A category of tokens known as MEV Protection has seen a surge in prices this week, coming in as the top weekly performing token category. The strong performance for the sector follows news from earlier this week that Eden Network (EDEN), a leading MEV protection project, raised USD 17.4m from a number of prominent investors.

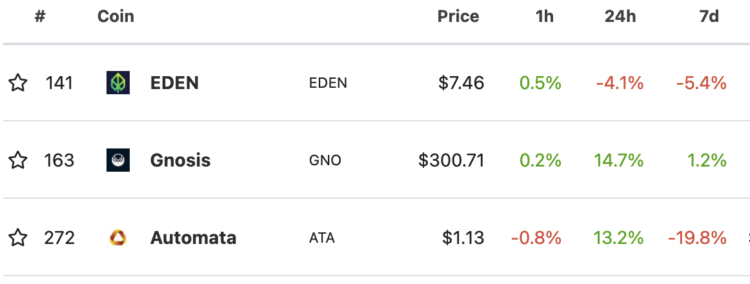

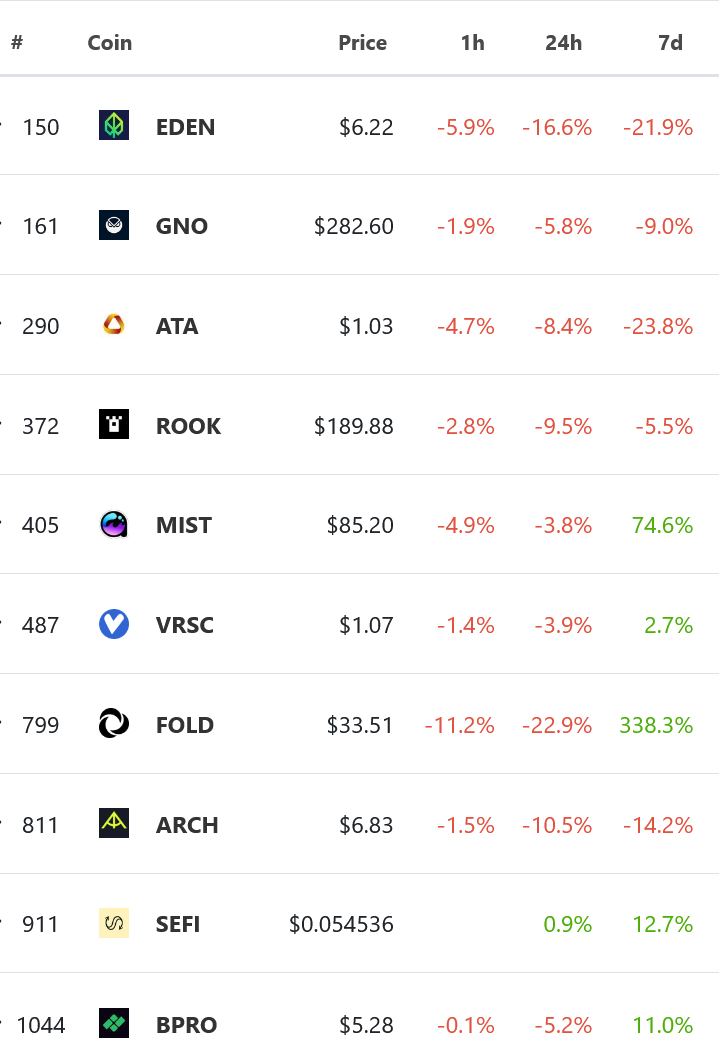

The category, which is made up of tokens such as EDEN, Gnosis (GNO), and Automata (ATA) has experienced growth in the wake of the roll-out of Ethereum Improvement Proposal (EIP)-1559 on August 4.

Short for miner extractable value, MEV is essentially the ability miners have on Ethereum to choose which transactions should be included in a given block, and the order of those transactions, thereby giving them an opportunity to profit.

During this week, MEV Protection tokens as a whole have risen almost 44%. The growth has brought the tokens to a combined market capitalization of USD 1.4bn, according to CoinGecko. However, weekly gains were trimmed by a sharp correction today:

As the top project in the category, Eden Network made headlines on Wednesday this week when it announced that it had closed its seed investment round, which was led by leading investors like Multicoin Capital, Alameda Research, and yearn.finance (YFI) creator Andre Cronje, among others.

According to Eden Network’s announcement, the USD 17.4m raised in the round will support the team in its mission to provide “a solution that protects DeFi users from malicious arbitrage, while simultaneously creating an open market for priority blockspace and augmenting decreasing miner revenue post EIP-1559.”

Among other things, EIP-1559 is also affecting miner revenue and this has led some to discuss whether miners will increasingly seek alternative revenue streams, which MEV can represent.

According to an estimate by crypto investment firm Multicoin Capital, MEV on Ethereum already amounted to more than USD 700m in 2021 alone, and the figure will naturally grow as DeFi usage on the platform grows.

___

Learn more:

– MEV Harms Ethereum Users And it May Be Here for Some Time

– Ethereum’s MEV Vulnerability To Be ‘Less of a Problem’ – Buterin

– ‘Intelectual Posturing’ Highlights Ethereum’s Extractable Value Vulnerability

– Ethereum Miners Can Transition to These Coins and Boost Their Values

Credit: Source link