- The global Bitcoin adoption rate will exceed 10 percent by 2030.

- According to various reports, there has been rapid growth in crypto adoption in the last few years.

A new report has shown that Bitcoin adoption would likely be faster than the adoption of previous disruptive technologies like the internet. Blockware intelligence report for June 9 states that its analysis of the adoption of nine previous disruptive technologies enabled it to arrive at this conclusion.

BTC adoption growth rate vs other disruptive technologies

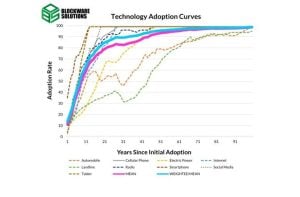

According to the report, some of the disruptive technologies used for this comparison are smartphones, social media, automobiles, the internet, and electric power. A part of the report reads, “all disruptive technologies have a similar pattern (the exponential S-curve pattern). However, the adoption of newer network-based technologies is growing faster than anyone can imagine.”

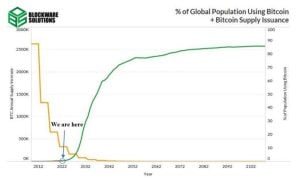

The report’s conclusion was based on comparing the BTC growth adoption rate and the weighted average curves of historical technology adoption. The analyst used a metric known as the cumulative sum of net entity growth to predict the BTC adoption rate. The global BTC adoption rate will exceed 10 percent by 2030 based on the 60 percent cumulative average growth rate (CAGR).

BTC adoption prediction based on CAGR. Source: Blockware intelligence.

However, the Blockware intelligence report might be slightly biased about its BTC adoption rate. Blockware intelligence is the research subsidiary of Blockware solutions. Blockware solutions is a BTC mining and blockchain technology firm.

BTC adoption and saturation

According to the report, there are three reasons why Bitcoin adoption will reach saturation faster than any other disruptive technology. They are the present macro-environment, the internet, and the direct monetary incentives. The report also states that there were convenience and efficiency reasons why consumers adopted previous disruptive technologies.

Technology adoption curves. Source: Blockware intelligence solutions.

Technology adoption curves. Source: Blockware intelligence solutions.

For instance, automobile adoption made transportation faster than a horse or a buggy. Also, cell phone adoption made calls possible without restriction to a particular location. However, BTC adoption depends heavily on financial incentives. Thus, it becomes a game theory where each person’s best response is BTC adoption.

Like previously mentioned disruptive technologies, BTC also benefits from the “network effect.” The network effect means the more people that adopt a technology, the greater would be the value of such technology. For example, a social platform with only one user has zero value. However, a social platform with several users becomes more valuable. The same can be said of these disruptive technologies.

The Blockware report analysts emphasized that the model they used to predict this BTC adoption rate isn’t fully developed yet. Hence, they advised readers not to use the analysis in the report as a short-term trading tool or investment advice.

But the analysts state that the model would be refined. Nevertheless, they said that there are clear indications that BTC’s global adoption will keep growing in the coming years. Also, its price would rise as well. Executives from top industry players are among the reviewers of the model used for this analysis. Executives from such as M31 Capital, Ark Invest and Arcane Assets were among them.

The rapid crypto adoption growth in the last few years

A 2021 data from TripleA, states that there are more than 300M crypto users as of 2021. TripleA is a global crypto payment gateway. That amount shows that there is an average of 3.9 percent rise in crypto holdings rate all over the world.

A Chainalysis (a blockchain data platform) report noted an 881 percent rise in crypto adoption between July 2020 and June 2021. The report further said, “Vietnam, India, and Pakistan (in that order) have the highest crypto adoption.” These three countries were among the 154 countries that Chainalysis surveyed.

Two months ago, a survey performed by Gemini (a leading crypto exchange) revealed that nations such as Brazil, Hong Kong, and India experienced greater crypto adoption in 2021. Over 50 percent of the respondents from these nations and 17 other nations revealed that they had their first crypto investment in 2021.

Credit: Source link