China’s Bitcoin (BTC) crackdown drove the lucrative business out of the country and helped establish the US as the heart of the mining operations, data from the Cambridge Centre for Alternative Finance reveals.

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), which provides a real-time estimate of the total electricity consumption of the Bitcoin network, mining activity in China dropped to zero.

Redeployment routes

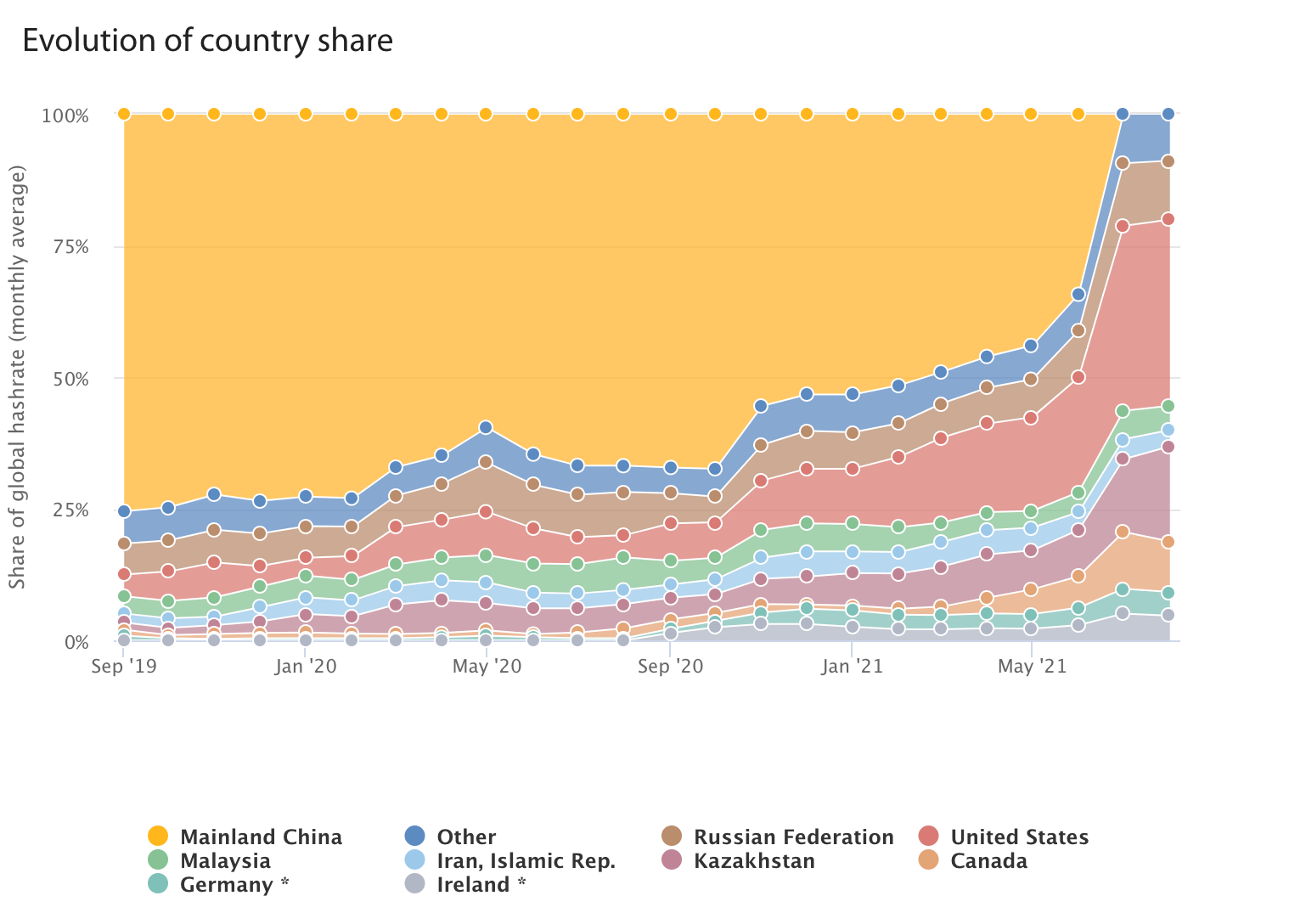

The CBECI started collecting data in September 2019 when the Asian country’s share was as high as 75%.

As a result of Beijing’s intensified efforts to restrain the crypto market, China’s recorded share of Bitcoin mining has effectively dropped to zero, the Cambridge team found.

Meanwhile, the US surfaced as the world’s new Bitcoin mining hub.

Based on the CBECI data, the country’s share of global mining surged from 16,8% in April 2021 to 35,4% in August.

Following the US, Kazakhstan became the second country that attracted the biggest portion of the redeployed operations, with currently accounting for 18,1% compared to 8,2% in April 2021. prior to the Bitcoin miner exodus in China.

