Cryptocurrencies pegged to the U.S. dollar have grown exponentially in the past several years.

Stablecoins, as their name implies, offer much-needed stability to traders who use them to store value, deploy capital, and exit their trades. Due to their inherent relation to Bitcoin and other cryptocurrencies, stablecoins are solid indicators of the broader market performance, as their abundance on exchanges is the primary indicator of market liquidity.

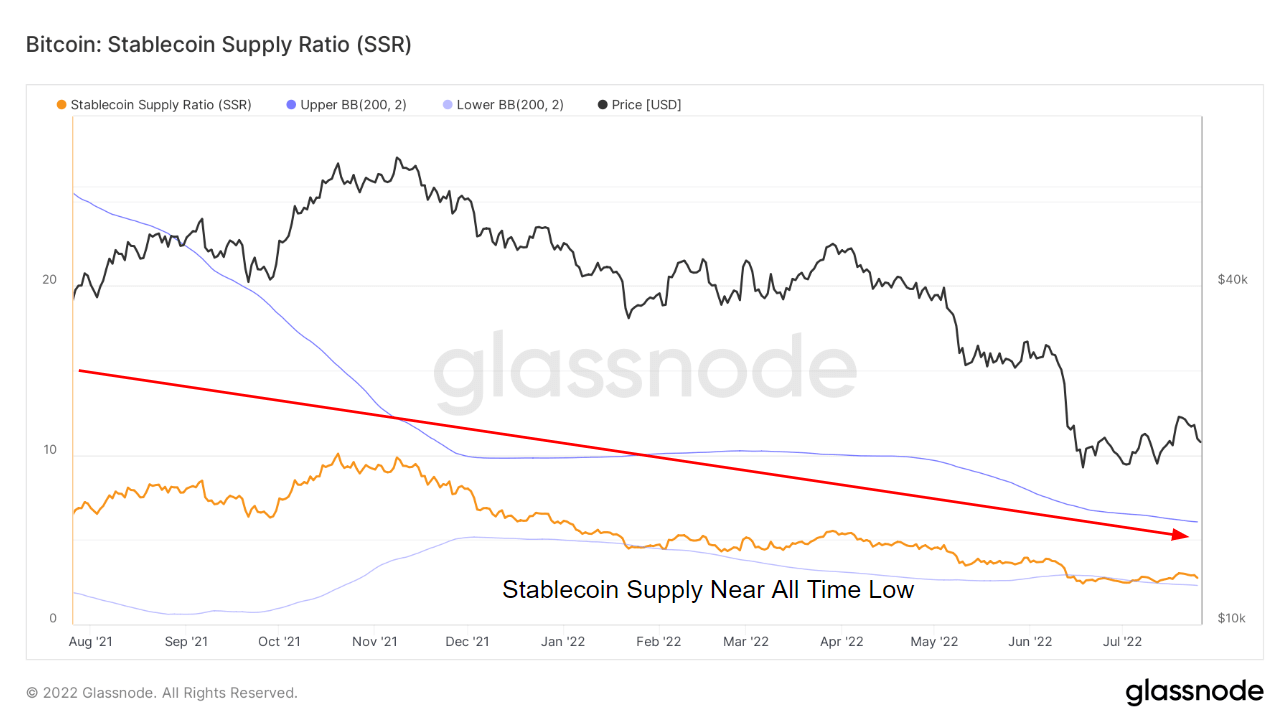

Take, for example, the stablecoin supply ratio (SSR). The SSR is the ratio between the Bitcoin supply and the supply of stablecoins denoted in BTC — Bitcoin’s market cap divided by stablecoin market cap.

The stablecoins included in the SSR are USDT, TUSD, USDC, USDP, GUSD, DAI, SAI, and BUSD.

When the SSR is low, the current stablecoin supply has more purchasing power to acquire BTC. When the ratio is high, the market has less purchasing power, and the buying pressure for BTC decreases.

The term “dry powder” refers to the amount of stablecoins, such as USDT and USDC, held on exchanges. High levels of dry powder are often taken as an indicator of an incoming bullish trend and a silver lining for BTC.

Many analysts believe this shows users are waiting for the macro to change from a risk-off to a risk-on environment, encouraging investors to store their wealth in cryptocurrencies pegged to fiat currencies and not convert it into fiat. It also shows that investors are more willing to hold capital in crypto, as a high stablecoin supply on exchanges doesn’t always mean that investors will convert it into BTC.

