Solana price is one of the best-performing cryptocurrencies in the market, with gains exceeding 90% in 30 days, 133% in 14 days, and 62% in seven. It is as if the token, SOL needed a little push north to win back the hearts of investors who have been walking away amidst rumors of a dying network. In just a few weeks, Solana’s value has jumped so that it’s trading above the $20.00 level in reference to December lows of $8.01.

Solana Ecosystem’s Death Rumors Could be Overstated

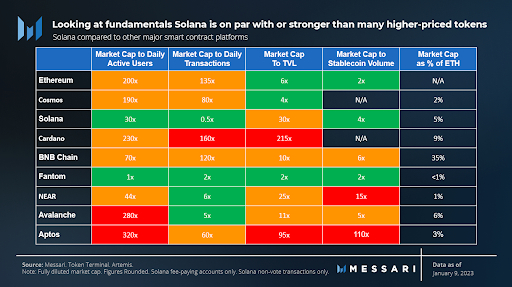

A report by Messari, a leading crypto analytics platform, has shed some light on matters surrounding the possible threat to the existence of the Solana ecosystem. Nevertheless, we cannot deny the fact that the network suffered greatly due to its close relationship with the defunct FTX exchange. Almost the entire value locked (TVL), blockchain transactions, and the value of tokens across the ecosystem was backed by FTX and its sister company Alameda Research.

As strong as almost any other Layer-1 protocol, the Solana ecosystem still possesses a network of builders, an ecosystem of applications, and a war chest of finance. Solana saw investors return in droves over the Christmas holidays, strengthened by these elements.

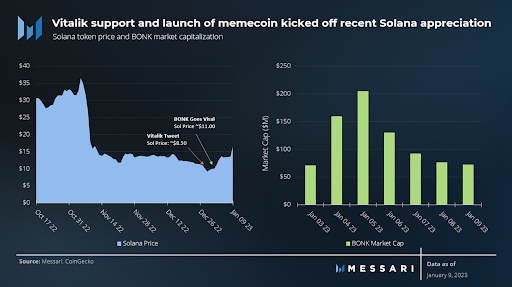

While the Solana price comeback is an encouraging story, it is not exactly as painted above. The activities in the ecosystem began ramping up after Ethereum’s co-founder Vitalik Buterin highlighted the Solana network in one of his tweets, with nothing but support.

Another factor for Solana price rally is the launch of the first meme coin, BONK, on the blockchain in late December. As the coin went viral, its market cap exploded to $200 million before gradually fading to $55 million at the time of writing.

To a great extent, the Solana price uptrend to $24 was greatly influenced by speculation, however, the network is solid, and an ecosystem of applications is thriving.

Key Solana Fundamentals Are on A Positive Trend

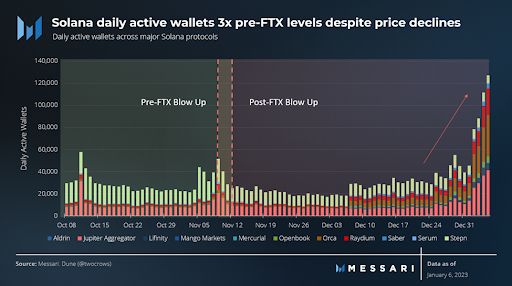

Contrary to what has been believed over the past two months that Solana’s network activity, plunged significantly after the FTX implosion, the daily active addresses transacting on the blockchain remained relatively unchanged post-FTX.

In the past few weeks, this metric tripled from pre-FTX levels. The question remains – will these levels hold in the short-term and possibly medium-term? Nevertheless, it proves that the Solana network is on a positive trend, considering the impact of the FTX collapse on the protocol.

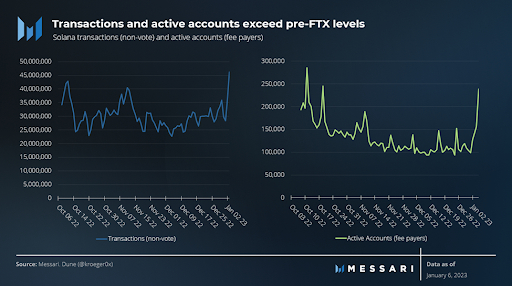

Messari reports that both the number of transactions and active accounts (controlling exclusively for fee-paying accounts) increased to pre-FTX levels. It is possible speculation due to the launch of BONK could have fueled the breakout, however, these indicators suggest that the amount of user activity never actually decreased from pre-FTX levels, which makes it impossible to isolate the FTX collapse.

Is Solana Past the Days Of network Outages?

The Solana blockchain suffered a series of network downtimes in 2022, leaving investors worried. However, throughout the collapse of FTX, the network never suffered an outage with the situation remaining the same post-FTX. It has been more than three months since Solana went offline.

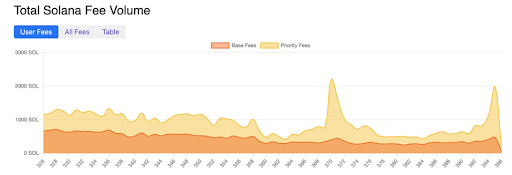

The updates developers have been working on are functioning. Meanwhile, the ecosystem’s local fee market, also known as the local priority fees experiment, has demonstrated that it was effective – gas fees have relatively stayed low, same as base fees apart from a spike in priority fees, possibly due to a spike in activities linked to BONK.

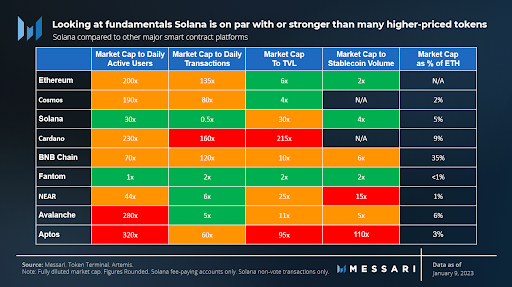

It is challenging to compare Solana to other Layer-1 blockchains, especially with vast differences between fundamentals and price. Moreover, Solana’s market cap is significantly lower in comparison to its peers like Ethereum and Cosmos when evaluating metrics such as active users, stablecoin volume, and blockchain transactions.

Looking ahead, Solana price could keep the uptrend intact supported by key user adoption mechanisms like Neon, the Solana Mobile Stack, and Solana Saga – likely to launch in 2023.

Solana Price Rally Takes A Breather

Solana price has retraced slightly from $24.00 to trade at $23.12 at the time of writing. The smart contracts token has pierced through major hurdles over the last few weeks, hence the supply zone running to $25.00 cannot hold the rally back for long.

The Moving Average Convergence Divergence (MACD) indicator is grounded in a bullish position as it lifts above the mean line. A buy signal confirmed at the New Year is still intact, implying buyers are in control.

In case Solana price slides further down, it might not drop significantly below $20.00 because the demand zone at $19.45 in close proximity to the 200-day Exponential Moving Average (EMA) (in purple), would cushion the bulls and pave the way for a rebound.

The path with the least resistance is bound to stay to the upside if the 50-day EMA (in red) keeps the distance above the 100-day EMA (in blue). Price action above $25.00 would call on more buyers, even institutional investors to reconsider Solana, thus, allowing SOL to rally toward $100.

Interested traders can buy Solana and take advantage of the rally likely to reach $100 in a few months. However, investors might want to look at Meta Masters Guild (MEMAG) for its better risk-reward potential. For more details on MEMAG, follow the link below.

New presale project: Meta Masters Guild – $MEMAG.

Related Articles:

Credit: Source link