Join Our Telegram channel to stay up to date on breaking news coverage

Synthetix Network Token (SNX) has rallied 15% over the last 24 hours to $2.63, as crypto market participants scrambled with excitement following the Fed’s ‘disinflationary’ remarks on Wednesday. The Synthetix price may sustain the uptrend if it clears the barrier at $2.753.

Let’s analyze the technical outlook after the recent uptick and see what factors could lead to a continued recovery in the near term.

Reasons Why Synthetix Price Will Remain Bullish

1. Jerome Powell’s Disinflationary Speech

The Federal Reserve announced a 25-basis points interest hike on Wednesday, February 1, bringing the cumulative increases to 4.75% up from 4.5%. This followed the previous 50-basis points increase in December. The crypto market remained drab in the first few hours following the announcement as investors waited for Federal Reserve Chair Jerome Powell’s comments.

Read Chair Powell’s full opening statement from the #FOMC press conference (PDF): https://t.co/oyouAulg0V pic.twitter.com/MnNgjMl336

— Federal Reserve (@federalreserve) February 1, 2023

After the Federal Open Market Committee (FOMC) meeting, Powell came out with a hawkish statement reinforcing the importance of bringing down inflation to the administration’s target of 2%. He also mentioned the start of a disinflationary phase but did not give much detail about it.

The Fed official emphasized that further interest rate hikes could be necessary for the long-term goal, though they may not be drastic. He said:

It’s gratifying to see a disinflationary process underway […], but this disinflationary process is in early stages.

To put this into context, the United States Central Bank increased interest rates by 0.75% four consecutive times across 2022. Most analysts already expect the Fed to add another 0.25% rate hike to a range of between 4.75% and 5% in the next meeting scheduled for the end of March.

The slightly raised interest rates catapulted prices in the cryptocurrency market with Bitcoin (BTC) rising above $24,000 for the first time since August. SNX price, which is currently among the top gainers according to CoinMarketCap, soared as much as 24% following the Fed Chair’s speech marking a green start to February.

February’s price action for the Synthetix price comes after an amazing performance in January which delivered a 90% monthly green candle, marking the biggest gains since January 2021. If the momentum is maintained going into the second month of the year, SNX’s value is set to continue growing.

2. SNX Technical Setup Favors The Upside

The price of the Synthetix Network token started recovering on January 1 making a 91% leap upward. The buyers tried to pump the price above $2.753, but were rejected by this supplier zone. When the SNX price turned away from this level, it formed a double top chart pattern, which meant that a correction was inevitable, threatening the token’s return to December 31 levels.

Fortunately, the correction did not yield much since after trading in a brief downtrend defined by the appearance of a bullish flag on the daily chart, the price confirmed a bullish breakout on Wednesday. At the time of writing, the DeFi token was trading above the upper boundary of the flag, meaning that increased buying from the current level could send it ballistic to hit the technical target of $4.817. This would represent an 83% climb from the current price.

SNX/USD Daily Chart

The bullish narrative was supported by the upward-facing moving averages and the rising Stochastic RSI away from the oversold region This suggested the market still favored the buyers.

Additionally, the simple moving averages (SMAs) were about to send a bullish signal as shown in the chart above. Though not a ‘golden cross’, when the 50 SMA crosses above the 100 SMA, it usually signifies a strong uptrend. Another call to buy SNX was about to come from the upward-moving MACD. This may take place in the near term when the 12-day exponential moving average (EMA) crosses above the 26-day EMA, signaling the continuation of an uptrend.

The technical formation also revealed that the Synthetix price had abandoned the double top set-up because of the relatively robust support on the downside. These were the $2.426 defense line where the 200-day SMA sat and the $1.9 demand zone, where the 50-day and 100-day SMAs converged.

