While some 56% of surveyed crypto hedge funds declare that bitcoin (BTC) was responsible for at least half of their daily crypto trading volume in 2020, with 15% of the funds trading solely in bitcoin, they were also looking into other cryptoassets.

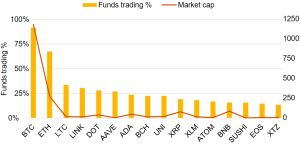

Among the top traded coins by daily volume last year, the funds pointed to ethereum (ETH), with 67% of funds trading the cryptoasset, litecoin (LTC), at 34%, chainlink (LINK), with 30%, polkadot (DOT), at 28%, and aave (AAVE) with 27%, according to a report released by international consultancy PwC, Elwood Asset Management, and the Alternative Investment Management Association.

“Among the top 15 traded altcoins, some of them are considerably more popular than their market capitalization would suggest. Litecoin and Chainlink are the second and third most traded altcoins, but their market capitalizations are far lower than Polkadot and Cardano, which fare lower in the trading ranks,” they noted.

Cryptoassets traded by crypto hedge funds and their market capitalization:

Also, compared with 2019, the share of funds involved in staking remained at the same level last year, at 42%, while lending activity increased to 38% compared with 33% a year earlier. The same share of crypto hedge funds engaged in borrowing, at 24%, the report said.

Henri Arslanian, Crypto Leader at PwC, commented that the consultancy expects “inflows into crypto hedge funds to continue to increase over the coming months as more and more institutional investors decide to allocate to this fast-growing space.”

Meanwhile, before the recent crash in the market, fund managers demonstrated a bullish approach to bitcoin.

“At the time of the closure of our survey, the bitcoin price was hovering around USD 59,000, and all but one respondent predicted a value higher than that, with the median predicted price being USD 100,000. In fact, the majority of predictions were in the USD 50,000 to USD 100,000 range (65%), with another 21% predicting prices would be between USD 100,000 and USD 150,000,” the report said.

At 11:35 UTC, BTC trades at USD 37,268 and is up by 6% in a day, trimming its weekly losses to less than 19%.

The fund managers also share optimism with regards to the total crypto market capitalization which, at the time the survey was closed, stood at about USD 2trn.

“Fund managers are also bullish, with over 76% of funds estimating that market capitalization would finish the year above current levels, with the median predicted level at USD 3 trillion, and most forecasts falling in the USD 2 trillion to USD 5 trillion range,” according to the report.

Today, it stands above USD 1.6trn.

Some of the other takeaways from the report include the following data:

- The total assets under management (AuM) of the world’s crypto hedge funds increased to nearly USD 3.8bn in 2020 from USD 2bn the previous year;

- The percentage of crypto hedge funds with AuM of more than USD 20m increased in 2020 from 35% to 46%;

- The average AuM for the surveyed funds increased from USD 12.8m to USD 42.8m, while the median AuM increased from USD 3.8m to USD 15m;

- The median crypto hedge fund returned +128% in 2020 against +30% in 2019.

____

Learn more:

– Bitcoin Dominance Rises Again As Funds Are Buying The Dip

– Analysts See ‘Seismic shift’ In Bitcoin Mining Amid Chinese ‘Crackdown’

– Traders Rotate From Bitcoin To Alts, While JPMorgan Sees Ether As Overvalued

– Bitcoin’s Correlation with Altcoins is Declining Again. What Does it Mean?

Credit: Source link