- XRP’s recent surge lacked whale activity, with Whale to Exchange Transactions at zero, indicating strong holder confidence.

- Ripple expands globally, enhancing XRP Ledger’s use and CBDC platforms in South America through key partnerships.

In the volatile market, XRP has once again soared above its important $0.60 threshold, a feat it has done multiple times before, but it has historically struggled to sustain a robust climb beyond this mark.

Many investors have been wary of the market’s reluctance to break through this barrier, but new data reveals that momentum may be shifting.

Analyst Forecasts XRP Breakout Amid Volatile Trends

One of the well-known analysts, XForceGlobal, has commented on the situation and stated that, according to the 4-hour chart, he thinks XRP will eventually break free from the macro triangle and the BD trendline thanks to a string of 1-2 patterns.

$XRP

Medium Timeframe AnalysisZooming in, I’m still expecting #XRP to finally breakout of the BD trendline from the macro triangle w/ these series of 1-2’s. We could see one last dip before the actual continuation, but other than that, the macro is the most telling! pic.twitter.com/gIMPd56HDJ

— XForceGlobal (@XForceGlobal) August 22, 2024

While there is a chance of one more dip before a true resumption, the general macro outlook remains the most compelling point to monitor. This perspective has heightened interest in XRP’s near-term potential.

Meanwhile, XRP is currently trading around $0.6004, up 0.56% over the last 24 hours, with a daily trading volume of $1.15 billion. This tiny increase has rekindled speculation about XRP’s ability to breakout from its recent stagnation.

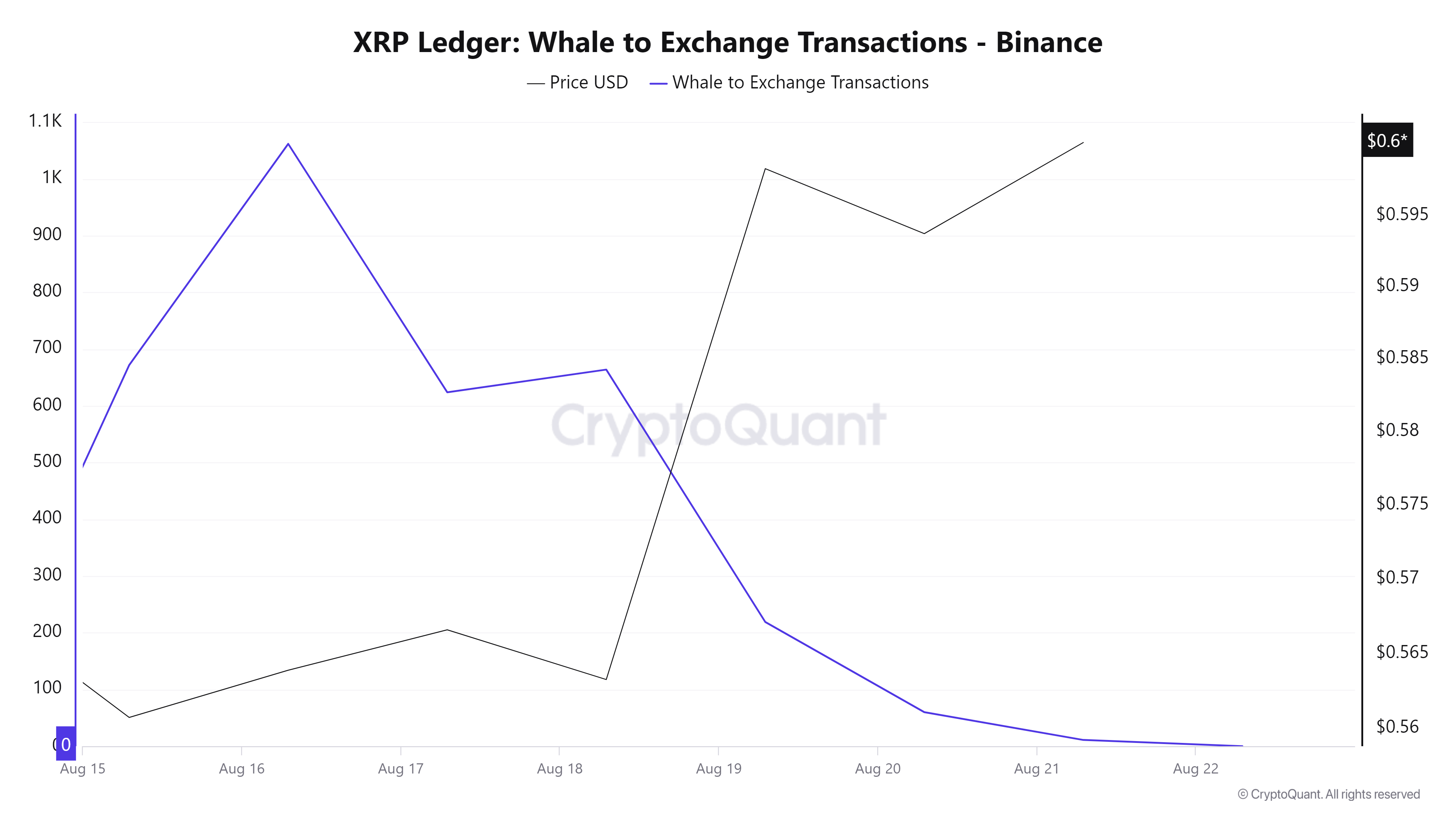

No less interesting, CryptoQuant data has shown an unexpected development: XRP’s Whale to Exchange Transactions value is now zero.

This shows that no whales moved huge quantities of the token to exchanges during the recent price surge, which is often associated with liquidation. The absence of such moves shows that major holders are confident in the asset’s existing course.

On the other hand, Switzerland has expanded its fast payment methods, as more banks integrate XRP into their trading platforms.

According to CNF, the acceptability of cryptocurrency in the Swiss banking system is progressively increasing, with 28% of banks allowing or proposing to allow their customers to invest in digital assets.

This expanding institutional acceptance in Switzerland mirrors a larger movement toward bitcoin in the traditional financial sector.

Meanwhile, as we previously reported, Ripple is rapidly expanding its international footprint through global collaborations, with a special emphasis on promoting the adoption of the XRP Ledger.

The company is making substantial progress in South America, developing its Central Bank Digital Currency (CBDC) platform in conjunction with the Bank of Colombia and Fenasbac in Brazil.

Recommended for you:

No spam, no lies, only insights. You can unsubscribe at any time.

Credit: Source link