The text below is an advertorial article that was not written by Cryptonews.com journalists.

Unless you’ve been living under a rock, you’ll know that Bitcoin has grown at an unbelievable rate over the last year. It recently hit a new peak of over 64,000 USD for a single BTC, rising by 63%, in the first quarter of 2021 alone.

Undoubtedly, one of the main causes of this incredible bull run is that the pandemic has weakened traditional currencies and driven many to look at alternatives to help see them through the storm. This has resulted in crypto investment by global financial institutions and major corporations. In turn, the increased adoption has led to a growth in the legitimacy and popularity of Bitcoin and cryptocurrencies in general, a development that is likely to be with us for the long term.

If you already own Bitcoin, you want to ensure that you don’t lose all your money if the price crashes again, and you also want to put your profits to work on your behalf, so they aren’t just sitting idle. The safest and most profitable way to achieve this is with crypto arbitrage.

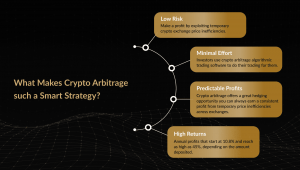

What Makes Crypto Arbitrage such a Smart Strategy?

There are a number of factors that make crypto arbitrage an attractive investment strategy. Let’s take a closer look at a few of the major benefits:

Low Risk

Crypto arbitrage is commonly used by institutional and retail investors alike because it is widely acknowledged to be one of the lowest-risk forms of investing. The reason for this is that it does not leave you vulnerable to crypto market volatility. Instead, you make a profit by exploiting temporary crypto exchange price inefficiencies. These are instances where for a few minutes only, a cryptocurrency will be available on different exchanges at different prices at the same time. During that brief window, you can buy the cryptocurrency on the exchange where it is offered at the lowest price and then instantly sell it on the exchange offering the highest available price before the market adjusts to compensate and the inefficiency resolves itself.

Minimal Effort

To find and take advantage of crypto arbitrage opportunities you would need to be able to track hundreds of coins on multiple exchanges at once and have split-second reaction times. This is why investors use crypto arbitrage algorithmic trading software to do their trading for them.

To get a better idea of how it works let’s use ArbiSmart, a popular, EU licensed, automated, crypto arbitrage platform, as an example.

ArbiSmart is connected to 35 different exchanges which it scans 24 hours a day to identify crypto arbitrage opportunities on multiple coins. It can react instantly to the market and execute a huge volume of trades simultaneously. All you do is register, deposit funds in either fiat or crypto and the company’s AI-based algorithm does the rest, earning you profits of up to 45% a year, while you get on with your day.

Predictable Profits

One of the primary characteristics of the cryptocurrency markets is its exceptionally high volatility, which means that digital currency investment can be very unpredictable, with dramatic highs and lows. In contrast, crypto arbitrage offers steady, consistent returns.

At ArbiSmart for example, you can go to the company’s Accounts page, and see in advance exactly how much you are guaranteed to make per month and per year, based on the size of your investment. This reliability allows you to plan financially, with far greater accuracy than would be possible with almost any other form of investment.

Crypto arbitrage also offers a great hedging opportunity, since whatever is happening to Bitcoin and the rest of the crypto market, whether it is soaring or crashing, you can always earn a consistent profit from temporary price inefficiencies across exchanges.

High Returns.

Saving the best for last, crypto arbitrage offers huge returns, with ArbiSmart offering annual profits that start at 10.8% and reach as high as 45%, depending on the amount deposited.

For example, an investment of 10 BTC, which is currently equivalent to around 600,000 USD will have more than tripled in just three and a half years, exceeding 1,886,000 USD. In fact, this calculation is extremely conservative for a few reasons. Firstly, in addition to your profits from crypto arbitrage, you will be making compound interest on those earnings. Also, you will be earning capital gains on the rising value of RBIS, the platform’s native token, which has already gone up by 350% in the two years since it was introduced.

When you sign up with ArbiSmart, your funds are automatically swapped into RBIS for use in crypto arbitrage trading, though they can be withdrawn in EURO or BTC at any time. Those who joined ArbiSmart in early 2019 have now more than tripled their profits from the growing value of the token and the coin is on track to rise far higher in 2021. Firstly, the company has a number of new products and services set for launch in the second half of 2021, including an interest-bearing wallet, adding new utilities for the token. Secondly, RBIS is in the process of becoming listed, so in the coming months the token will be tradable on the exchanges, which is likely to drive the price higher. Lastly, the company’s crypto arbitrage platform is growing at a steady rate of 150% a year, leading to greater demand for the token, which has a limited supply.

What About the Risks of Entering the Crypto Space?

However low-risk your investment strategy, any time you step into the crypto arena you are exposing yourself to a certain degree of danger. Unfortunately, since legislation has not caught up to the rapid developments with this emerging asset class, the crypto world is massively under-regulated. As a result, it is up to you to take extra precautions before entrusting your hard-earned capital into the hands of any crypto arbitrage platform.

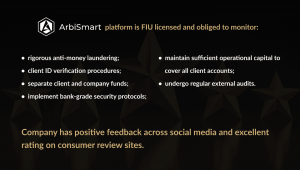

Most importantly, you should only invest with a fully licensed company, since regulatory compliance guarantees a high level of security and transparency. For example, ArbiSmart, as an FIU licensed platform, is required to follow rigorous anti-money laundering and client ID verification procedures, separate client and company funds, implement bank-grade security protocols, maintain sufficient operational capital to cover all client accounts and undergo regular external audits.

You also need to research the reputation of your chosen platform, seeing what the crypto community has to say in industry press and across social channels. For example, a quick online search on ArbiSmart shows the company has positive feedback across social media, with an excellent rating on consumer review sites like Trustpilot, with regard to the standard of support, speed of withdrawals and reliability of its profit guarantees.

An automated crypto arbitrage platform offers a great investment opportunity, allowing you to put your capital to work at low risk, for unparalleled passive profits all without requiring you to lift a finger. Making zero demands on your time, it enables you to reap the benefits of the fast-paced digital currency markets, without exposing you to the dangers of crypto market volatility.

Interested in tripling your Bitcoin with crypto arbitrage? Get started now!

Credit: Source link