Take, for example, Argentina. Since regaining independence from Spain in 2816, the country has defaulted on its debt nine times and has seen almost constant double-digit inflation. At its worst, Argentina’s inflation hit 5,000%, resulting in several large currency devaluations. Argentinians looking to preserve their life savings are likely to keep them in stablecoins, thus adding to a significant portion of the stablecoin supply held on exchanges.

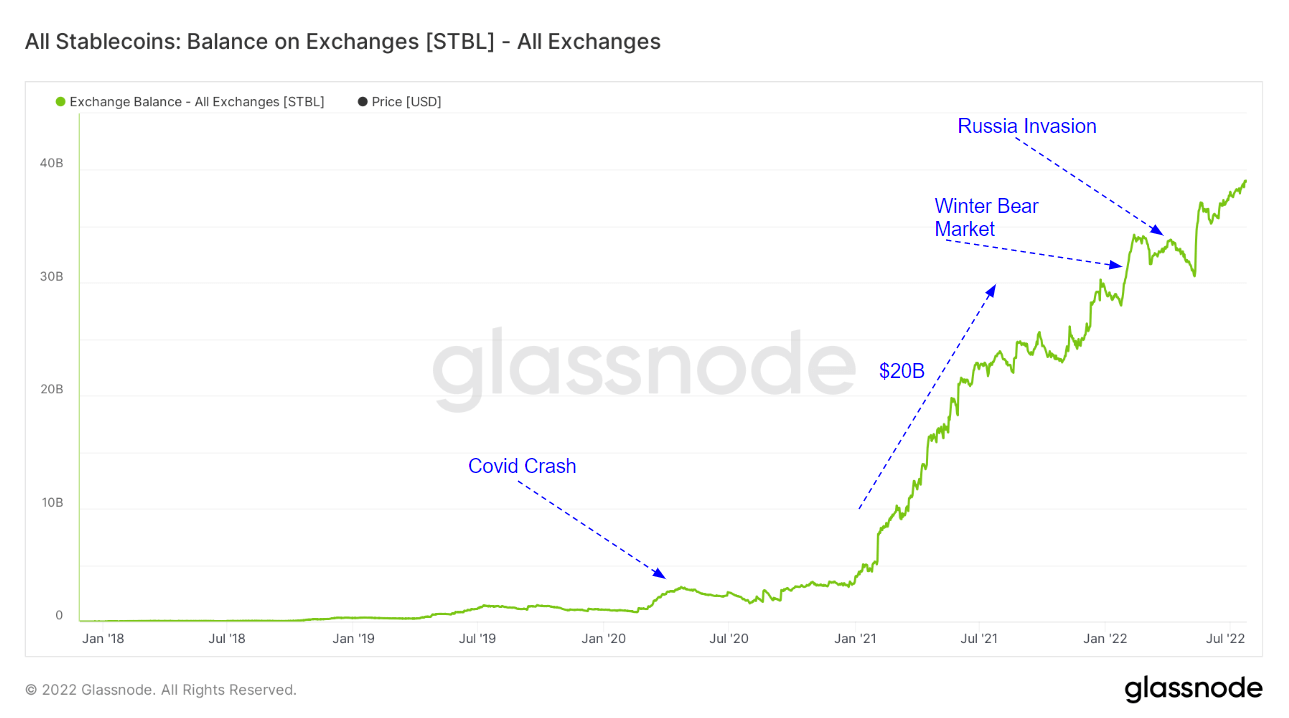

The chart above shows STBL, a virtual asset that aggregates the data of the largest ERC-20 stablecoins (USDT, USDC, DAI, BUSD, GUSD, HSUD, USDP, EURS, SAI, and sUSD). STBL is used to create a metric that sums up stablecoin balances across exchanges.

The exchange metrics are based on CryptoSlate’s constantly updated labeled data of exchange addresses, data science techniques, and statistical information that changes over time. Therefore, all of the metrics presented are mutable — while the data itself is stable, the most recent data points are subject to slight fluctuations as time progresses.

According to data from Glassnode, over $40 billion worth of stablecoin “dry powder” is waiting on the crypto market’s sidelines.

Overlapping this supply with dramatic macro events shows the exact moments when the stablecoin supply increased dramatically. The COVID-19 crash of March 2020 seems to have triggered a broader stablecoin accumulation trend throughout 2021. The onset of a bear market at the end of 2021 led to a further increase in their supply on exchanges, which continued to rise even further after Russia invaded Ukraine in February 2022.

Analyzing the data reveals that the stablecoin supply on exchanges tends to increase significantly when uncertainty hits the market.

Credit: Source link