Russia stands as the third migration destination, whose hashrate share rose from 6,8% to 11,2%.

China’s miner exodus

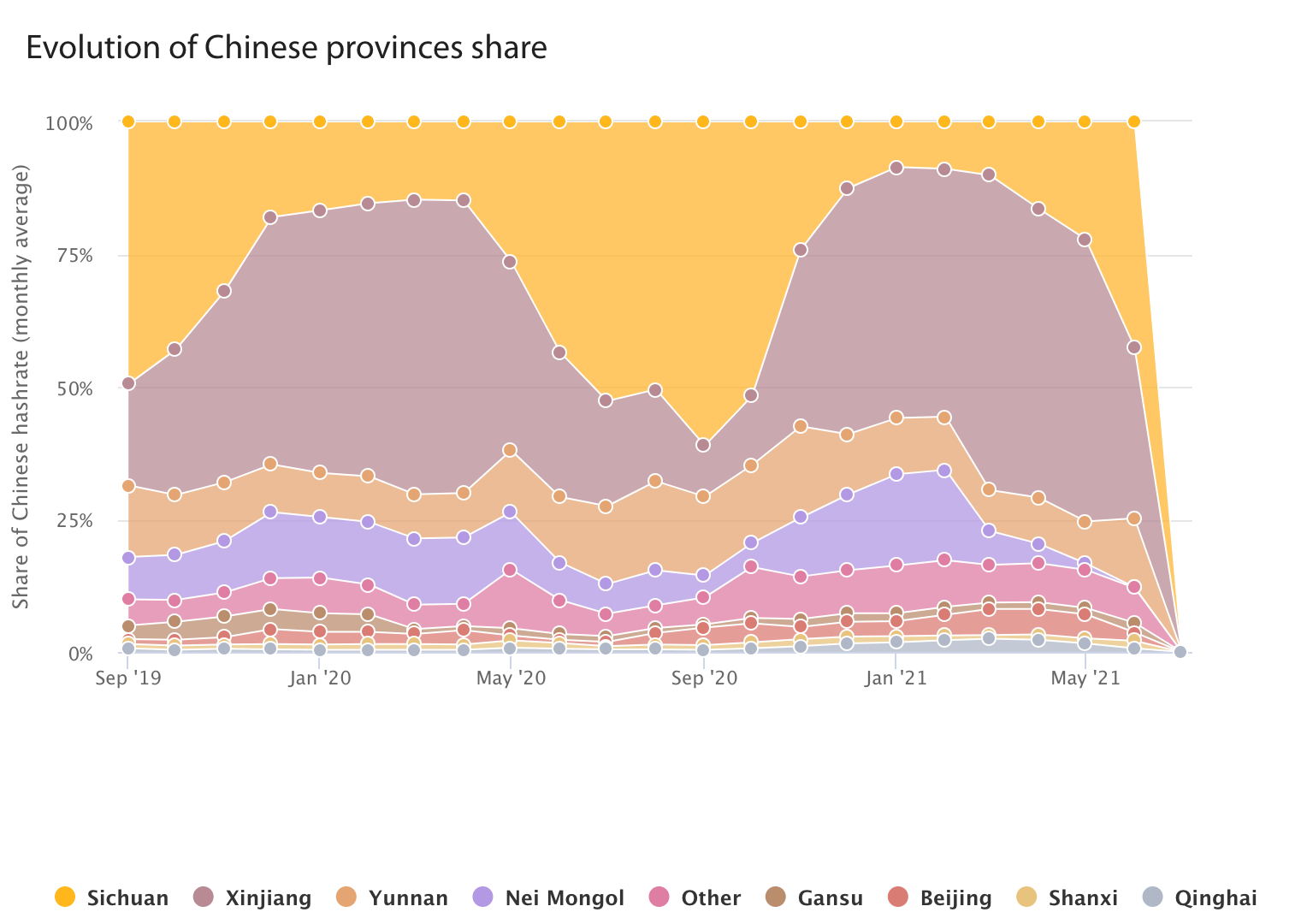

CEBCI’s dataset empirically recorded the seasonal hashrate migration within mainland China, observing how the mining operations in the country periodically relocated from the more stable coal-fired regions like Xinjiang, where they were based during the dry months, to areas with temporary overcapacities in cheap hydropower, like Sichuan, during the wet season.

“Since the government crackdown on the mining industry in June 2021, no data has been available – and the migrations have likely become a phenomenon of the past,” according to the project.

While data suggests a complete wipeout in activity in China, the possibility that covert mining is still happening in the country remains, as the project pointed to recent suspicious increases in the hash rate of two EU countries.

“To our knowledge, there is little evidence of large mining operations in Germany or Ireland that would justify these figures. Their share is likely significantly inflated due to redirected IP addresses via the use of VPN or proxy services,” according to the CBECI.

Ad: Up to 20x margin on FTX.

Sign up

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link