And the fields of green continued. Following a successful January for the most top 100 coins by market capitalization, February brought further gains, with only two coins – that’s right, only two out of 100 – ending the month in red.

Even though the markets turned red in the past week, it still wasn’t enough to change the color of the overall monthly performances. Not a single coin in the top 10 dropped over the course of the past month, with some pushing to the never-before-seen highs as well: we’re primarily talking about bitcoin (BTC) and ethereum (ETH) here, which jumped above USD 58,000 and USD 2,000, respectively, in the second half of February.

The performance of the crypto markets, particularly that of bitcoin, kept the eyes of many retail and institutional investors glued to it for two months now.

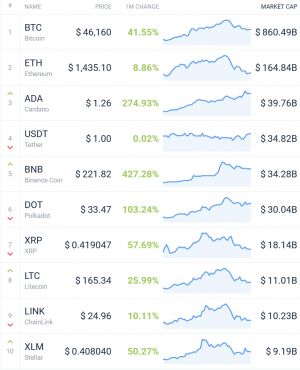

Top 10 Coins

All top 10 coins by market capitalization finished the month of February in green – though some more so than the others. Therefore, on the very top this time around sits binance coin (BNB), which saw a rise of 427% over the past month.

BNB is followed by two more coins with triple-digit jumps, these being: cardano (ADA) with nearly 275%, and polkadot (DOT) with 103%.

Nearly all of the remaining coins saw double-digit rises last month, including bitcoin, which is up by 42%. This is somewhere in the middle compared to the other four coins – XRP and stellar (XLM) are up 58% and 50%, respectively, while litecoin (LTC) and chainlink (LINK) appreciated 26% and 10%, respectively.

As for XRP specifically, it was the best performer in January, pulled up by a massive pump seen in the month’s last days, but has since then dropped from the 3rd to the 7th place by market capitalization. On the third place now sits ADA.

Meanwhile, the only coin that saw a single-digit rise is the second one by market capitalization: ethereum, which is up nearly 9%. But as said, February is still the month the coin reached its current all-time high, even if dropping in the past week with the rest of the market.

Top winners in January

The heavy greenery landed upon the top 50 coins by market capitalization as well, out of which the top 10 winners all boast triple-digit increases in their prices in February.

At the very top, for the first time we see pancakeswap (CAKE) – a Binance Smart Chain-based decentralized exchange launched in late 2020 – with a 684% rise.

Voyager token (VGX) took the somewhat distant second place, with its rise of 441% – after it entered the top 50 list, and after being one of the January losers in the top 100. Right behind it is the top 10 winner, BNB.

Terra (LUNA) is the only coin in the 300%-rise range, while three are up between 200% and 290%, these being: solana (SOL), ADA, and the graph (GRT).

The prices of the remining three – OKB, IOTA, and NEM (XEM) – have increased between 156% and 196% – objectively high percentages all around.

Out of the mentioned coins, SOL was a winner in January as well, while OKB took a green turn, rising from the losers’ to the winners’ list.

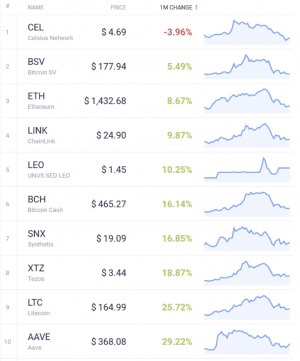

Top losers in January

Well, this will be a short list – actually, unlike in January, we now don’t have enough redness to even make a list.

The only coin among the top 50 that saw a drop over the course of the last month is celsius network (CEL). It continued its losses, as it was one of the red coins in January as well. CEL’s drop is minor this time around – less than 4%.

Another thing that can be noticed is that bitcoin (BSV) appreciated the least among the top 50. Interestingly, ethereum is in the second place here.

Winners & losers from top 100

Ready for some more good news: nearly all coins in the top 100 by market capitalization finished February with higher prices.

Ravencoin (RVN) rose to the first place on this list, with a rise of 805%. It’s then followed by CAKE, as well as venus (XVS)‘s 511%. Polygon (MATIC) and BNB are next on the list, followed by xinfin token (XDC), fantom (FTM), pundi X (NPXS), and LUNA’s 325% in the 10th place.

Only red coins on this list are curve DAO token (CRV), which dropped 6%, and the mentioned CEL.

___

Learn more:

– Bitcoin Rally Might Be Back To ‘Normal’ by April or ‘Sooner’ – Pantera’s CIO

– This Is Why Old Models Don’t Work With Bitcoin According to Raoul Pal

– Bitcoin Is a Sideshow & a Poor Hedge, but It’s Mainstream – JPMorgan

– DOGE’s Rally Has Revived Dogecoin Development, But For How Long?

– ETH ‘Insanely Cheap,’ DeFi To Rally, BTC Dominance to Drop – Pantera Capital CIO

Credit: Source link