- Hong Kong’s SFC granted licenses to Panthertrade and YAX, expanding regulated virtual asset platforms.

- Wu Jiezhuang suggests adding cryptocurrency to Hong Kong’s fiscal reserves to strengthen its economy.

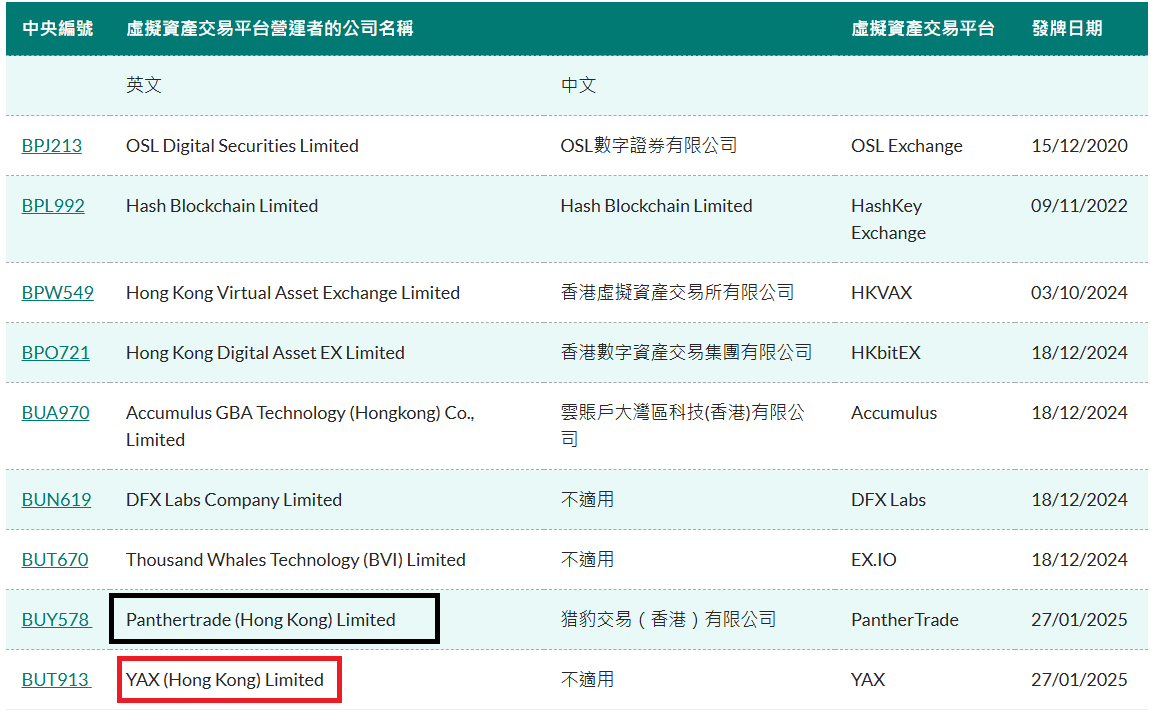

The Securities and Futures Commission (SFC) of Hong Kong has granted licenses to two virtual asset trading platforms: Panthertrade (Hong Kong) Limited and YAX (Hong Kong) Limited. YAX is part of Tiger Brokers, and Panthertrade is part of Chinese internet company Futu.

Chinese Companies Expanding Globally via Hong Kong

So, investors in the Special Administrative Region (SAR) of the People’s Republic of China are ensured security and transparency in trading virtual assets through these licenses. Nine other platforms, such as OSL, HashKey, and HKVAX, had already obtained similar licenses before Panthertrade and YAX.

Hong Kong is not only safeguarding investors but also drawing multinational businesses to seize this market by keeping high standards for regulations.

Futu and Tiger Brokers’ participation in the Hong Kong market reflects the growth of Chinese companies in the worldwide crypto industry. These companies are expanding their activities abroad using Hong Kong as a link, even though China has rigorous crypto rules.

Setting the Standard for Blockchain Adoption in Asia

Being one of the main financial centers in the area, Hong Kong offers a good illustration of how control may inspire creativity without endangering security. Clear control helps Hong Kong draw more foreign investment in the digital asset industry.

Besides, Hong Kong’s action inspires other Asian nations to control virtual asset trading using a similar strategy. The control put in place in Hong Kong provides a model for other nations to fast adopt blockchain technology and develop their crypto ecosystems.

On the other hand, Wu Jiezhuang, Chairman of the Web3 Virtual Asset Development subcommittee for Hong Kong, had advised that the country should add cryptocurrency into its financial reserves.

As we have reported, he suggested, as a long-term strategic step, acquiring and managing digital assets using foreign exchange funds. Wu also underlined the need for a limited Bitcoin allocation in order to lower its volatility risk.

Credit: Source link