Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin has surpassed the $66,000 mark, and market commentators has analyzed the factors that could help it reclaim the $70,000 level. Experts in the industry believe that the recent interest rate cuts by the Federal Reserve could significantly influence Bitcoin’s price trajectory, as lower rates typically encourage investments in riskier assets.

At the same time, analysts have noted that the TD Sequential indicator on Solana’s daily chart is pointing to a promising buying opportunity. This indicates a possible price recovery may be on the horizon, with predictions suggesting a rebound could occur within the next one to four daily candlesticks based on SOL’s price behavior.

Meanwhile, tokens within several networks have also witnessed rallies. This article curates the top trending crypto coins on DEXTools.

Top Trending Crypto Coins on DEXTools

Melo is currently priced at $0.00000666, with a market cap of $2.39 million. Citadel.one aims to be a holistic platform for Decentralized Finance (DeFi) by incorporating multiple essential features into one application. Snap: First Space Coin (SNAP) is valued at $0.00000255, boasting a market capitalization of $819.62K.

Meanwhile, Memebet is carving out a niche in the expanding meme coin market by merging online gambling with cryptocurrency. Recently, Bitcoin and cryptocurrency stocks have experienced an uptick following a half-percentage-point reduction in interest rates by the Federal Reserve.

1. Melo (Melo)

Melo is currently valued at $0.00000666, with a market capitalization of $2.39 million. It has a 24-hour trading volume of $10.08 million, reflecting a significant 68,983.60% increase in daily trading activity. Melo has a circulating supply of 410.55 billion coins, which matches its total supply. Approximately 1,710 wallets hold it.

Furthermore, Melo’s price fluctuated throughout the day, showing a volatile trend. Over the past five minutes, the price rose by 6.47%. However, in the last hour, it dropped by 23.56%. In the past 24 hours, the price surged dramatically by over 68,782%. The liquidity stands at $188.5K, while the percentage of pooled Melo coins is at 3.93%. Additionally, the asset’s volatility is recorded at 53.59%. Notably, buy transactions (5,398) slightly outpaced sell transactions (4,257), indicating mixed market sentiment.

Between 06:00 and 09:30, there was a notable price increase, peaking at $0.07345. However, after that peak, the price began to fall and entered a downward trend with minor fluctuations. At present, the price seems to be stabilizing around $0.056, suggesting the potential for consolidation.

🚀 Just submitted our request to list $melo on @CoinGecko!

Looking forward to having the cutest cat on the interwebs listed $melo

🎫 Request ID: CL2909240023

— $MELO – The Doge Founder’s Cat (@CTO_Melo) September 29, 2024

In terms of trading volume, the chart shows an initial spike during the price surge. This was followed by a decrease as the price corrected. The current volume reads 50.24K, which indicates moderate trading activity. The chart reflects both bullish and bearish sentiments. There was a series of green candles during the price increase, followed by larger red candles as the price dropped.

2. Citadel.one (XCT)

Citadel.one is positioning itself as a comprehensive platform for Decentralized Finance (DeFi) by integrating several key features into a single application. The platform’s core service, for instance, revolves around its Staking-as-a-Service model, which allows users to participate in staking across multiple networks. Currently, Citadel.one serves as a validator for over 20 blockchains, including Tezos, Cosmos, and Solana.

