Xuehui Han is an Economist in the International Monetary Fund (IMF)’s Fiscal Affairs Department. Paulo Medas is Deputy Division Chief in the same department, while Susan Yang is a senior economist in the department.

_____

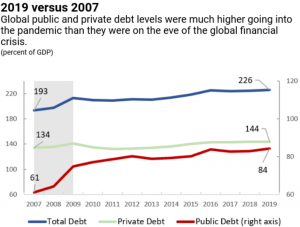

Many countries entered the pandemic with elevated debt levels. Our new update of the IMF’s Global Debt Database shows that global debt—public plus private—reached USD 197 trillion in 2019, up by USD 9 trillion from the previous year. This substantial debt created challenges for countries that faced a debt surge in 2020, as economic activity collapsed and governments acted swiftly to provide support during the pandemic.

Our data show that the global average debt-to-GDP ratio (weighted by each country’s GDP in US dollars) rose to 226 percent in 2019, 1.5 percentage points higher than in 2018. Most of the increase came from higher public debt in emerging market economies and advanced economies outside of Europe. In low-income countries, total debt rose by 1.3 percentage points of GDP in 2019—mostly driven, in contrast, by higher private debt.

As shown in our chart of the week, a dive into the numbers reveals that the 2019 global public debt surpassed its 2007 level by 23 percentage points of GDP. This is primarily driven by the higher levels among advanced economies, where public debt rose from 72 to 105 percent of GDP, and to a lesser degree by emerging market economies (from 35 to 54 percent of GDP) and low-income countries (an increase of 14 percentage points to 44 percent of GDP). Higher debt can potentially reduce the ability of governments to react to the COVID-19 crisis as forcefully as they were able to respond to the global financial crisis (see the January 2021 Global Financial Stability Update). However, many countries benefited from much lower borrowing costs in recent months, partially because very low inflation rates have allowed central banks to keep interest rates at record low levels. Compared to 2007, the average interest bill as a share of revenues was 0.3 percentage points lower in 2019.

Indeed, the high public debt did not immediately restrict the ability of many countries—especially the advanced economies—to borrow to address the crisis. But some highly indebted emerging market and developing economies are starting to find it more difficult to borrow to support the response to the pandemic.

High and rising private debt may also be cause for concern as countries try to transition to a solid recovery.

In the leadup to some past financial crises, we have seen private debt accumulate at a rate far exceeding GDP growth, so this phenomenon can be a warning sign of rising vulnerability. Past experience shows that following credit booms, economic activity tends to suffer.

If private debt of households, firms, or both proves unsustainable, it can result in large-scale bankruptcies, which might require government intervention in the form of bailouts of critical sectors or government guarantees on private loans. Private sector debt can therefore pose an additional risk to governments that are already highly indebted. Moreover, as public finances are further stretched during the pandemic, elevated private debt levels before the pandemic can leave governments with less room to maneuver in promoting a healthy and robust recovery.

___

This article has been republished from blogs.imf.org.

___

Learn more:

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems

Global Uncertainty Drops But Is Still 50% Above Historical Average

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies

Undetected Inflation: Your Fiat Money Devalues Faster Than You Think

How BRRRing Money Printers Today Might Lead to Higher Taxes Tomorrow

Davos 2021 & A ‘Great Reset’: We Can’t Count On the Same Old Globalists

Governments Paralyzed by Pandemic and Politics Are Bullish for Crypto

Credit: Source link