than 44% and 11%, respectively.

Both of these assets are native tokens of smart contract platforms that have increasingly challenged Ethereum’s dominance in the space, helped by its high transaction fees that have pushed many DeFi users in particular over to alternative chains.

The gains for SOL and DOT this month follow strong gains for the two tokens over the course of August as well. Back then, however, the two tokens were joined by cardano (ADA), which did not manage to stay in the green this month.

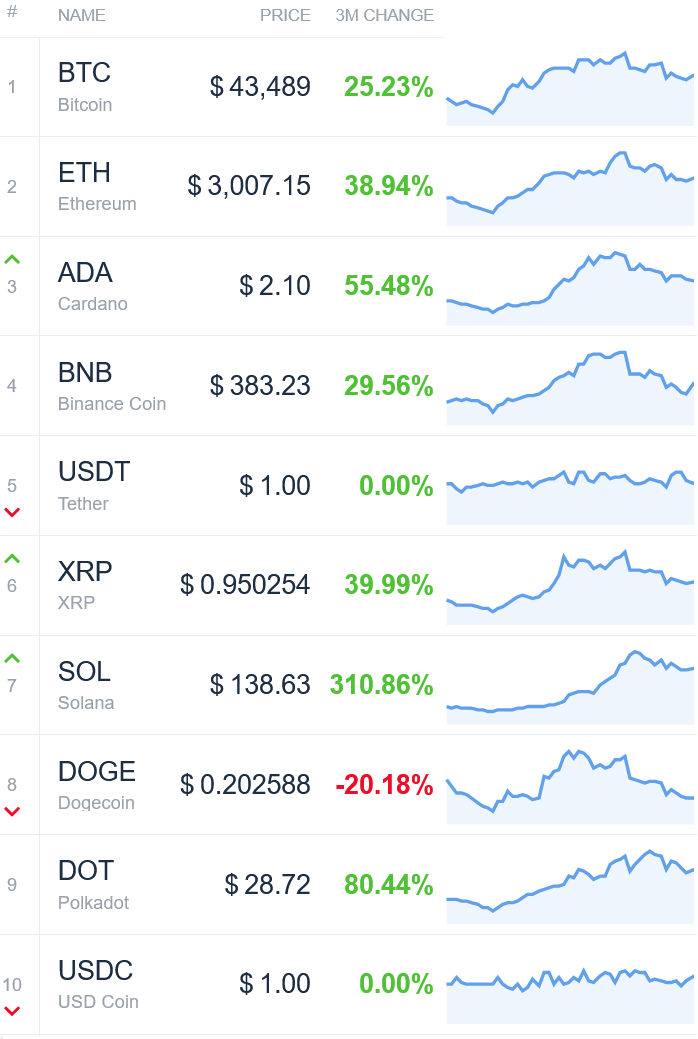

For the quarter as a whole, bitcoin finished it up by about 25% – or almost USD 9,000 – from just over USD 35,000 on July 1, to USD 43,489 today.

However, the gain bitcoin recorded was minuscule compared to the one seen by the clear winner this quarter: SOL. Over the past quarter, the token rose by a whopping 310%, by far outperforming every other token in the top 10 by market capitalization.

Best from the top 50 in September and Q3

Zooming out a bit to cover all of the coins in the top 50 by market capitalization, we can see that the makeup of our top performers looks quite different. As the top performer for the month, the DeFi-focused smart contract platform fantom (FTM) stands out with a gain of over 105%.

The token is closely followed by OMG, the native token of the Ethereum scaling solution OMG Network, and DYDX, the native token of the Ethereum-based decentralized exchange with the same name, which has recently seen a sharp rise in trading volumes.

