Despite being designed for stability and security, stablecoins are increasingly being used as a profitable investment option — enabled recently by the dramatic surge in decentralized finance and the launch of various new yield-bearing stablecoin options.

Here, we examine three ways you can turn a profit using your stablecoins — including low, medium, and high risk options.

Low risk: Mint CHIP and hold yBXTB

One of the simplest ways to earn a yield with stablecoins, is to simply use a yield-generating stablecoin option, such as CHIP.

Though stablecoins like Tether (USDT) and DAI are popular, they don’t provide a direct yield for users. Instead, if you’re looking to turn a yield with these assets, you’ll need to invest them in another platform, and risk them potentially suffering a security breach or being lost — not ideal.

With the release of CHIP, stablecoin users now have a way to earn a return directly from the BXTB network, which means there’s no need to trust any third-parties or intermediaries with your funds.

The way it works is simple. BXTB’s ecosystem consists of two main tokens: BXTB and CHIP. BXTB is a token that can be generated through mining or purchased from exchanges, and then combined with a supported stablecoin like USDT or DAI to mint a new type of stablecoin known as CHIP. At the same time, users receive a yield-bearing token, known as yBXTB.

Image credit: BXTB

This yBXTB entitles holders to a large chunk of the transaction fees from CHIP transfers on BXTB’s network. As such, by simply using regular stablecoins (e.g. DAI) to mint another type of stablecoin (CHIP), it’s possible to generate a perpetual yield with essentially zero risk. Like all stablecoins, CHIP can then be traded, spent, or converted back into its underlying TUSD or DAI stablecoins through the simple destaking process.

Medium risk: Leverage transient price differences

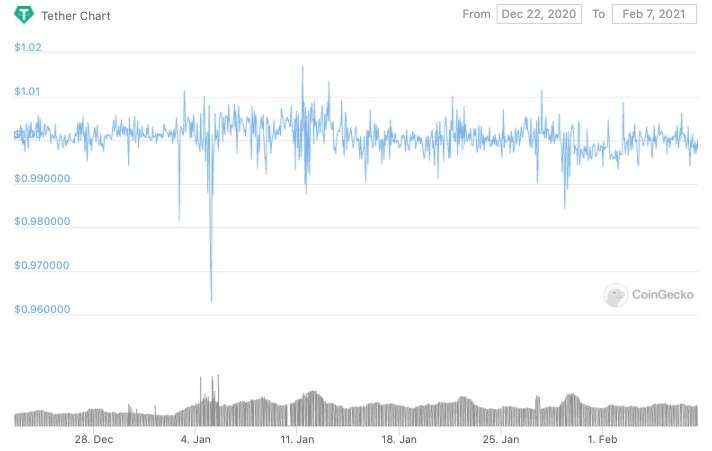

Although stablecoins are designed to resist volatility, they’re generally not perfect. Over time and for various reasons, the value of stablecoins can vary somewhat, either increasing their value above their peg temporarily or dropping it below this peg. Take Tether (USDT) as an example. Despite being pegged at 1 USD, sudden significant changes in trading volume and user sentiment have caused USDT to drop in value to below 1 USD on numerous occasions in the last three months alone.

For example, in early January 2021, USDT briefly touched as low as $0.962 on one occasion, and under $0.99 on three other occasions. Comparatively, other popular stablecoins like USD Coin (USDC) and TrueUSD (TUSD) frequently maintain their dollar peg at the same time.

This represents an opportunity to purchase the stablecoin at a reduced price, before supply and demand eventually push it back to its pegged value. Using the above example, it would have been possible to purchase around each USDT for $0.97 using another stablecoin at its low point in early January, e.g. using 1,000 USDC to purchase 1,030 USDT.

Though it is uncommon that popular stablecoins will deviate by more than a few percentage points from this peg, this is still enough to net significant profits in the right circumstances, since most exchanges charge around a 0.1% to 0.2% fee on each completed trade.

These opportunities can easily be leveraged by simply setting a limit order at more than 0.1% to 0.2% below the stablecoin’s pegged price. If it is ever executed, you’ll have successfully purchased stablecoins at below their pegged value, and be in a net profit despite the exchange fee.

High risk: Multiply your leverage using stablecoins

When you think about using leverage to increase your profits, odds are you’ll be thinking about the leverage you can use when trading cryptocurrency derivatives — like futures and options contracts.

But that’s not the only way you can multiply your exposure to the market.

Thanks to the advent of the huge range of DeFi open lending protocols, including Aave, Compound, and JustLend, it’s now possible to take out low APR cryptocurrency loans by depositing your crypto assets as collateral.

By depositing your stablecoins to one of these platforms and taking out a loan in a volatile cryptocurrency that you believe will appreciate in value, you’ll be able to essentially turn a profit on your stablecoin holdings without actually needing to buy the volatile asset and exit your stable position.

For example, assume you believe Bitcoin will double in value in the next 30 days. You deposit $1,000 worth of stablecoins into a secure open lending platform and take out a loan for $800 in Bitcoin (BTC). Over the next 30 days, your prediction proves to be accurate, and the $800 BTC you hold is now worth $1,600. You send back $800 worth of BTC (in addition to any fees) to the lending platform and reclaim your collateral — you’ve now got $1,000 in stablecoins in addition to $800 in BTC.

Of course, if you’re wrong, your collateral may be either partially or completely liquidated — so it’s best to only use this option when the odds are strongly in your favor.

Credit: Source link