Hong Kong, Hong Kong, 13th March, 2021, // ChainWire //

Linkflow (https://www.linkflow.finance/), a Hong Kong-based crypto prime brokerage service, has launched a new digital asset-based services platform for providing seamless connectivity to the broader cryptocurrency ecosystem giving clients unprecedented access and management to a wide array of digital assets.

Earn

Earn offers a fixed interest rate for Stable Tokens such as USDT or USDC transferred and locked into a liquidity pool. All the assets in the pool are transparently managed through a smart contract and recorded on the blockchain. All assets in the pool are invested in Linkflow Prime Brokerage and Algo-Trade strategies to maximize profits.

Earn is designed to provide easy accessibility. By using external wallets such as MetaMask or MEW, deposited assets (e.g. USDC) are connected and the Linkflow web-interface is used to deposit into the liquidity pool. When users become a liquidity provider through their deposit, they are entitled to receive LF Tokens (e.g LFUSDC) to represent their liquidity share of the pool. Other features include:

- Upon completion of the lock-up period, users can request withdrawal of the locked asset and profits. The user’s percentage share of the profits (different by each product) can be claimed by using their LF Tokens.

- All gas fees (including providing liquidity and withdrawals) are deducted from the requesters’ crypto wallet, however, there will be no additional fees other than the network gas fees.

Prime Brokerage

The rapid and huge growth of the cryptocurrency market has recently attracted large-scale investment banks along with retail investors. Linkflow has expanded its Prime Brokerage service to the crypto market in order to provide traditional financial market services as well as unique Prime Brokerage services to reduce counterparty risks and lead proactive asset management for its users.

Liquidity Provider

There are 2 ways to provide liquidity in the Linkflow platform. One way is to be a Smart Liquidity Maker that supports hedge funds, institutions and investors to participate in liquidity providing (LP) and the creation of new liquidity pools. The other way is to participate in Algo-Trade which is responsible for the expansion of existing Pool. The Smart Liquidity Maker service integrates all the Linkflow DeFi services together with access to all of its liquidity pools to provide the most optimized service in an easy, fast and secure way.

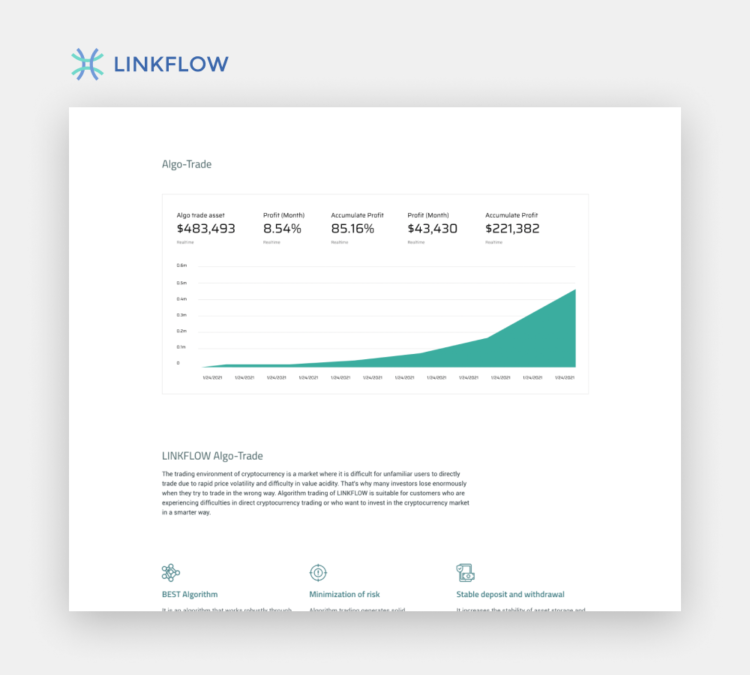

Algorithmic Trading

Linkflow’s Algo-Trade service will offer profits from High-Frequency Trading, Volume in-line, and logic-based trading through hedge funds, institutions, and retail investors. All these services are conducted using LF Tokens as collateral.

Linkflow.Finance intends for its new product to cater to and attract hedge fund managers and other high net worth individuals and corporations from traditional finance into crypto investing to make trading and management easier for non-crypto investors by giving them access to a unified API gateway, secure services, and friendly user experience. The core team was formed in 2018 led by blockchain & financial expert Chris Jung, while the Linkflow company itself was newly established in 2021 with an aim to offer collaborated Defi and Prime Brokerage services.

Contacts

Head of PR

- Jimmy Wong

- Linkflow

- contact@linkflow.finance

Credit: Source link