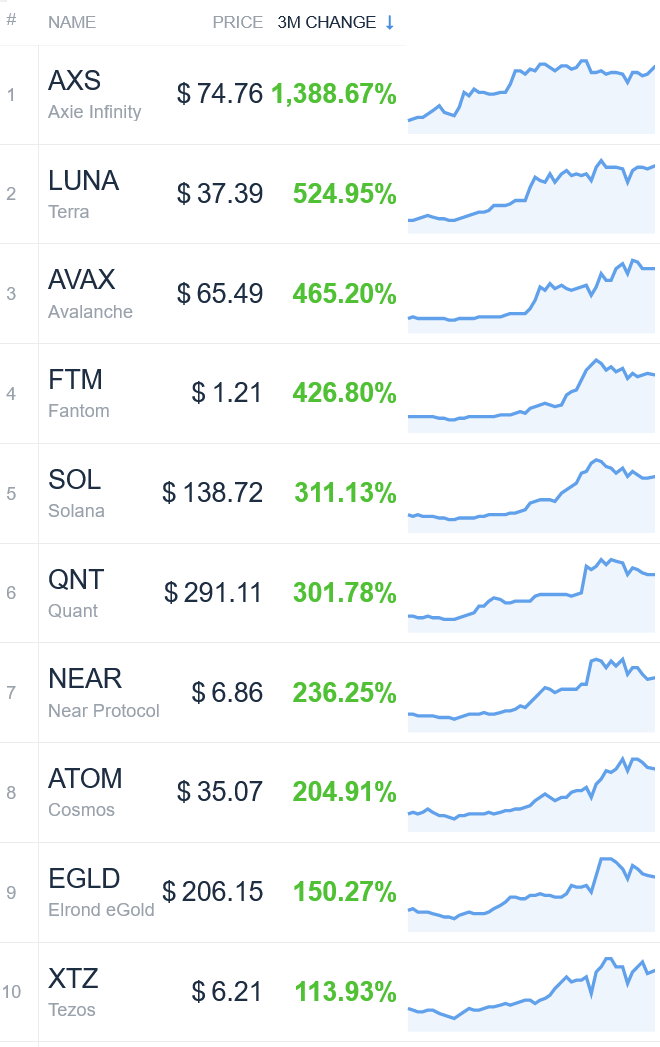

For Q3, blockchain game Axie Infinity’s AXS token easily made the top of the list, gaining more than twice as much as the second coin on the list, Terra’s LUNA token.

Helped in large part by massive gains in July and August, the AXS token managed to climb 1,388% for the quarter, as the game developers hit several major milestones.

