Polkadot has been noting fall in price over the past few days. Although the coin has been laterally trading, there has been continuous dips in the price. Over the last 24 hours, DOT fell by 4.2% and in the last week the coin brought home minor gains.

Broader market weakness can be attributed to most altcoins either trading sideways or moving downtrend. The coin broke below its crucial support of $14 and ever since that Polkadot has been moving south.

Buying strength also automatically faded from the market as the bears took over the price action. Despite the bears strengthening, DOT continued to attempt moving on the upside but the coin was met with selling pressure each time.

The bulls just need to push the price a little above the $9.60 mark after which the buyers could attempt to re-enter the market. This could bring in some relief to the altcoin’s price.

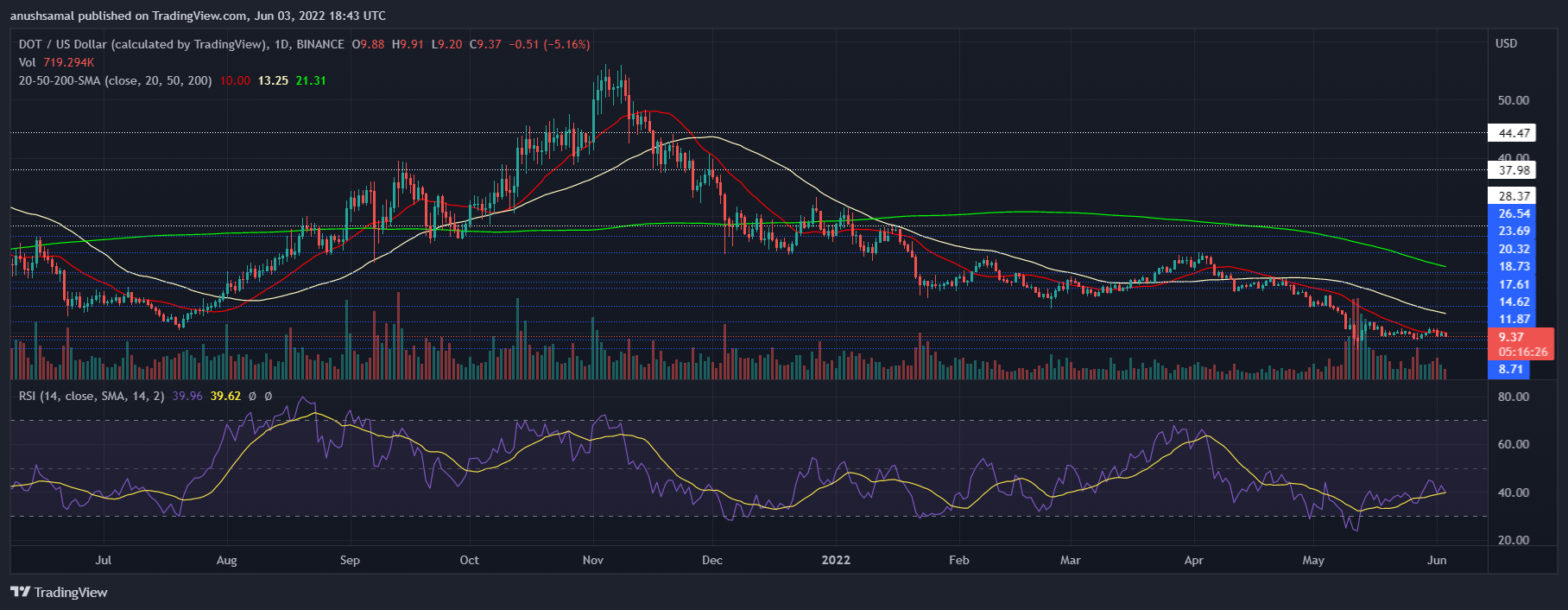

Polkadot Price Analysis: One Day Chart

DOT was trading at $9.30 on the one day chart. Polkadot was mostly consolidating but was trying to break past the same every now and then. Bears have gotten stronger as buying strength has fallen. A fall below the $9.30 price mark will cause the coin to rest on the $8.71 support line.

This would mean DOT would touch the price level of August, 2021 again. Overhead resistance for the coin stood at $10 and a push above the same will make the altcoin trade near the $11.87 price mark.