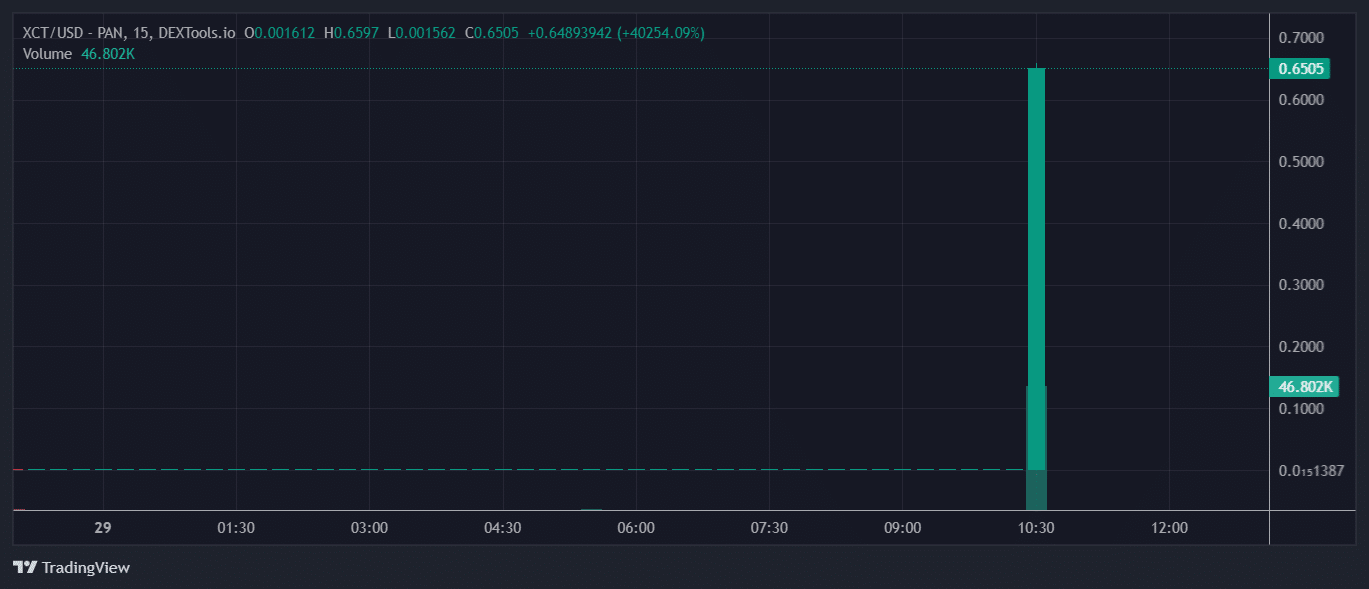

The live price of Citadel. one’s native token (XCT) currently stands at $0.650, with a market capitalization of $30.78 million. The token has seen a notable 40,300.18% increase in trading volume over the past 24 hours, bringing the current 24-hour trading volume to $46.80K. Furthermore, the circulating supply is reported to be 47.33 million XCT out of a total supply of 980.25 million.

In addition, Citadel. one’s total market cap is $637.57 million, with liquidity at $23.5K and volatility sitting at 1.99. Moreover, the circulating supply accounts for 4.82% of the total supply, while 36.05K XCT is pooled, representing 0.0036% of the total.

Upcoming mainnets we can’t wait:

❒ @Artela_Network

❒ @berachain

❒ @initiaFDN

❒ @ParticleNtwrk

❒ @union_buildQ4 is going to be sick!

— Citadel.one (@CitadelDAO) September 26, 2024

Additionally, in terms of network activity, the platform has recorded 274.37K total transactions, with 3.89K XCT holders. These figures indicate steady growth in user engagement and transactional volume across its supported networks. Overall, Citadel. one’s diverse range of services and network participation reflects its growing presence in the DeFi space.

3. Snap: first space coin (SNAP)

Snap: First Space Coin (SNAP) is currently priced at $0.00000255 with a market capitalization of $819.62K. Over the past 24 hours, its trading volume skyrocketed to $7.88M, reflecting an astonishing 23,133.64% increase. The total circulating supply stands at 420.69B SNAP, matching its maximum available supply.

Earlier in the day, SNAP experienced a steady rise from 06:00 to 09:30 before reversing into a clear downtrend, with lower highs and lower lows confirming the shift in market momentum. This bearish trend has continued throughout the session.

Trading volume spiked around 09:00 during the upward movement, indicating strong buying pressure. However, as the price declined after 10:00, the volume also decreased, reflecting reduced interest in trading. The current volume stands at 28.649K, suggesting moderate activity, though lower than earlier peaks.

Market sentiment started on a bullish note, with several green candlesticks showing buying pressure early in the day. However, after the price correction post-09:30, red candlesticks dominated the chart, indicating selling pressure. The market is currently in a consolidation phase, with no strong momentum, either upward or downward.

In summary, SNAP experienced early gains but has since shifted into a downtrend. Trading activity has slowed, and the market is showing signs of indecision. Despite brief attempts at recovery, the asset remains in a bearish phase.

What Might Be The Next Top Trending Crypto?

Memebet is positioning itself in the growing meme coin sector by combining online gambling with cryptocurrency. So far, the project has raised over $331,000. Its main product, the “Memebet Casino,” allows users to bet on a wide range of games using meme coins, appealing to both crypto traders and gambling enthusiasts. A standout feature is its no-KYC requirement, enabling players to start by simply connecting their crypto wallets via Telegram, which streamlines the onboarding process.

The platform offers a variety of crypto-based games along with a global sportsbook covering popular sports leagues, including the EPL and NBA. Memebet’s approach is focused on the intersection of cryptocurrency and gambling, with a specific emphasis on engaging meme coin traders. This strategy, particularly targeting Telegram users, aims to leverage the platform’s existing base of crypto enthusiasts.

Although Memebet is still in its early stages, it is offering incentives such as play-to-earn (P2E) airdrops, rewards designed for more aggressive traders, and VIP benefits for those holding its native token, $MEMEBET. At $0.0255, the token is expected to rise as user participation grows, with a price increase scheduled soon.

Overall, Memebet offers an interesting combination of two emerging trends—crypto gambling and meme coins. While still developing, its unique features may attract users and investors looking for a new form of online entertainment.

Visit Memebet Presale

Read More

Most Searched Crypto Launch – Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards – pepeunchained.com

- $10+ Million Raised at ICO – Ends Soon

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link