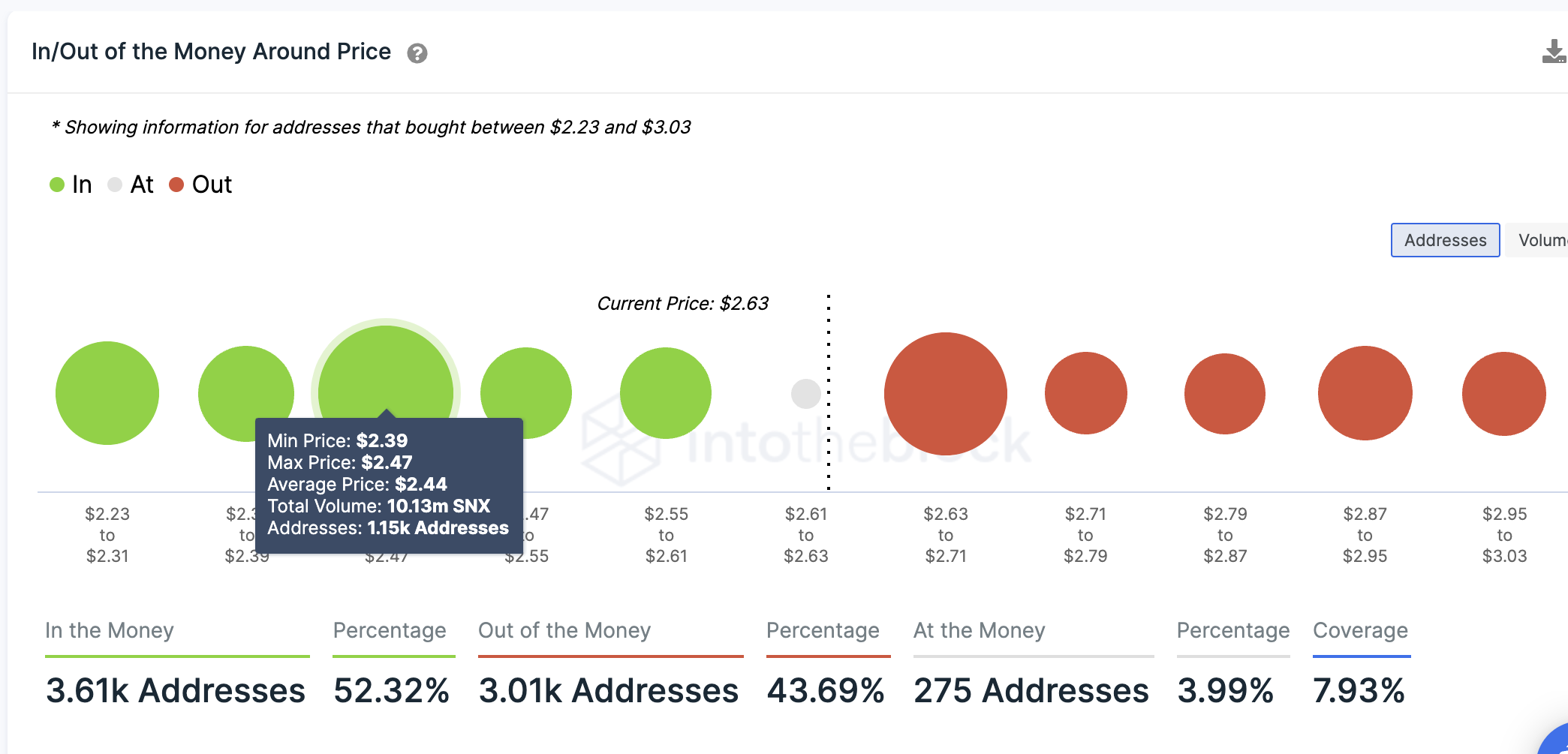

Perhaps the most important area of support is the one defined by the upper and lower boundaries of the flag between $2.192 and $2.5. The importance of this defense zone was emphasized by on-chain metrics from IntoTheBlock’s Global In/Out of the Money (GIOM) model, which showed that the $2.44 support, which lies within the flag, is relatively robust.

This is where roughly 1.150 addresses previously bought approximately 10.15 million SNX. Any attempts to pull the price below the flag would be met by immense buying from this cohort of investors who may wish to maximize their profits. The ensuing demand pressure would cause the Synthetix token to rise even higher.

Synthetic NetWork Token IOMAP Chart

3. Total Value Locked

In light of the bear market conditions experienced last year, decentralized liquidity providers are among the few areas in the DeFi ecosystem that have shown consistent growth. With the Synthetix Network, one of the leading decentralized liquid staking providers, deposits are constantly coming on the protocol.

