Solana price prediction remains negative, having broken below all significant support levels on all timeframes. Solana has dropped by almost 26% in the last 24 hours and nearly 50% in the last seven days.

Solana tokens and NFTs have suffered as a result of the revelation of FTX’s collapse, and on-chain statistics show that greater losses are expected.e Prediction

On Wednesday, Binance announced that it will no longer be acquiring FTX, leaving Sam Bankman-crypto Fried’s empire in jeopardy. Hence, we are experiencing more dips in the crypto market.

Is It Time to Get Rid of Solana?

Solana’s ecosystem appears to be collapsing alongside FTX and Alameda, with evidence indicating that customers are fleeing in droves. Solana price volatility and pessimistic sentiment are at an all-time high as a result of recent events between the CEOs of Binance and FTX.

Furthermore, because of the dip in price, Solana whales are dumping their positions and wiping out entire SOL holdings.

One such example was offered by Wu Blockchain on November 9 and depicted a whale who owed $44.8 million USDC but only had 2.4 million SOL in collateral, making the total debt just over $51 million.

The minimum amount required to liquidate the property at that address was $43 million.

The Solana evacuation was witnessed by CNBC crypto dealer Ran Neuner. The market has recognized that CZ Binance presently owns 10% of the tokens, and in a statement released on November 9, he declared that he wanted to favor the BNB chain over the SOL chain.

Solana and FTX – How Are They Connected?

Solana drew a varied group of private investors in 2021, including Alameda Research, which donated $300 million to the company’s native token sale. Andreessen Horowitz served as the lead investor in this round of fundraising. Fried’s, a banker’s firm, has maintained its Solana blockchain integration.

In March 2022, FTX and CoinShares launched their Solana-based ETP. Investors in this revolutionary concept have gotten a portion of the profits from staking Solana. SOL also made significant investments in FTX to further its cryptocurrency ambitions.

According to CoinDesk, the company’s SOL holdings were worth $1.1 billion at the end of 2017.

Investors are concerned that SBF and FTX’s investments in Solana and its ecosystem may be lost. To make matters worse, the Solana blockchain is now experiencing performance issues.

The Solana network’s status dashboard reveals that the network is now operating at a decreased capacity. As a result, it appears that investors should use caution when considering investing in Solana.

Solana Price Prediction

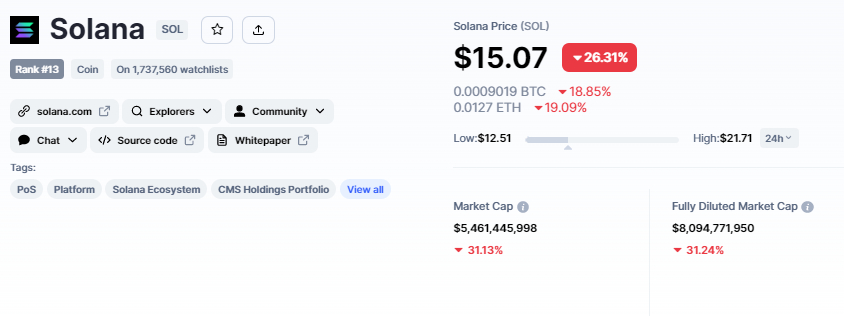

Solana’s current price is $15.07, with a $4.9 billion 24-hour trading volume. Solana has lost 26% in the last 24 hours. CoinMarketCap is now ranked 13th, with a live market cap of $5.5 billion. It has a total supply of 362,331,154 SOL coins in circulation.

The SOL/USD pair has fallen below a key support level of $16.30. Solana’s price may continue its downward trend after falling below $30, the 50-day moving average.

A “three black crows” pattern has formed under Solana’s 50-day moving average, suggesting the decline is likely to continue. SOL might drop to $5.5 if sellers push it below its immediate support at $11.50.

Alternative Coin – Dash 2 Trade (D2T)

The market is witnessing risk-off attitude as a result of the Solana plunge, which is driving the broader crypto market slump. The market is currently focused on one of the most prominent coins, D2T presale, which has significant upside potential.

Dash 2 Trade is an Ethereum-based trading intelligence platform that gives traders of all skill levels with real-time statistics and social data, helping them to make better-educated decisions.

It began its token sale three weeks ago and has now raised more than $5.8 million, while also confirming its maiden CEX listing on LBank exchange.

1 D2T is now worth 0.0513 USDT, however, this is expected to climb to $0.0533 in the following stage of sales and $0.0662 in the final stage.

Visit Dash 2 Trade now

Credit: Source link