Litecoin Price Prediction – May 27

The Litecoin price continues to drop with a loss of 0.95% after touching the daily high of $208 as it currently trades at $197.

LTC/USD Market

Key Levels:

Resistance levels: $280, $300, $320

Support levels: $120, $100, $80

LTC/USD experiences a 0.95% price drop over the past 24 hours of trading which may be caused by the fact that Bitcoin is also dropping. The Litecoin price is now trading near the 9-day moving average within the channel but looks like it might be headed beneath it. Meanwhile, a break beneath this 9-day MA could see LTC/USD headed towards the $150 level and it is likely to occur if Bitcoin (BTC) continues to drop over these next few days.

Litecoin Price Prediction: What is the Next Direction for Litecoin (LTC)?

Analyzing the daily chart above, we can see the Litecoin price moving sideways. It has been struggling at the resistance levels of $180 to $200 over the past few days of trading. However, as the pair moves in this range, the market can be considered as neutral at this moment in time because the Relative Strength Index (14) is moving around the 41-level and it looks like that the sellers may be increasing their momentum in the next few days which could certainly result in Litecoin falling below the lower boundary of the channel.

On the downside, the first level of support lies at $120. This is followed by support at $100 which is expected to prevent the market from falling further. Meanwhile, if the selling continues, traders can expect added support at $80 and below. From the upside, crossing above the 21-day Moving Average could hit the resistance levels at $280, $300, and $320.

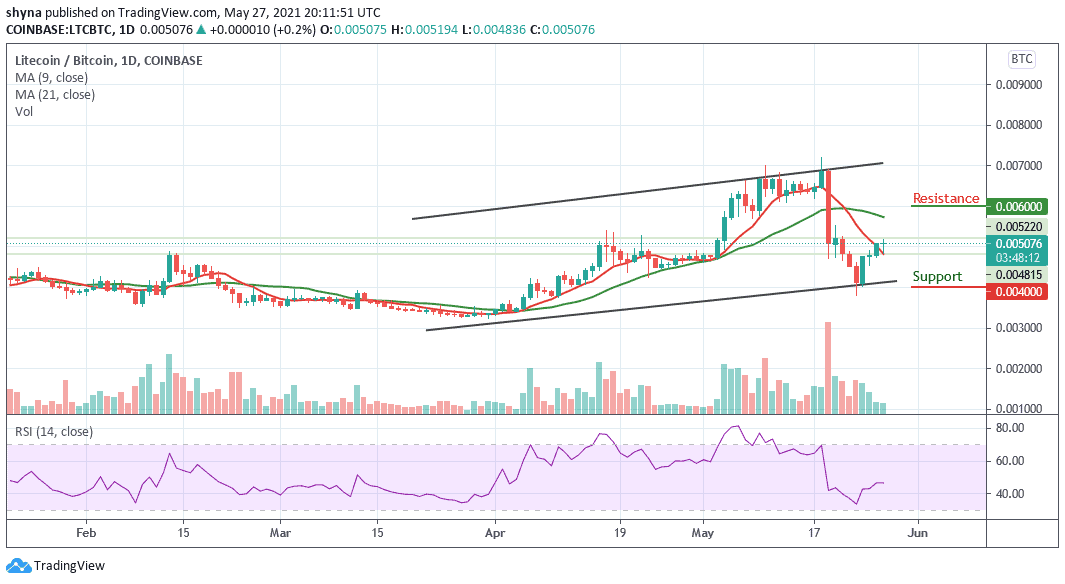

When compares with BTC, the bulls are making an attempt to step back into the market. At the moment, the Litecoin price is trying to show some promising signs that could keep the coin above the 9-day moving average. From the upside, the nearest resistance levels are located above the 21-day moving average at 6000 SAT and above.

Meanwhile, from the downside; any bearish movement below the lower boundary of the channel could hit the nearest support levels at 4000 SAT and below. Meanwhile, the technical indicator Relative Strength Index (14) is moving above the 40-level, which shows that the more bullish signals may come to play.

Credit: Source link