If you’re contemplating buying Bitcoin (BTC), look no further. In this guide, we’ll demystify the process and teach you how to buy the world’s favorite cryptocurrency safely and securely.

Bitcoin is an asset that inspires intrigue the world over. Nicknamed “digital gold” due to its unique properties, the cryptocurrency was the best-performing asset of the 2010s, rising from a fraction of a dollar to an all-time high (ATH) just shy of $20,000. In the final months of 2020, bitcoin’s price surged dramatically once more before achieving a new ATH of over $41,000 in early 2021.

The headlines generated by this surge have inspired a new wave of buyers keen to add bitcoin to their investment portfolios – a desire that will only increase as governments tempt inflation by pumping trillions of liquidity into the economy. Because growth in its value cannot possibly inflate the bitcoin supply, the crypto is considered to be the “hardest” money ever invented and an excellent long-term hedge against inflation. So, how can you get your hands on bitcoin?

The easy way to buy Bitcoin

There are several ways to buy bitcoin. If you know someone who owns some, you can simply ask to buy directly from them in exchange for cash. You can alternatively locate sellers online who are willing to sell via peer-to-peer (P2P) marketplaces. Additionally, several cryptocurrency platforms feature fiat on/off-ramps, enabling users to purchase bitcoin using their credit or debit card.

Let’s discuss the process for buying bitcoin on one such platform, the popular bitcoin exchange KuCoin. Based in Singapore, KuCoin provides digital asset transaction and exchange services for customers all over the world.

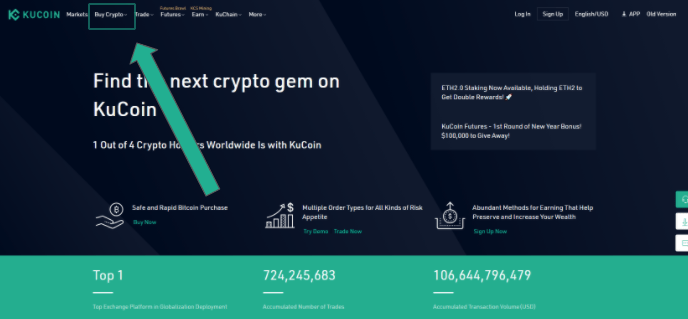

Within seconds of alighting on the website, you’ll notice ‘Buy Crypto’ at the top of the page, alongside options like Markets, Trade, and Futures.

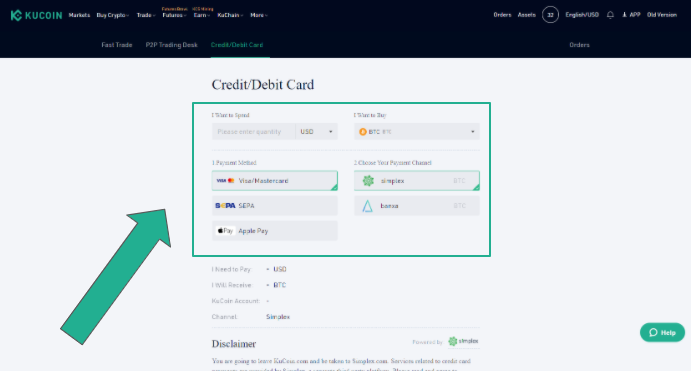

Hovering over ‘Buy Crypto’ will reveal your options, which comprise credit/debit card (Simplex, Banxa, PayMIR), P2P fiat trade (bank transfer, PayPal, SEPA, Interac), and fast trade. For the purposes of this article, let’s say we want to buy crypto using a debit card. Clicking this option brings up the following:

OK, so pretty self-explanatory. Complete the form, noting how much bitcoin you wish to buy in dollar terms (or your choice of fiat currency: there are many options including GBP, AUD etc). Visa/Mastercard is pre-selected, as is Simplex, the payment gateway that will facilitate the fiat-to-crypto purchase. There will be a modest difference between Banxa and Simplex, with a ‘Best Offer’ tag attached to the option that provides the highest amount of BTC for your stipulated payment value.

When the form is complete, you’ll be shown how much bitcoin you’re set to buy. Check the disclaimer below and hit Confirm.