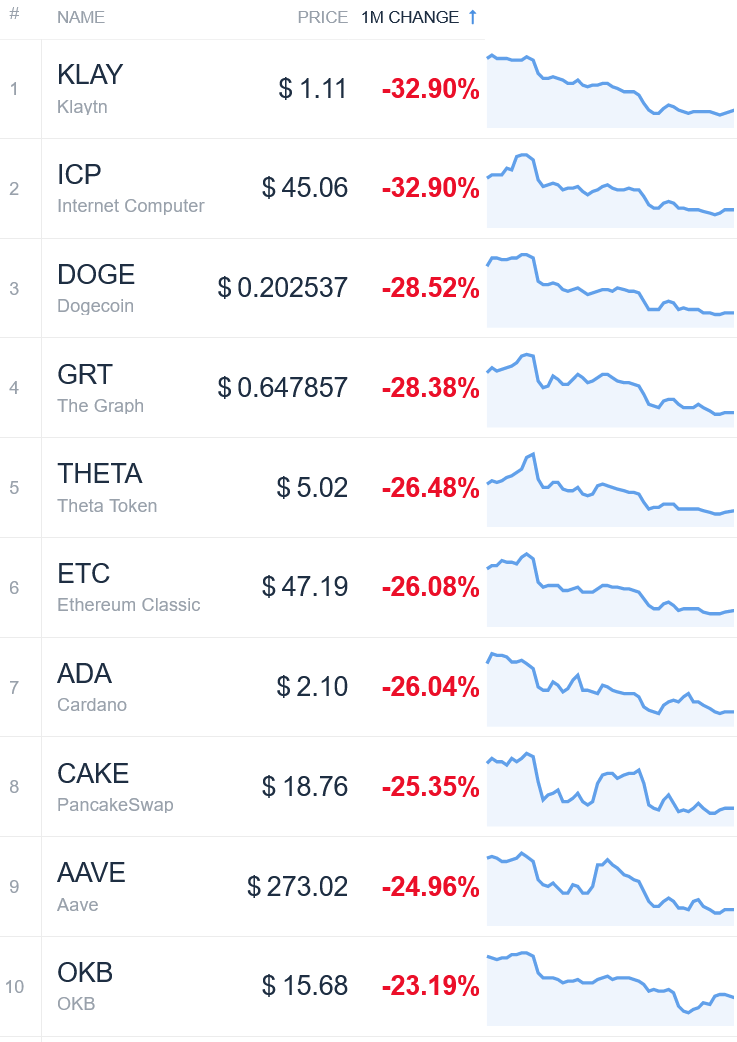

Worst from the top 50 in September and Q3

Out of the largest 50 coins by market capitalization, a number of coins also ended the month in red, although the differences in price performance between these coins are not very significant.

Worth noting in this group of coins is the meme token dogecoin (DOGE), which ended the month at USD 0.20, 28.5% lower than it started it. The drop happened as the coin resumed a major downtrend that started after the all-time high from early May of USD 0.74.

Also interesting to note was the drop seen by OKEx’s exchange token OKB, which earlier this month fell along with Huobi’s huobi token (HT) on news that China is again cracking down on all things crypto.

Looking at the worst-performing coins for the quarter as a whole, we can again see some of the same coins listed as September’s worst performers.

Standing out in this respect for the third quarter, theta token (THETA) saw a drop of more than 26%. The token, ranked 32 by market capitalization, is the native token of the video streaming blockchain network with the same name, purpose-built for users to share bandwidth and computing power on a peer-to-peer basis.

Worth noting is also that the tokens of the two DeFi protocols PancakeSwap (CAKE), built as a decentralized exchange on Binance Smart Chain, and Aave (AAVE), an Ethereum-based lending and borrowing platform, both fell by about 25%.

Best from the top 100 in September and Q3

Zooming out even more to cover all of the coins in the top 100 by market capitalization, we still see some of the same winners as earlier, with FTM, OMG, and DYDX being notable examples.

However, the list also includes lesser-known coins that have performed well over the past month. This includes OMI, a token belonging to the NFT marketplace ECOMI, which rose by 79% for the month, and the smart contract platform Algorand’s ALGO token, which rose 55%.

For the quarter, blockchain game Axie Infinity’s AXS token again stood out as the clear winner. Further, the list is nearly identical to the list of the best performers from the top 50, with two notable exceptions: elrond egold (EGLD) and tezos (XTZ).

Among these, EGLD rose by 150% for the quarter, while XTZ rose nearly 114%.

Worst from the top 100 in September and Q3

HT stood out with the worst performance for the month, likely driven by the Chinese government’s latest nail in the coffin for China’s once-flourishing crypto industry.

Huobi token fell by 43% for the month, and was followed by decred (DCR), enjin coin (ENJ), and maker (MKR), which were down by 40%, 38%, and 36%, respectively.

Expanding our scope to the whole quarter, it becomes clear that the Theta blockchain has had a difficult time recently, with both THETA and theta fuel (TFUEL) down by between 26% and 36% for the quarter.

____

Learn more:

– ‘Extreme Volatility’ Expected as Bitcoin Investors Learn to Value It

– Bitcoin Price to Face Another Test as Central Banks Eye Rate Hikes

– Trading Volumes Collapse at Most S Korean Crypto Exchanges, New Restrictions Confirmed

– Cardano Gives More Info on Stablecoin & New Partnerships, ADA Drops

– Solana Gets More Investments Than Ethereum

– DYDX Soars as Protocol Sees Trading Volume Double That of Coinbase

– Axie Infinity Token Rises as Platform Introduces Staking Rewards

– OKEx and Huobi Tokens Try to Recover as Chinese Ban Takes Effect

Credit: Source link