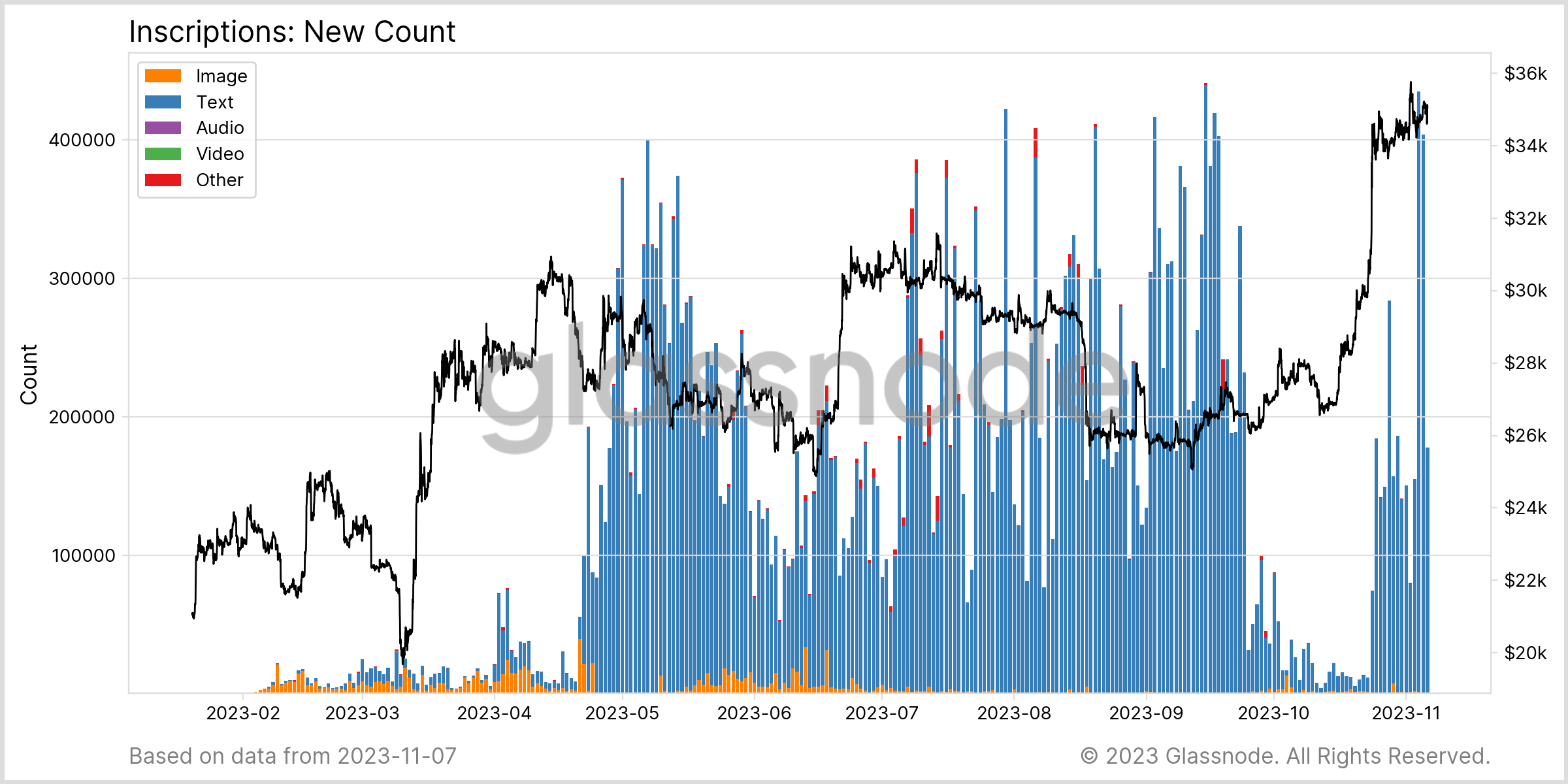

The recent analysis of Bitcoin Inscriptions reveals a substantial uptick in activity and interest, a trend that carries notable implications for network performance and user costs. Between Aug. 10 and Nov. 6, 2023, the total count of Bitcoin Inscriptions escalated from 22.66 million to 38.27 million, with Text/BRC-20 inscriptions – which allow for embedding text or token data in transactions – swelling from 18 million to 32.7 million.

A significant increase in the daily creation of new inscriptions was noted on Nov. 5, surging to 440,000 from just 40,000 on Oct. 5. Furthermore, the proportion of Text/BRC-20 transactions to the total volume dramatically rose to 62% on Nov. 5, a stark contrast to the 10% on Oct. 5, which points to a considerable shift in the types of transactions users are conducting on the Bitcoin network.

