On Wednesday, Greyscale Capital added nearly 8,500 Litecoin to their crypto investment holdings. The investment firm has further spent the last week loading up on Litecoin.

Within the last seven days, they purchased just over 15k Litecoin and in the past 30 days added an additional 15k to their holding. Concurrently, they offloaded a large amount of other cryptocurrencies in the last 24 hours with 35 Bitcoin, 216 Ethereum, and 4,714 Stellar Lumens being the largest movers sold off from their portfolio of crypto assets.

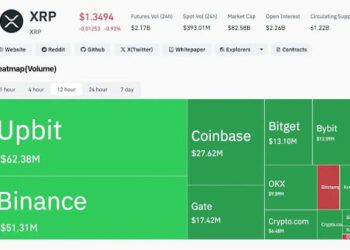

As is evident in the chart of Greyscale’s holdings below, they are very bullish on Litecoin while also showing some slight doubt for the rest of the crypto market.

Image from Bybt.com

Related Reading | Crypto Analyst: Buying Litecoin Now Is Like “2020 Ethereum”

Although it is never a good idea to closely scrutinize whale-like holdings from investment firms or crypto wallet addresses that make large moves, seeing a few massive purchases over the last month proves Greyscale’s confidence in Litecoin and their ability to continue leading the way for new blockchain technology.

Large investment firms do not make any moves lightly or without careful consideration for the market as a whole. With this purchase, Greyscale is showing crypto investors what it thinks of both the market right now and where they think the market is moving in the near future.

Crypto investors in general should be bullish that Greyscale is making such a large move. But nobody should get too hyper focused on Greyscale’s fire sale of some of their other crypto assets. Large firms are always attempting to manipulate the markets and catch lightning in a bottle. If they feel they can make a quick buck on an uptick in Litecoin, they’ll do it. The rest of the market will continue to move as a decentralized network does and will continue to reward those that hold their investments over a long term.

Related Reading | Pantera Capital CEO: Bitcoin Has Only Been This “Cheap” 20% Of The Last 11 Years

Why Greyscale Would Buy Litecoin

There are many reasons why an investment firm like Greyscale would buy a massive amount of Litecoin while simultaneously dumping a lot of other cryptocurrency assets. Not only are they obviously bullish on Litecoin and it’s direction, but they may have also been overexposed with investments in other coins.

As the crypto asset market and blockchain technology in general continues to change on a near daily basis, Greyscale certainly could have realized that they were holding too much of certain crypto. Then, in their effort to mitigate the risk of having too much holdings in any one investment, they have slowly been liquidating cryptocurrencies that they are not as bullish on and those they feel they have a surplus of.

Remember, Greyscale is one of the biggest players in the cryptocurrency investment space right now does not want to risk losing a lot of money on any one investment. They still have billions in holdings of both BTC, ETH, and multi million dollar holdings in over ten other cryptocurrencies. Their purchase of Litecoin simply shows how optimistic they are about Litecoin and the future of that crypto.

Photo by fabio on Unsplash

Credit: Source link