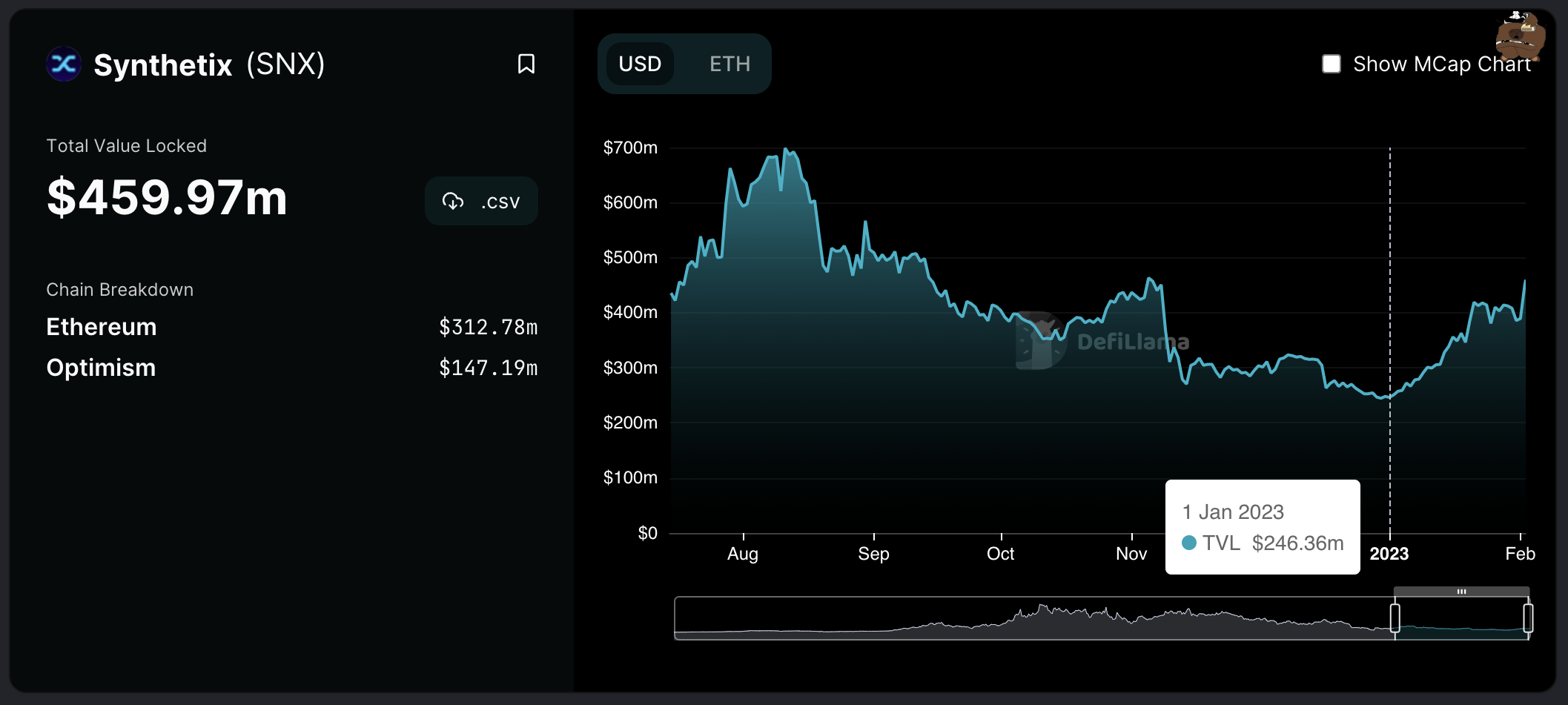

According to data from DeFiLlama, the project’s total value locked (TVL) rose moderately in November after the collapse of the centralized crypto exchange FTX. However, the real rise in TVL happened in January as cryptos prices embarked on a steady recovery when the total value locked on Synthetix climbed 86% from $246.36 million on January 1 to $459.97 million at the time of writing.

Total Value Locked On The Synthetix Network

Increasing TVL reinforces investor confidence in the project which in turn positively impacts the price.

SNX Price May Reach These Levels

Noteworthy, if bulls are unable to sustain the higher levels, the ongoing correction may continue in the near term taking the price back into the confines of the flag. Market participants could expect the price to continue trading with this technical formation recording to lower levels.

Related News:

Meta Masters Guild – Play and Earn Crypto

- Innovative P2E NFT Games Library Launching in 2023

- Free to Play – No Barrier to Entry

- Putting the Fun Back Into Blockchain Games

- Rewards, Staking, In-Game NFTs

- Real-World Community of Gamers & Traders

- Round One of Token Sale Live Now – memag.io

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link