A report has revealed that FTX’s acquisition of the Blockfolio crypto mobile app was mostly paid for in FTX’s own FTT tokens which are now virtually worthless.

According to Bloomberg, which said it has obtained financial statements from FTX, about 94% of the Blockfolio acquisition was paid for in FTT tokens. The amount paid was roughly $84m for a 52% equity stake in Blockfolio.

The original deal came with an option for FTX to buy the rest of the company within two years and valued Blockfolio at almost $160m.

Sharp contrast to earlier reports

The new Bloomberg report stands in sharp contrast to what was previously believed to be situated around the acquisition.

According to media reports at the time, FTX paid $150m for Blockfolio when the transaction happened in mid-2020. The price was reportedly paid in cash, crypto, and equity.

Judging from the latest Bloomberg report, however, it’s clear that the cash and equity part of the payment made up almost nothing compared to the massive transfer of FTT tokens.

FTX held large amounts of FTT

FTT tokens were created by FTX for use by traders on its exchange. As reported, FTX held a large amount of FTX on its balance sheet. It has also been widely reported that the same was true for Sam Bankman-Fried’s trading firm Alameda Research.

Given the large holdings of FTT by these two entities, the collapse in the FTT price also contributed strongly to the collapse of both firms.

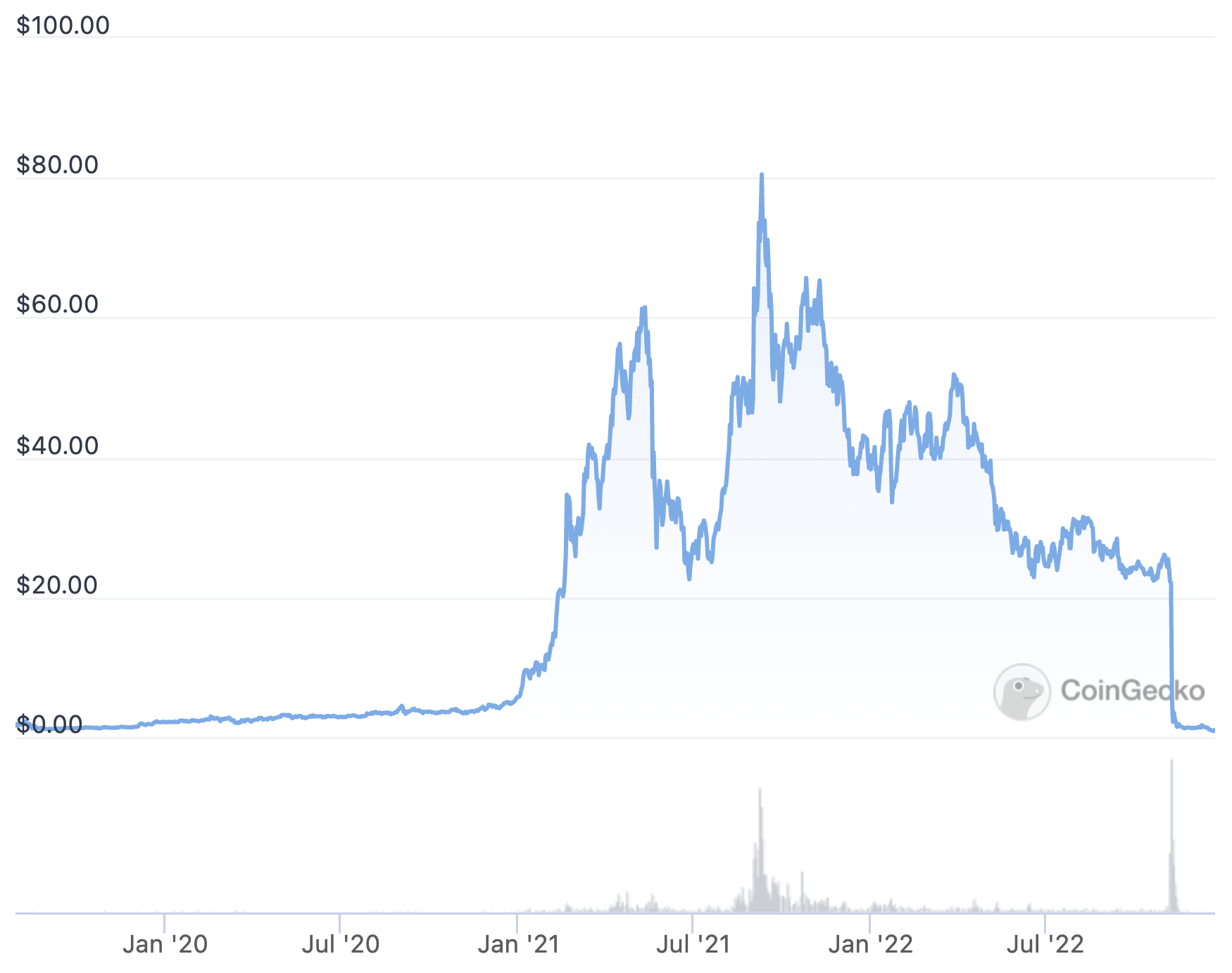

Since FTT reached its all-time high of $85 in September 2021, the price has collapsed by about 99% to $0.97 as of press time. The total market capitalization of the token stood at $323m at the time of writing.

Credit: Source link