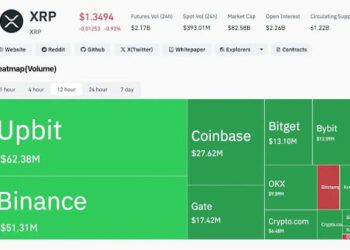

XRP, one of the top cryptocurrencies by market capitalization, has been bullish since May 26th, outperforming most of the top 10 cryptocurrencies. This surge in price comes as investors have high expectations for the outcome of the ongoing SEC vs. Ripple Labs case.

XRP Shatters 2-Year Trendline

The recent uptrend in XRP is particularly significant as the cryptocurrency has just broken through a two-year trendline, a key technical indicator for traders and investors, according to the trader Jaydee.

Per the analysis of Jaydee, In 2017, XRP experienced a significant breakout when it surpassed a two-year trendline. This breakout led to a massive increase in value for the cryptocurrency, with XRP seeing a surge of 504x over just one year. This means that if an investor had purchased XRP at the start of 2017, they would have seen a return on investment of more than 50,000% by the end of the year.

If XRP were to experience a similar surge in value today, with the cryptocurrency currently trading at $0.5116, it could reach a value of $258 by 2024. However, it’s important to note that predicting future price movements in cryptocurrency markets is highly challenging, and many factors could impact the value of XRP.

For example, the ongoing SEC vs. Ripple Labs case could significantly impact the token’s future price movements. If the case is resolved in Ripple Labs’ favor, it could lead to increased adoption and investment in XRP. On the other hand, if the case is decided against Ripple Labs, it could lead to a decrease in demand for the cryptocurrency and a drop in its value.

However, Jaydee believes that the cryptocurrency will not experience a surge of 504x shortly. According to the analyst, XRP’s market cap is too high to support such a significant increase in value. The token has a market cap of over $26 billion, making it the sixth-largest cryptocurrency by market capitalization.

Despite these uncertainties, many investors remain bullish on XRP’s prospects. The cryptocurrency has already seen significant adoption within the financial industry, with many major banks and payment processors using XRP for cross-border transactions.

Key Indicators Point To Significant Growth Potential

According to the Average Sentiment Oscillator (ASO), the current set-up for XRP is highly bullish, with several key indicators pointing toward a strong upward trend in price. One key factor contributing to this bullish sentiment is the high volatility of XRP’s market depth, indicating significant interest and demand for the cryptocurrency.

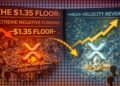

Additionally, the current trend’s strength is strong, with a bullish cross indicating that XRP is likely to continue its upward trajectory, per a recent analysis by Egrag Crypto. While XRP has been ascending in the price for almost four months, there is still a major resistance level known by Egrag as the ‘Final Wake Up Line’ that XRP has yet to break through.

However, even if the token experiences a minor correction after a 20% pump, there are still possible support levels at $0.4810 and $0.4277 that could prevent a significant drop in value, according to Egrag Crypto’s latest analysis.

If XRP does dip below these support levels, it is considered normal and not necessarily a cause for concern as long as it respects its below lines as strong support in the near term. This support box could act as a key area of stability for XRP, allowing it to continue its upward trend in price.

Featured image from iStock, chart from TradingView.com

Credit: Source link