Source: Tobias Arhelger – Shutterstock

- EIP-1559 is expected to be implemented on Ethereum in July with the “London” hard fork.

- Opposition to the EIP remains strong, with Chinese miners apparently discussing a fork, as reported by Wu Blockchain.

The deploying of EIP-1559 to change the fee model on Ethereum seems inevitable. However, the proposal is still heavily debated among miners, while the deployment is tentatively scheduled for a rollout with the “London” hard fork in July. Just yesterday, EIP-1559 was again the subject of a community call.

The controversy comes despite the fact that Ryan Berckmans, an Ethereum consultant, noted that the proposal will only reduce Ethereum miner revenue by 20% to 35% – a much lower percentage than the 50% previously estimated. On a recent Ethereum core developer call, Tim Beiko compiled some feedback that some miners have given on EIP-1559.

Among those supporting the proposal is mining giant f2pool, one of Ethereum’s largest mining pools. During the call, the group claimed that the Ethereum network roots its value in its users and applications, and therefore urged other miners to adopt the proposal.

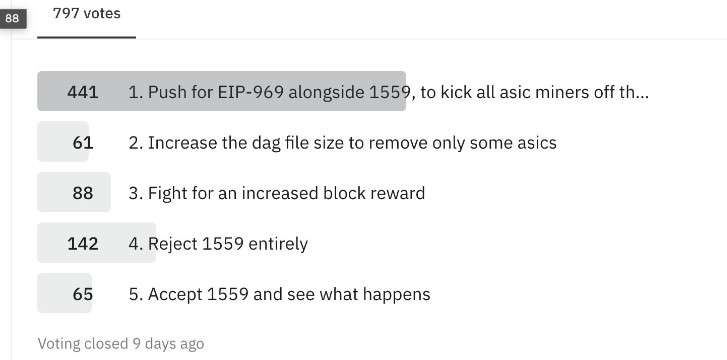

Representatives from the Flexpool mining pool recently conducted a survey to gauge miners’ opinions. 441 of the 797 miners surveyed voted in favor of implementing the proposal, while 142 were opposed. However, Flexpool and other participants in the call still show concerns about the “burning” mechanism, a possible reduction in transactions, and the creation of an “imbalance,” miner BitsBeTrippin added:

(…) if you have an exponential amount of hashpower joining at that time, a lot of hashpower could become available to rent, increasing the odds of 51% attacks on Ethereum.

Source: https://twitter.com/TimBeiko/status/1365307255822970885/photo/1

Deribit Insights researcher Hasu believes that the Bitcoin and Ethereum mining sector has already seen “stronger” declines than EIP-1559 and will be “fine.” In addition, Hasu claimed:

(…) if you have an exponential amount of hashpower joining at that time, a lot of hashpower could become available to rent, increasing the odds of 51% attacks on Ethereum.

Meanwhile, developer Abdelhamid Bakhta has revealed the results of the latest test performed for EIP-1559 which ran for 22 hours uninterrupted with 6,426 blocks processed. The results were positive and only one item – the risk of a DoS attack – remains which will have to be addressed before deployment in July.

🔥 EIP-1559 Performance Test Update 🔥https://t.co/kcTuzq7sLS

TL;DR

– 22 hours non-stop test

– 6426 blocks processed

– 41 M gas/block average

– 12 M transactions executed

– 2139 average transactions per block

– 95% of blocks were at least 15M worth of gas#supportEIP1559— Abdelhamid Bakhta (@dimahledba) February 25, 2021

The consensus among the call participants is that EIP-1559 will greatly enhance the user experience and be a benefit to the community. As a result, miners should be able to continue to grow their revenues.

@gakonst: main takeaway for miners should be that MEV drastically changes the landscape, and that the fee loss from 1559 is lower than what is being calculated now. Miners are long the Ethereum economy, as that grows, so does their revenue.

— Tim Beiko | timbeiko.eth (@TimBeiko) February 26, 2021

Will Chinese miners fork Ethereum?

Meanwhile, a recent report by Chinese Wu Blockchain’s Colin Wu examines the actions that could be taken by miners who completely disagree, particularly Xinghuo Mining Pool. Xinghuo’s argument is that after the proposal is implemented, “there will be no more ecology for fees.”

Although these miners have considered a fork of the network, they know that much of the revenue comes from the DeFi sector, which cannot be easily migrated to a new blockchain. As a result, Wu believes the miners will stay on Eth1’s blockchain, but may fork Ethereum when the Proof of Stake is activated:

(…) if PoS is realized, the Chinese miners will unite and fork to maintain an ETH before the PoS status, otherwise their large number of graphics cards and ASIC mining machines will become scrap iron.

As reported by CNF, EIP-1559 will introduce a fixed-per-block network fee that is burned and dynamically expands/contracts block sizes to deal with transient congestion. Proponents of the proposal not only argue that it will alleviate pressure from high fees, but will give ETH “more certainty over its supply.”

Credit: Source link