The volume of the coin traded had fallen and was seen in red. This indicated that the bulls had weakened at press time.

Technical Analysis

DOT noted a consistent increase in buying strength as seen on the Relative Strength Index. There has been an uptrend on the RSI. At press time, the coin displayed fall in buying strength as the indicator captured a downtick signifying increase in selling pressure.

In regards to DOT registering a shift in price action, the price pf the asset was seen slightly above the 20-SMA line. This meant that buyers were slowly gathering momentum and that the sellers might not continue to drive the price momentum in the market.

Related Reading | Polkadot Surged Over 4%, What Are The Technicals Indicating?

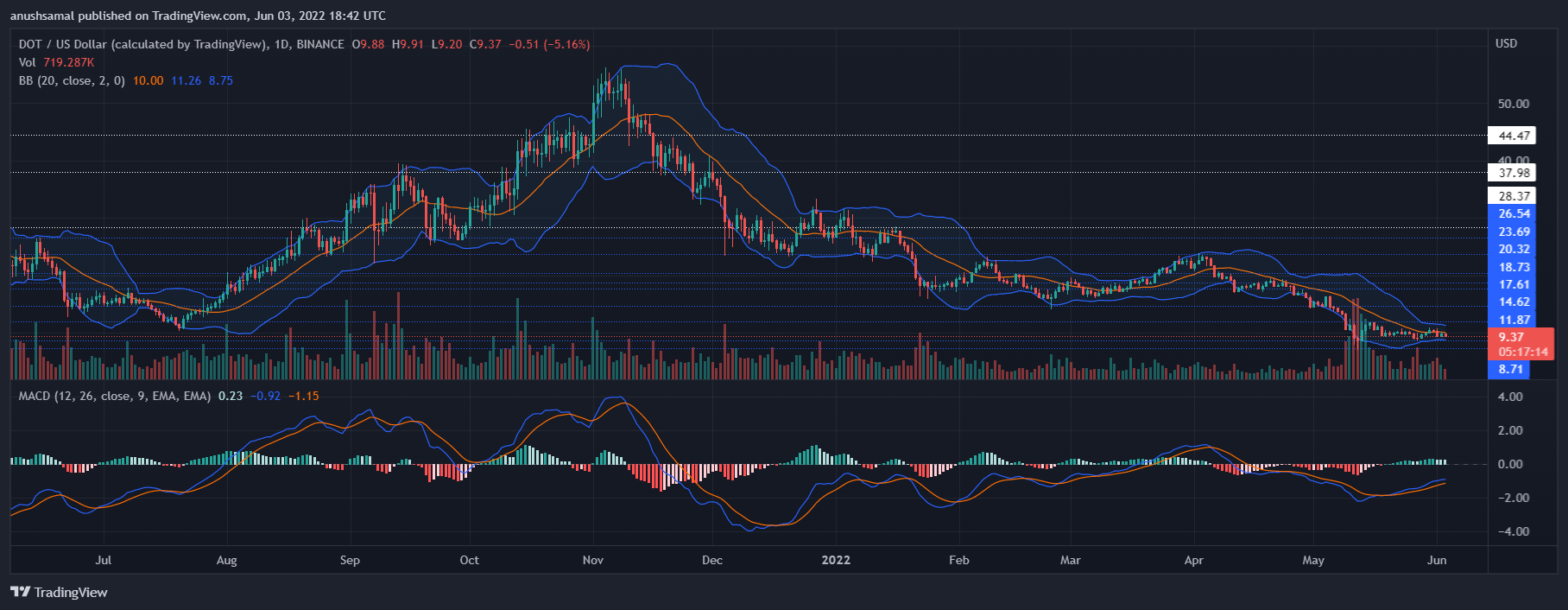

DOT flashed a buy signal which amounts to the coin displaying a possible change in the price action. Moving Average Convergence Divergence depicts the price momentum, and it indicated bullishness. MACD portrayed green signal bars which are tied to a buy signal.

Bollinger Bands that indicate price volatility showed narrowing of the bands. If the bands become narrowed it means that price volatility is about to drop.

A drop in the same means lesser price fluctuations. DOT can try to rise above the given immediate resistance if the buying strength increases in the market over the immediate trading sessions.

Related Reading | Bitcoin NUL Suggests More Downside To Come Before The Bottom

Credit: Source link