PancakeSwap, the DEX that bills itself as a faster and cheaper alternative to UniSwap, hit an all-time high today of $20.69. The total value locked in the Binance Smart Chain (BSC) also hit an all-time high recently, at $24.4bn.

The platform has been operational for half a year, compared to two and a half years for UniSwap. Considering its success, in a comparatively short time, should UniSwap be concerned?

PancakeSwap vs. UniSwap: Battle of DEXes

Although DeFi is associated with Ethereum, where DeFi activity occurs, excessive gas fees have opened up demand for cheaper alternatives. Enter PancakeSwap.

PancakeSwap is a decentralized exchange (DEX) running on the BSC. It uses an automated market maker (AMM) model to fulfill orders instead of the order book model that matches buyers and sellers as seen on traditional exchange platforms.

Code analysis shows PancakeSwap is a copy of UniSwap, with several lines still referring to UniSwap. Ethereum maxis have labeled the platform a rip-off. However, proponents of open source code say it’s fair game.

Nonetheless, PancakeSwap includes additional features not found on UniSwap. Not only is it possible to stake liquidity provider tokens to earn CAKE, but it’s also possible to stake CAKE to earn more CAKE or other BEP20 tokens. Currently, most of the APYs on offer are over 100%, with FOR Pool now yielding the highest at 123.71%.

Both have similar volumes and market share, with UniSwap edging ahead on both counts and pulling forward substantially regarding the number of markets available. But the fundamental difference comes down to cost.

Source: coinmarketcap.com

PancakeSwap fees are paid in BNB with trades costing cents, a marked difference compared to UniSwap, where peak congestion times equate to eyewatering charges. This becomes particularly apparent for users making lower-value transactions.

Binance Smart Chain is Not Decentralized

BSC uses a version of PoS called Proof-of-Authority (PoA). This essentially means three-second block times for quicker transaction settlement and lower fees as there is little network congestion.

“Proof of Authority (PoA) is a modified form of Proof-of_Stake (PoS) where instead of stake with the monetary value, a validator’s identity performs the role of stake.”

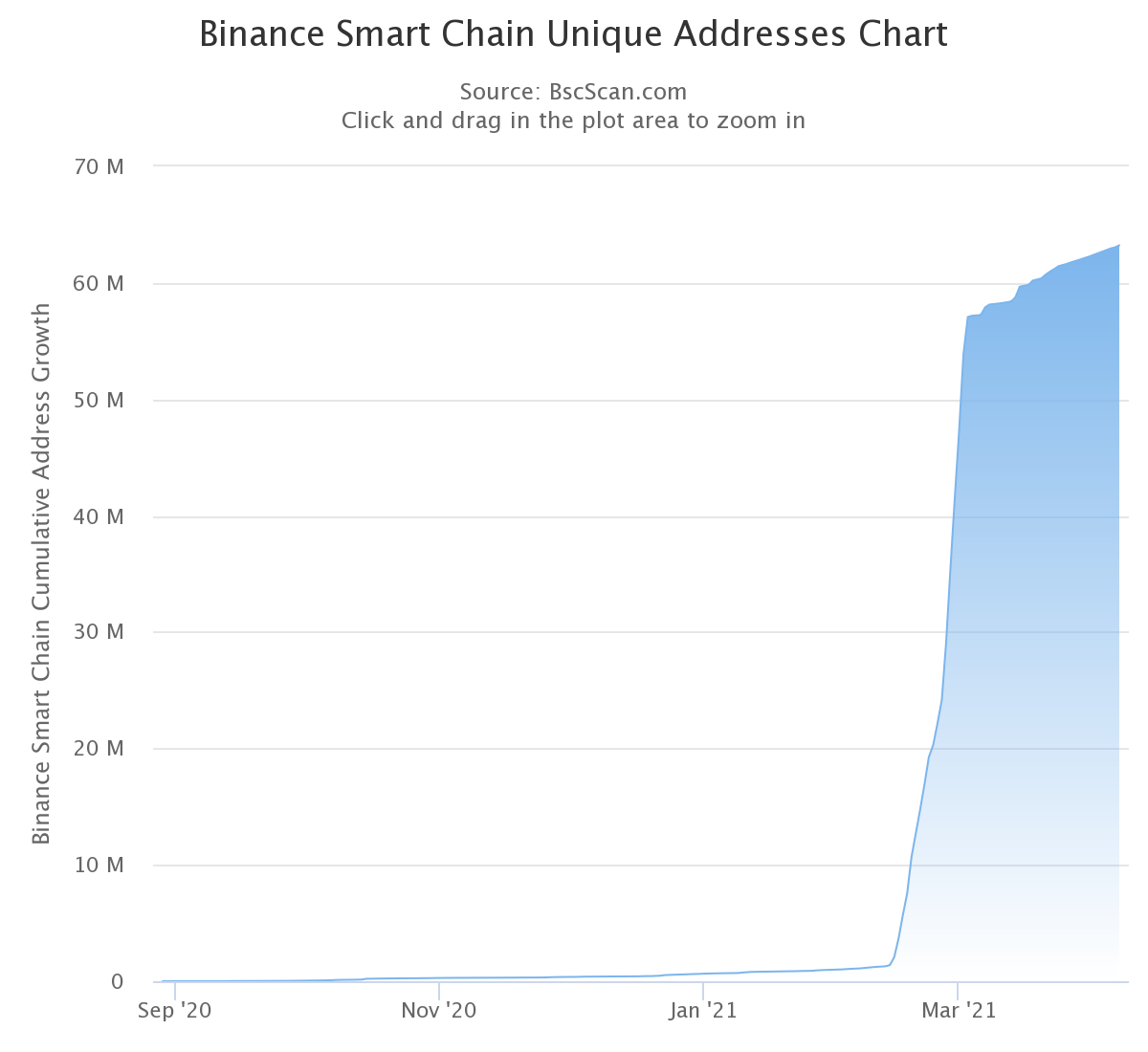

Add to that compatibility with the Ethereum network, and there are compelling reasons for users and devs to shift to BSC. Over 63mn unique addresses are currently using the network. With mid-February seeing a vertical uptake of users coming on board.

Source: bscscan.com

However, critics say BSC is not true DeFi as Binance manages the network nodes. This also means the network has a single point of failure. Then again, the real crux of the matter is that users tend to care more about yields and low fees than decentralization.

Can PancakeSwap and BSC take over? Well, crypto is not necessarily a zero-sum game. All platforms can likely flourish together.

Source: CAKEUSD on coingecko.com

Credit: Source link