Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

Mining news

- The owner of the vertically integrated Bitcoin (BTC) mining and power generation facility in Upstate New York, Greenidge Generation Holdings, said it will operate an entirely carbon-neutral Bitcoin mining operation at this facility, starting June 1. The company said it will purchase voluntary carbon offsets from a portfolio of US greenhouse gas reduction projects and it intends to invest a portion of its mining profits into renewable energy projects. “We are demonstrating we can provide the same critical transaction verification and processing services to secure the bitcoin network while maintaining a fully carbon-neutral footprint,” Jeffrey Kirt, CEO of GGH, was quoted as saying in the announcement. As reported, the company aims to go public.

- Crypto mining company Argo Blockchain and blockchain and crypto technology company DMG Blockchain Solutions have announced their partnership with the Crypto Climate Accord that aims to deescalate the carbon footprint of the crypto industry. The three are creating a working group that will address transparency in renewable energy crypto mining and outline their objectives.

Crime news

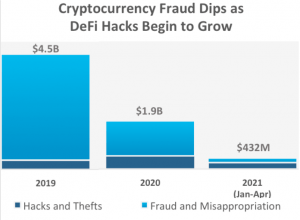

DeFi hacks are significantly growing along with the space itself, according to the Cryptocurrency Crime and Anti-Money Laundering Report by blockchain analytics company CipherTrace. From January to the end of April 2021, major crypto thefts, hacks, and frauds totaled USD 432m, with DeFi-related incidents making up 60% of this number. This is up from only 25% in 2020; in 2019, DeFi Hacks were virtually non-existent, they added. At USD 156m, the amount netted from DeFi-related hacks in the first five months of 2021 already surpasses the USD 129m stolen in DeFi-related hacks throughout all of 2020, per the report.

Source: CipherTrace - German police arrested six people over a crypto scam worth more than USD 36m. The group had allegedly created at least four online trading platforms for cryptos and high-risk options, manipulating victims into believing their investments were paying off, National News reported.

- Colonial Pipeline, the largest pipeline system for refined oil products in the US, paid 75 BTC (USD 3.8m) to hackers when they fell victim to a ransomware attack, as reported by Bloomberg—but a company spokesperson has refused to confirm or deny this. Reportedly, the company had to shut down their network to prevent the ransomware from spreading, which caused widespread panic, panic buying at gas pumps, and oil price spikes.

Investments news

- Asset management firm Point72, owned by hedge fund manager Steve Cohen, is looking into making a move into the crypto space, Bloomberg reported. In an investors letter, the firm stated, “We would be remiss to ignore a now USD 2trn cryptocurrency market.”

- Huobi Group, the operator of major crypto exchange Huobi, said it launched a wholly-owned subsidiary called Huobi Ventures that aims to deploy USD 100m into blockchain and crypto-related projects in their infancy over the next three years. The company also plans to establish a USD 10m NFT fund, as well as make “strategic acquisitions to diversify and expand Huobi’s offerings.”

- Singapore-based DBS Private Bank has launched a trust solution for cryptoassets via its subsidiary DBS Trustee to allow its private banking clients to invest in cryptoassets, The Business Times reported. They only support BTC, ethereum (ETH), bitcoin cash (BCH), and XRP, which are also available on the DBS Digital Exchange.

- Digital asset custodian Digivault said it is the first stand-alone custodian wallet provider to receive approval from the UK Financial Conduct Authority to register as a custodian wallet provider. The company aims to provide custodial services to corporate and institutional investors.

CBDCs news

- Bank of England governor Andrew Bailey said the central bank will be launching their own digital currency in the following few years, adding that crypto popularity is a “warning sign” and that these assets have no intrinsic value, Bloomberg reported.

- The South Korean internet giant Naver, the nation’s answer to Google, is set to launch central bank digital currency (CBDC) services for the digital won – even though the central Bank of Korea is still yet to confirm that it will actually issue a token. Per Hanguk Kyungjae, the Naver subsidiaries Naver Financial and Line Plus are set to create a pilot for CBDC distribution, payment and settlement to ensure it has a framework in place should the bank decide to green-light a token. The media outlet claimed Naver wants to test the utility and stability of its prototype CBDC-related framework. The central bank is still in talks with private companies prior to the launch of its own pilot program in the coming months.

Tax news

- More crypto has been seized from tax evaders in South Korea, as regional tax authorities from around the country continue to examine crypto exchange records in search of irregularities from the highest band of taxpayers. Per News1, the latest crackdown was conducted in Gongju, in South Chungcheong Province, where undeclared crypto holdings and other assets such as cars, securities, and more from 28 individuals and five “groups” (likely companies, in this instance) were seized. Previous seizures in Seoul and elsewhere saw tokens seized and forcible liquidated in some instances.

Exchanges news

- South Korea’s Fair Trade Commission has conducted an audit of all South Korea’s major crypto exchanges – from the “big four” trading platforms to smaller and medium-sized exchanges. Per the Electronic Times, the financial watchdog is examining possible legal violations in platforms’ terms and conditions, and will examine historical cases whereby exchanges have failed to reimburse customers for crypto losses due to “server” and “security-related” issues. The audit is the commission’s first to be conducted on the entire domestic industry since 2017.

___

(Updated at 19:26 UTC with a video.)

Credit: Source link