A major Korean finance powerhouse, Mirae Asset Securities, has joined hands with a popular blockchain network, Polygon. This partnership has ignited curiosity about how it might impact the price of Polygon’s native cryptocurrency, MATIC.

Top Financial Organizations Join Forces With Polygon To Create Tokenized Securities Network

In the early hours of today, September 7, 2023, South Korea’s largest financial group, Mirae Asset Securities, with over $500 Billion under manager, announced they are connecting to the Polygon network. According to the report, the collaboration aims to increase the adoption of Web3 technologies and develop a tokenized securities community.

In a press release, the asset manager said that Polygon Labs will be the chief technical consultant in the Token Working Group of Mirae Asset Securities. The asset manager said the group would work “efficiently” to create infrastructure to issue, exchange, and distribute token-based securities.

According to the Head of the digital assets division at Mirae Asset Securities, Ahn In-sung:

Polygon Labs is a leading global blockchain technology development company that is innovating throughout all aspects of Web3. Through technical collaboration with Polygon Labs, Mirae Asset Securities aims to establish global leadership in the field of tokenized securities.

Notably, several financial companies are included in this collaboration. These include Linger Studio and Coin Plug, Hana Financial, and SK Telecom’s security token consortium, Next Finance Initiative (NFI).

According to the report, Big finance names like Franklin Templeton and Hamilton Lane, a big investment company with over $823.9 billion in assets, are already using Polygon for tokenization projects.

Will Polygon’s Partnership With Mirae Asset Securities Affect MATIC’s Price?

The Partnership between Polygon Labs and Mirae Asset Securities to advance tokenization will benefit Web3 adoption within the ecosystem and could boost MATIC’s price.

On September 5, Polygon 2.0 was announced with Zero Knowledge L2 chains, three Governance pillars, and the Polygon Business Model part of the new upgrades. This upgrade will likely attract investors like Mirae Asset Securities to rely on Polygon for different purposes.

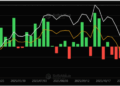

From September 1-3, MATIC traded in the $0.54 range but has increased to $0.56 today, September 7. It implies that the partnership is likely driving the slight gains noticed in the last 24 hours and might signal an uptrend ahead for MATIC.

MATIC has formed six consecutive green candles on the daily chart, suggesting buyers defend current levels. Also, it found critical support at $0.55, with its next price moves likely to send it to the $0.57 resistance level.

If the buyers persist, MATIC can break above the $0.57 resistance level and move into an uptrend. The Relative Strength Index (RSI) indicator, with a value of 41.57, shows a neutral sentiment among investors. However, the Moving Average Convergence/Divergence (MACD) displays a buy signal confirmed by the green Histogram bars.

MATIC will likely record a positive price action in the coming days based on a more positive investor sentiment and valuable partnerships.

Featured image from Pixabay and chart from TradingView.com

Credit: Source link