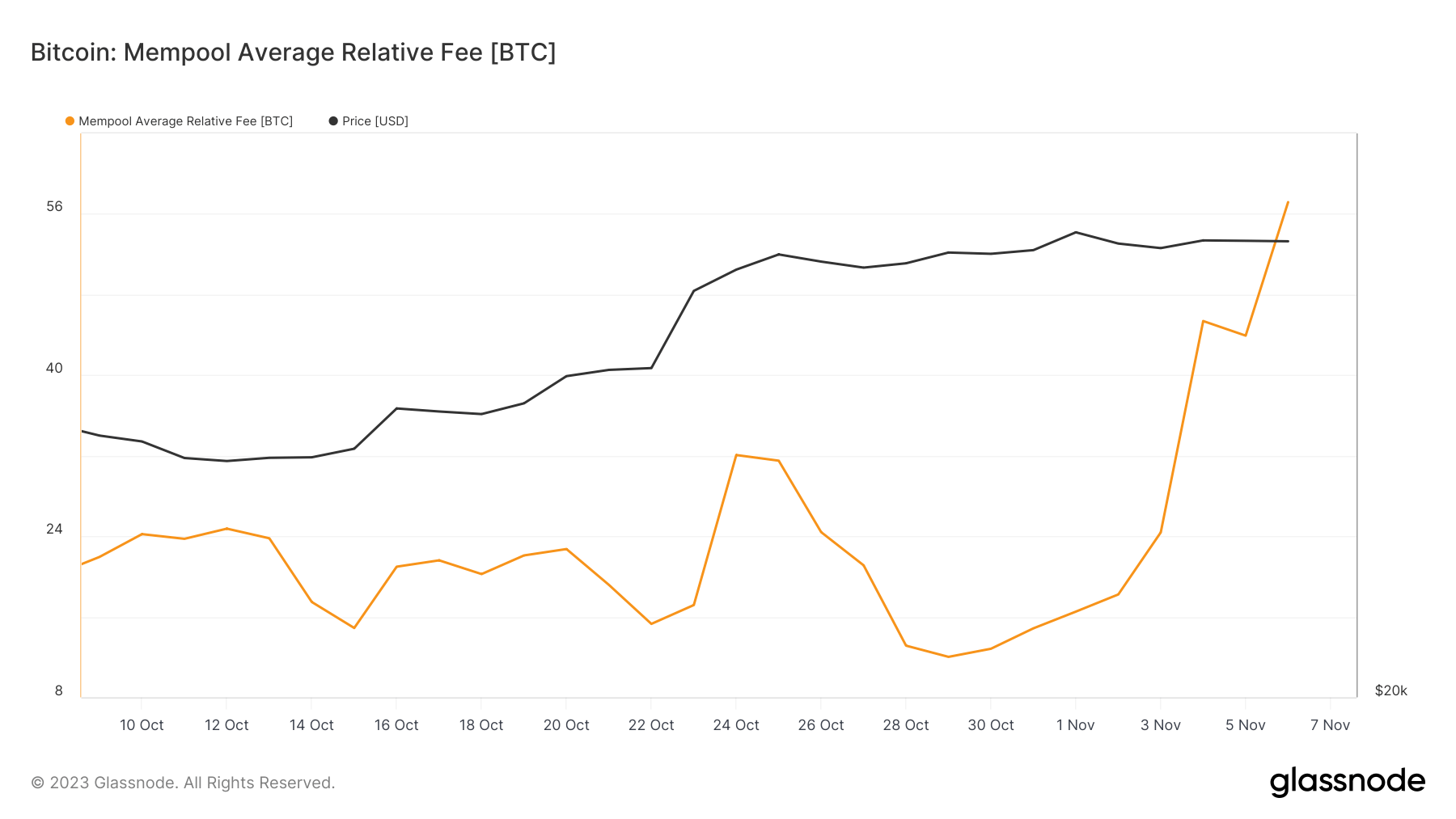

Simultaneously, Bitcoin’s mempool — the holding area for all unconfirmed transactions – has shown a significant rise in activity. The mempool’s total transaction count increased from 28,700 on Oct. 4 to 149,500 on Nov. 4. This considerable growth in the mempool’s size indicates that more transactions are awaiting confirmation and suggests a correlation with the rise in inscriptions.

Accompanying the increase in mempool size is the uptick in transaction fees. On Nov. 6, the average relative fee in the mempool reached 57.12 BTC, the highest since June 2023, and a substantial rise from 30.2 BTC on Oct.4. This increase in fees can be attributed to the growing demand for block space due to the higher number of transactions, particularly Inscriptions, which require more data to be included in each transaction.

The correlation between the growing popularity of Inscriptions and the increase in mempool congestion and fees is a critical observation. As users embed more data within transactions, the block space becomes more competitive, leading to higher fees as users bid to confirm their transactions sooner. This scenario highlights the direct impact of transaction types on the efficiency and cost-effectiveness of the Bitcoin network.

The surge in inscription activity, especially on Nov. 5, could point to a particular catalyst prompting a spike in usage. This pattern warrants attention as it represents a significant behavioral shift within the network. The implications for network throughput and user costs are considerable. If the trend of increasing inscriptions continues, we may expect sustained pressure on the network, resulting in higher fees and potentially longer confirmation times for all Bitcoin transactions.

The demand for block space is a pivotal factor affecting network congestion and transaction costs, and inscriptions are becoming an increasingly impactful element in this dynamic.

The post Rising Bitcoin Inscriptions activity signals shift in transaction types appeared first on CryptoSlate.

Credit: Source link