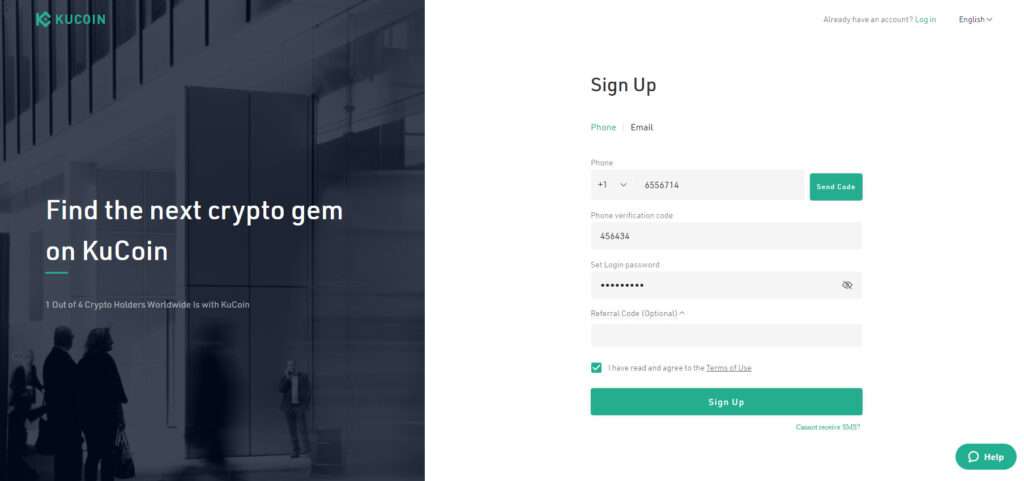

A log-in screen will now appear. If you haven’t opened an account already, select ‘Sign up now’ then enter your details. KuCoin only requires a phone number or email address: enter your email or digits and hit ‘Send Code’; depending on which choice you select, you’ll either receive an email or text message containing the code. Put this in the relevant tab, set a log-in password, check the Terms of Use box, and sign up.

Having signed up, you’ll see an order summary. Simply enter your details, including your name, date of birth, and home address. Then hit Submit verification. Thereafter, you’ll receive your BTC deposited directly into your KuCoin wallet.

All in all, the process of buying bitcoin via KuCoin is a breeze and can be done in less than ten minutes. Bitcoin isn’t the only supported cryptocurrency either: you can take your pick of altcoins, including ETH, XRP, TRX, LTC, and BCH. You can also buy US-pegged stablecoins such as USDT and USDC, assets that play a vital role in trading if you’re into that kind of thing.

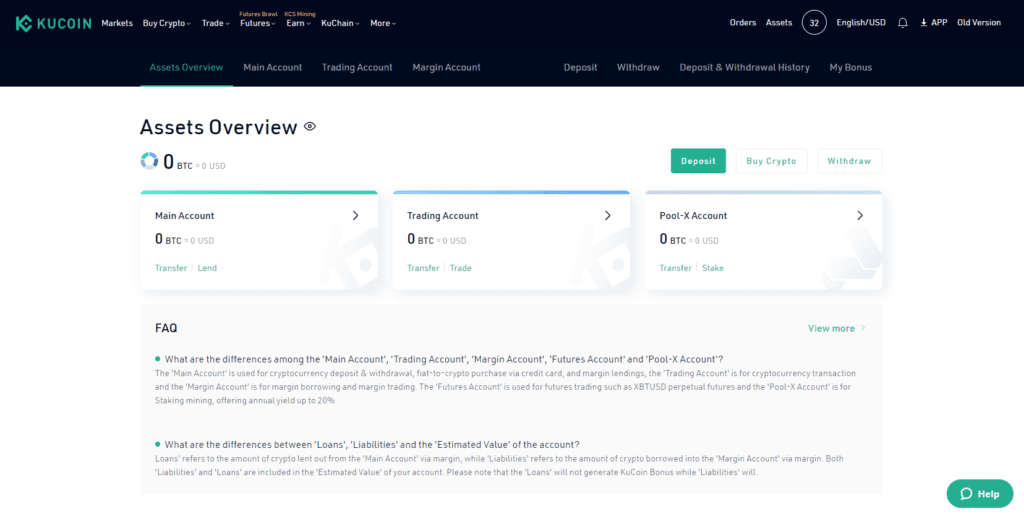

When you’ve made your purchase, you can view your account via the website or the official KuCoin mobile application, from which you can also dispatch funds to another address, receive digital assets, view your order history, check price charts and trade.

Demystifying Bitcoin

As a provably scarce asset, bitcoin is only likely to attract more interest in years to come. If you’ve yet to purchase your first BTC, there’s never been a better time to give it a go. The process is far quicker and easier than you may have suspected. Once completed, and the coins – or fractions of a bitcoin, since you’re unlikely to purchase a whole BTC – have been added to your wallet, congratulations: you’re now a cryptocurrency holder, or “hodler,” as they’re known. Whether you choose to use your BTC for trading, digital payments, or saving is your call. Once you’ve acquired your first coins, you can afford to take your time mulling over what to do with them. After all, bitcoin isn’t going anywhere. The world’s original cryptocurrency is here to stay.

Credit: Source link